India: The World’s Progress Champion At the same time as Progress Slows

For the previous few years, India has been hailed because the darling of world buyers. As soon as thought of a secure and apparent wager, Indian inventory markets skilled meteoric rises, pushed by spectacular financial development and a wave of worldwide capital. But, current developments have launched uncertainty. Inventory indices within the nation have retreated, main many to query India’s prospects. This paradox captures the complexity of a nation touted because the “Subsequent China.”

The Subsequent China: India’s Emergence as a Progress Engine

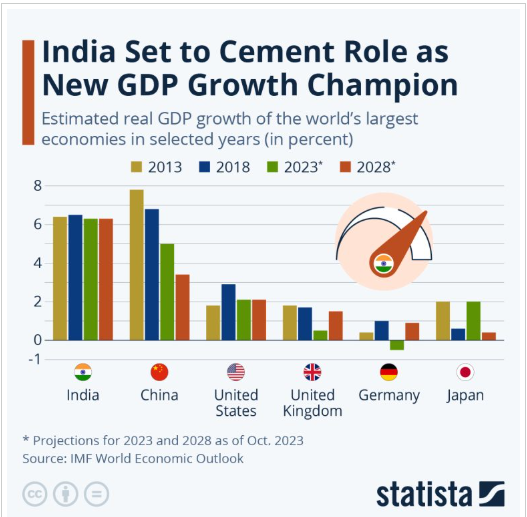

India has usually been known as the “Subsequent China,” a moniker that underscores its potential to drive world development at a time when China’s financial engine is dropping steam. With annual GDP development charges exceeding 7% in recent times, the Indian economic system appeared poised to imagine the mantle of the world’s main development driver. This optimism was mirrored in Indian inventory markets, which posted spectacular good points over the previous two years. For buyers, India seemed to be a certain and apparent selection, providing alternatives in burgeoning industries, a rising shopper base, and an economic system ripe for growth.

Nonetheless, as 2024 drew to an in depth, cracks started to type on this rosy narrative.

Beneath is a comparability between the FTSE India Index and the DJI China Index, highlighting the placing distinction in efficiency since 2012.

A Market Slip: India’s Inventory Indices Tumble

In a shocking flip of occasions, Indian inventory markets have shed 11% of their worth from historic highs, and this decline occurred inside only a few weeks. Such a fast retreat has sparked doubt amongst world buyers. The ultimate quarter of 2024 witnessed a big exodus of overseas capital from India—a development that rattled markets and undermined confidence within the nation’s development story.

What brought on this sudden shift?

Sky-Excessive Valuations: A Bubble Ready to Burst

One main issue behind the market downturn is valuation. Over the previous few years, the keenness for “taking part in the India story” led to exuberant market conduct. Inventory costs soared to stratospheric ranges, creating valuations that always defied logic. Traders clamored to take part in what they believed was a bulletproof development trajectory, however many did not account for the dangers of a bubble-like state of affairs. By late 2024, the unsustainable nature of those valuations grew to become obvious, triggering a correction within the markets.

