Digital property supervisor CoinShares says institutional buyers are doubtless being scared away by US financial coverage because the crypto markets endure outflows for the eighth week in a row.

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional buyers bought off $88 million in crypto holdings final week, presumably attributable to rates of interest.

“Digital asset funding merchandise noticed outflows totaling $88 million, bringing this 8-week run of outflows to $417 million, closing in on the report 12-week run of outflows seen in April to June final yr. We imagine, like final yr, that that is financial coverage associated, with at the moment no clear finish in sight to rate of interest rises, leaving buyers cautious.”

CoinShares says that a lot of the outflows got here from North America, suggesting that a lot of the promoting stems from fears on US rates of interest.

“87% of the outflows have been targeted on one supplier, accordingly virtually all of the outflows have been North America based mostly. Minor inflows of $9.2 million have been seen in Switzerland, whereas Germany noticed outflows of $9.4 million.”

Bitcoin (BTC) suffered the largest outflows at $52 million, bringing its eight-week outflow complete to $254 million.

Altcoins, together with Ethereum (ETH), noticed combined outcomes. Whereas ETH, Polygon (MATIC) and multi-asset funding automobiles misplaced $36 million, $0.4 million and $0.8 million respectively, Litecoin (LTC), Solana (SOL) and XRP correspondingly noticed inflows of $0.7 million, $0.3 million and $0.5 million every.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

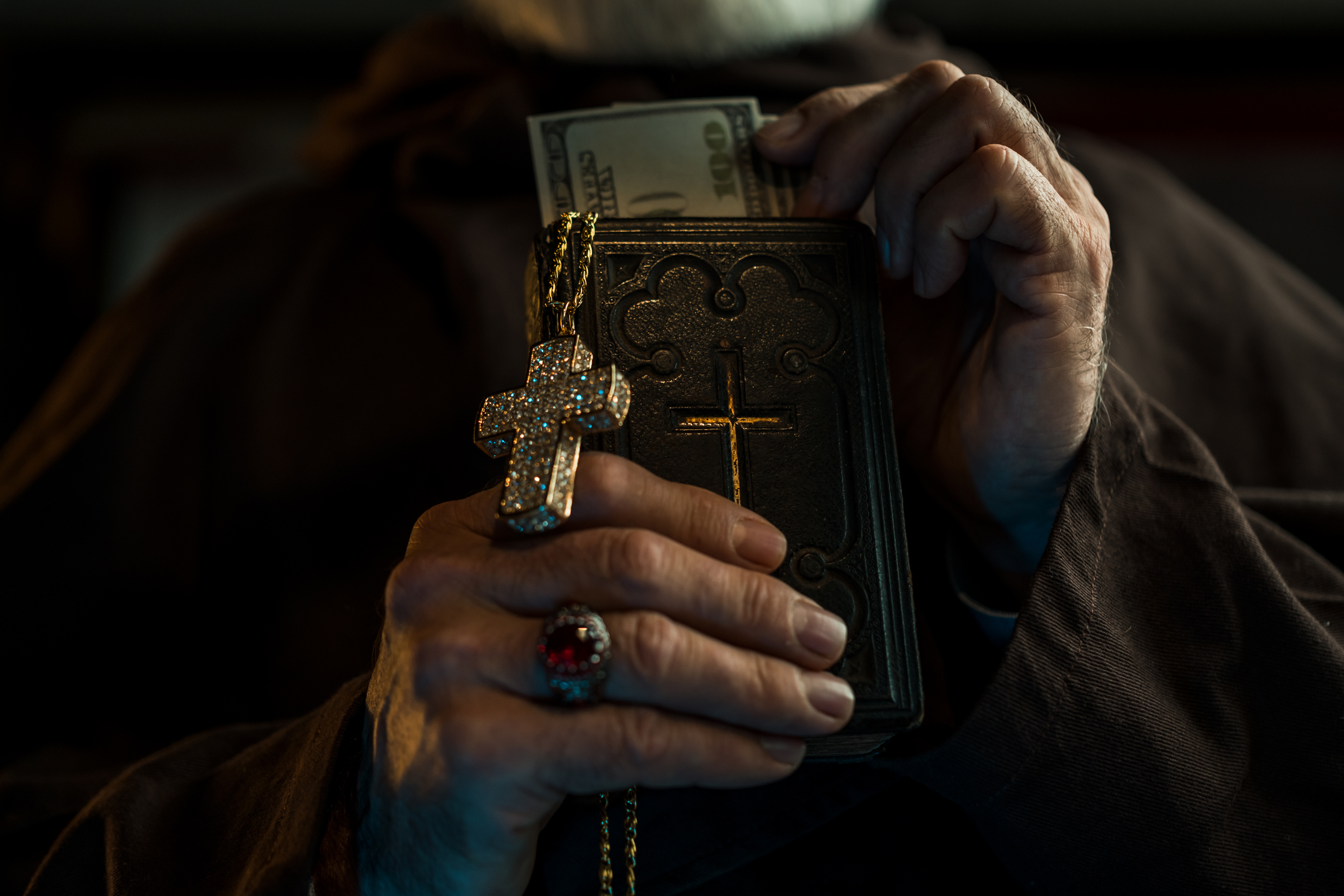

Featured Picture: Shutterstock/phive/Sensvector