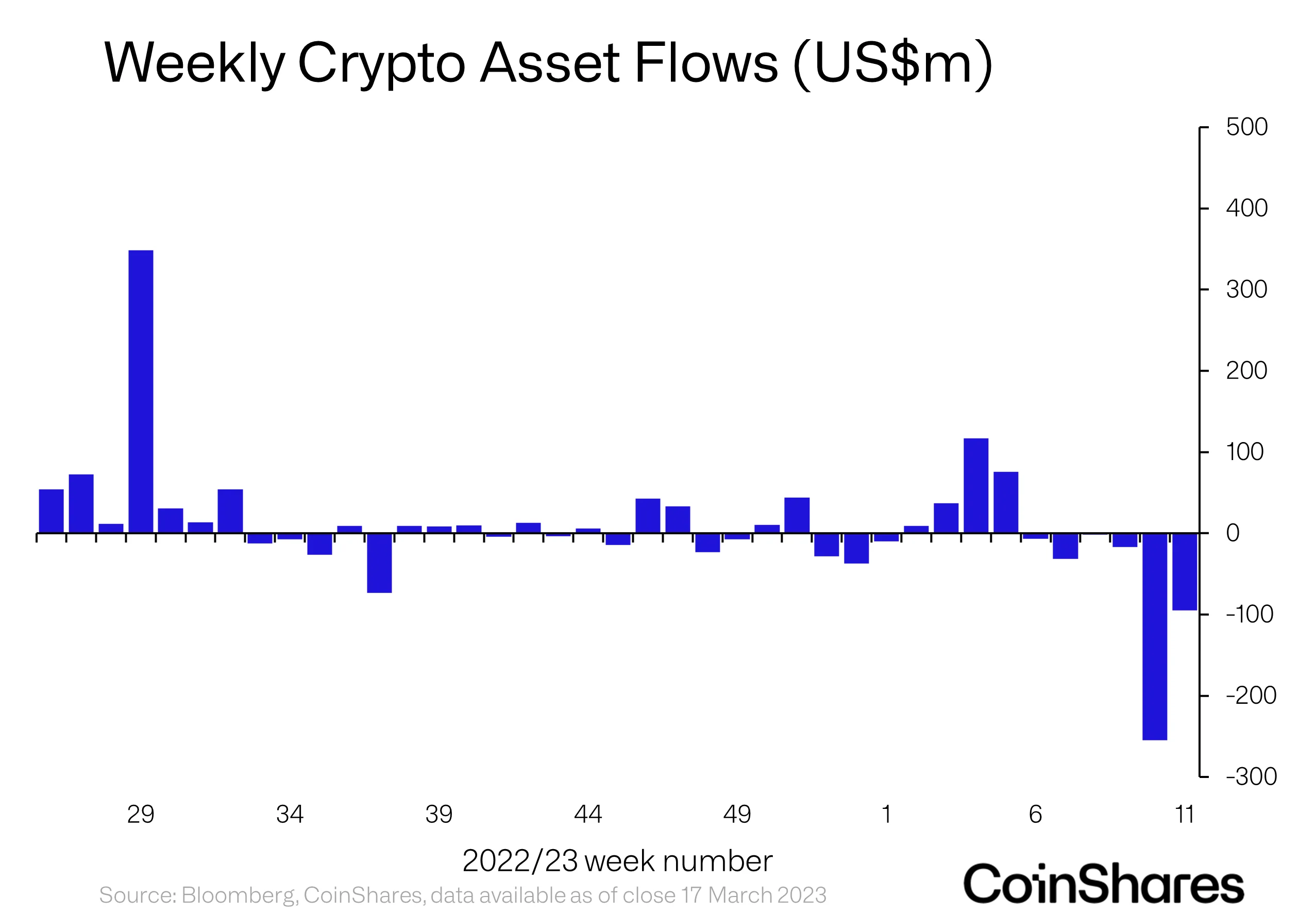

Digital belongings supervisor CoinShares says institutional crypto funding merchandise suffered their sixth consecutive week of outflows final week.

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional crypto funding merchandise suffered outflows of almost $95 million final week regardless of a broader crypto market rally.

“Digital asset funding merchandise noticed outflows for the sixth consecutive week totaling US$95m, with the five-week complete being US$406m, representing 1.2% of complete belongings beneath administration (AuM).”

CoinShares suggests the contrarian positions taken by establishments could also be as a consequence of a liquidity necessity moderately than a bearish market view.

“The outflows had been in stark distinction to the broader market and recommend it was, partially, as a result of want for liquidity moderately than unfavourable sentiment.”

Bitcoin (BTC) merchandise took the heaviest hit of outflows at $112.8 million, and short-BTC merchandise noticed inflows.

“Conversely, regardless of inflows into short-bitcoin totaling a file US$35m final week, its AuM fell by 13% over the identical interval. It’s evident this sentiment is contrarian relative to the remainder of the crypto market, however it could be pushed, partially, by the necessity for liquidity throughout this banking disaster, an identical state of affairs was seen when the COVID panic first hit in March 2020.”

Altcoins had been equally a blended bag. Apart from Ethereum (ETH) struggling $12.7 million in outflows, Solana (SOL), Litecoin (LTC) and Polygon (MATIC) all loved $0.2 million in inflows, respectively. XRP merchandise loved $0.4 million in inflows.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in online marketing.

Featured Picture: Shutterstock/Scharfsinn