Macro-Financial Woes: A Sobering Actuality Test

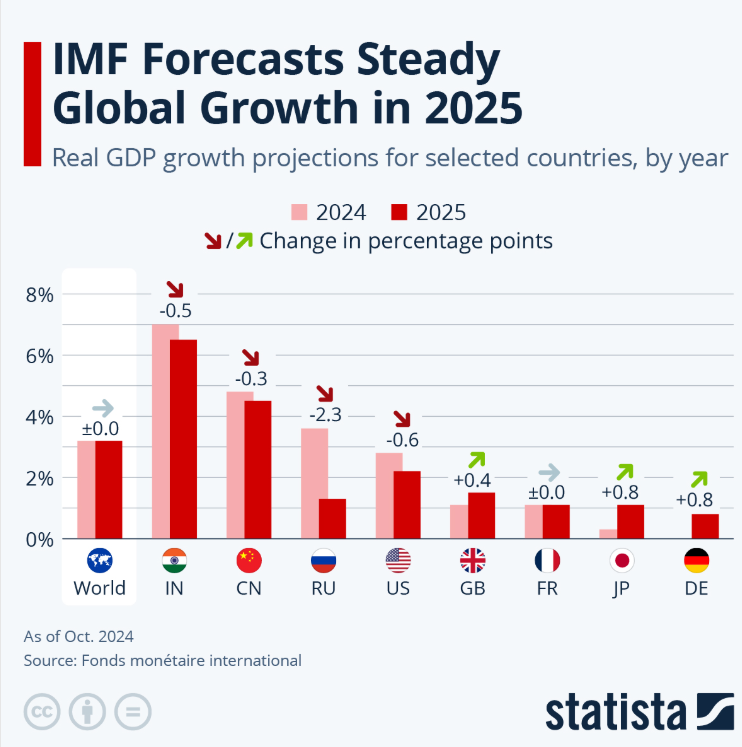

Past market valuations, the broader macroeconomic atmosphere started to deteriorate. India’s GDP development, whereas nonetheless strong by world requirements, fell beneath 7%, edging nearer to five% by the top of the 12 months. Whereas 2024 noticed an general development price of 6.6%, projections for 2025 have been much less optimistic. This slowdown marks a stark distinction to the double-digit development charges many had hoped India would maintain.

