A number one digital property supervisor is discovering that institutional buyers are benefiting from discounted crypto costs in mild of the FTX-fueled market crash.

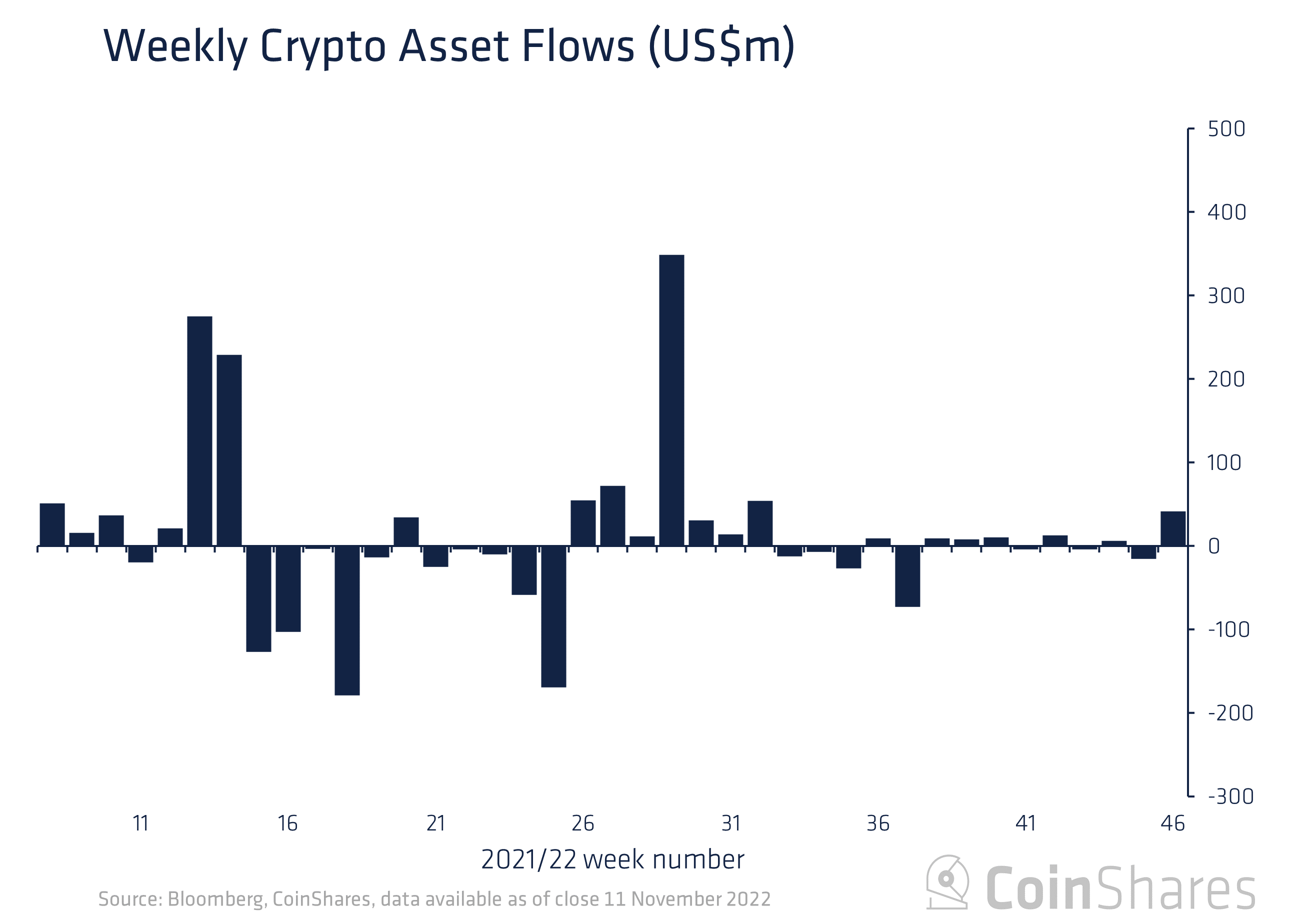

In its newest Digital Asset Fund Flows Weekly report, CoinShares says digital asset funding merchandise had their highest inflows in 14 weeks.

“Digital asset funding merchandise noticed the biggest inflows for 14 weeks totaling $42 million.

The inflows started later within the week on the again of maximum value weak spot prompted by the FTX/Alameda collapse.”

Bitcoin (BTC) funding autos loved the lion’s share of inflowing capital, gaining $19 million final week.

“Bitcoin was the first focus with inflows totaling $19 million, the biggest since early August this yr. Nonetheless, short-bitcoin funding merchandise additionally noticed inflows totaling $12.6 million.”

CoinShares noticed inflows from all areas, particularly the US, Brazil and Canada.

“Switzerland was the outlier, seeing minor outflows totaling $4.6 million, though it stays the nation with by far probably the most inflows year-to-date.”

Ethereum (ETH) funding merchandise noticed $2.5 million in inflows final week whereas Solana (SOL) misplaced $1.1 million and Polygon (MATIC) took in $200,000. Multi-asset funding autos, or these investing in a couple of digital asset, had their largest week of inflows since June, in accordance with CoinShares.

“Multi-asset noticed its largest inflows since June 2022 of $8.4 million suggesting buyers see it as a relative protected haven, whereas there was little or no exercise in altcoins.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/sparkzen