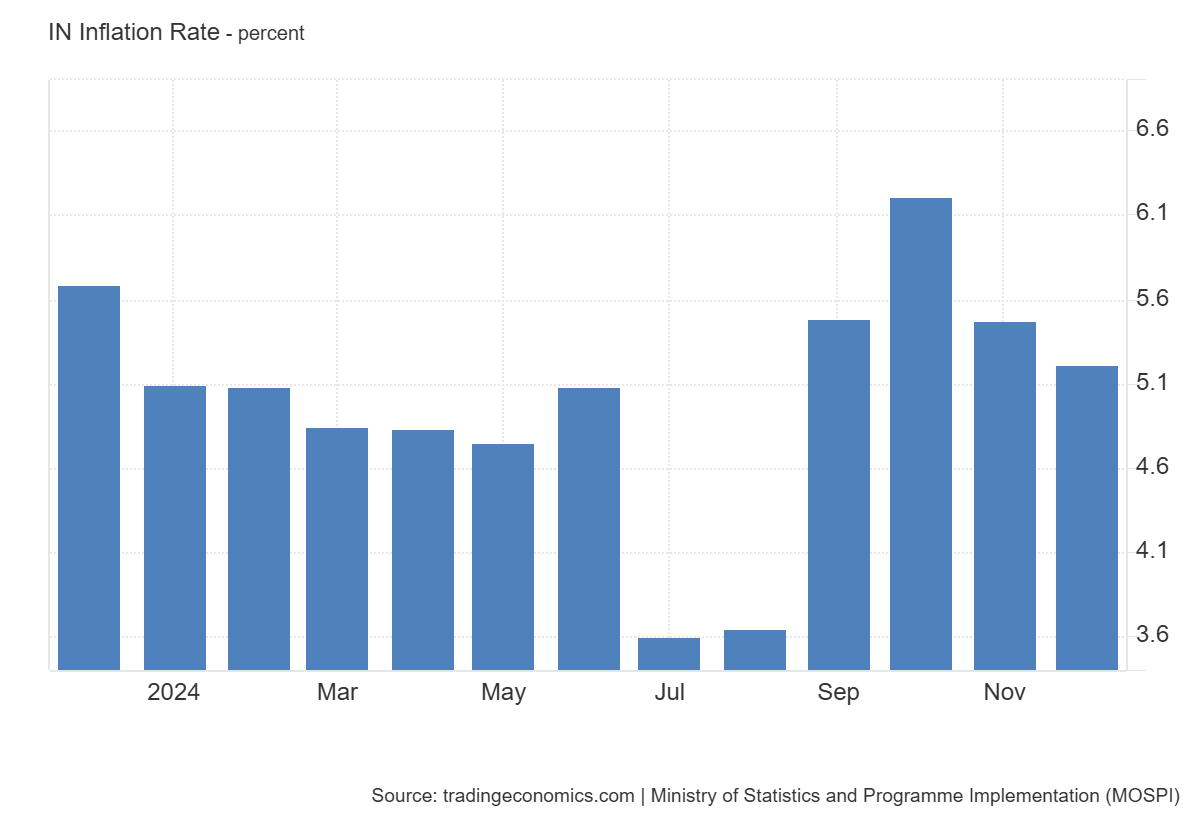

Inflation has additionally emerged as a persistent problem. With value will increase hovering above 6%, Indian households have seen their buying energy eroded. Family debt has risen to regarding ranges, additional straining shopper confidence. Compounding these points, enterprise investments a essential driver of future development have slowed significantly.

The end result? A dampening of the bullish sentiment that when surrounded the Indian economic system.

A Interval of Normalization

Whereas the current market correction and financial slowdown might seem alarming, you will need to view these developments in context. India’s development shouldn’t be collapsing; somewhat, it’s normalizing. Double-digit development is tough to maintain indefinitely, and even a 6.6% development price locations India among the many fastest-growing main economies on the planet.

Regardless of the challenges, India stays a vital engine of world development. Its economic system might account for simply 4% of world GDP at this time, however its strategic significance is way higher. With a younger and rising inhabitants, rising urbanization, and a burgeoning center class, India has immense long-term potential.

Furthermore, India occupies a good geopolitical place. As tensions rise between China and america, India stands to learn from its standing as a strategic companion for Western nations. The worldwide diversification of provide chains partly pushed by the need to scale back dependence on China has additionally created alternatives for India to emerge as a producing and know-how hub.

What’s Subsequent for Traders?

For these contemplating their subsequent strikes, it’s essential to not “throw the child out with the bathwater,” because the saying goes. The current market correction, whereas painful, may current alternatives for buyers prepared to undertake a long-term perspective. Indian equities, after their pullback, might now provide extra affordable valuations, making them a horny choice for many who imagine within the nation’s development story.

Nonetheless, a cautious method is warranted. Inflation should be carefully monitored, because it has the potential to stifle shopper spending and hinder financial restoration. Moreover, structural reforms and coverage initiatives might be essential in addressing a number of the deeper challenges going through the economic system, reminiscent of revenue inequality, infrastructure deficits, and regulatory bottlenecks.

India stays an important participant on the worldwide stage, and its potential as a development driver is simple. The current turbulence, whereas unsettling, is a part of the rising pains of an economic system transitioning from emerging-market darling to a extra mature and secure development engine. Traders ought to regulate the horizon alternatives in India are prone to re-emerge sooner somewhat than later.

Dangers of Investing within the Indian Inventory Index

Investing in an Indian inventory index just like the Nifty 50 or BSE Sensex gives alternatives as a result of India’s fast development, however it comes with dangers:

- Rising Market Volatility: Indian markets are extra unstable, as seen with a 5.15% Nifty drop post-2024 elections.

- Excessive Valuations: Elevated price-to-earnings ratios sign potential overvaluation, risking corrections like the ten% drop in late 2024.

- Political and Regulatory Dangers: Coverage shifts or governance points (e.g., the 2023 Adani scandal) can impression markets.

- International Financial Publicity: Slowdowns or commodity value spikes (e.g., oil) have an effect on development and indices.

- Foreign money Threat: Rupee depreciation (e.g., 83.48 vs. USD in 2024) can erode returns for overseas buyers.

Mitigation: Diversify by way of ETFs, undertake a long-term view (6-7% annual development), and enter after corrections.

Regardless of development potential, volatility and exterior dangers require warning.

Conclusion

In conclusion, India’s development story is way from over. Whereas the journey forward could also be marked by occasional setbacks, the nation’s fundamentals stay robust. The “Subsequent China” nonetheless holds promise, even when the highway is bumpier than initially anticipated. For these with persistence and conviction, the Indian development narrative is one value watching and investing in.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.