Digital belongings supervisor CoinShares says institutional traders are bullish on Bitcoin (BTC) and altcoins as crypto sees over $120 million in inflows final week.

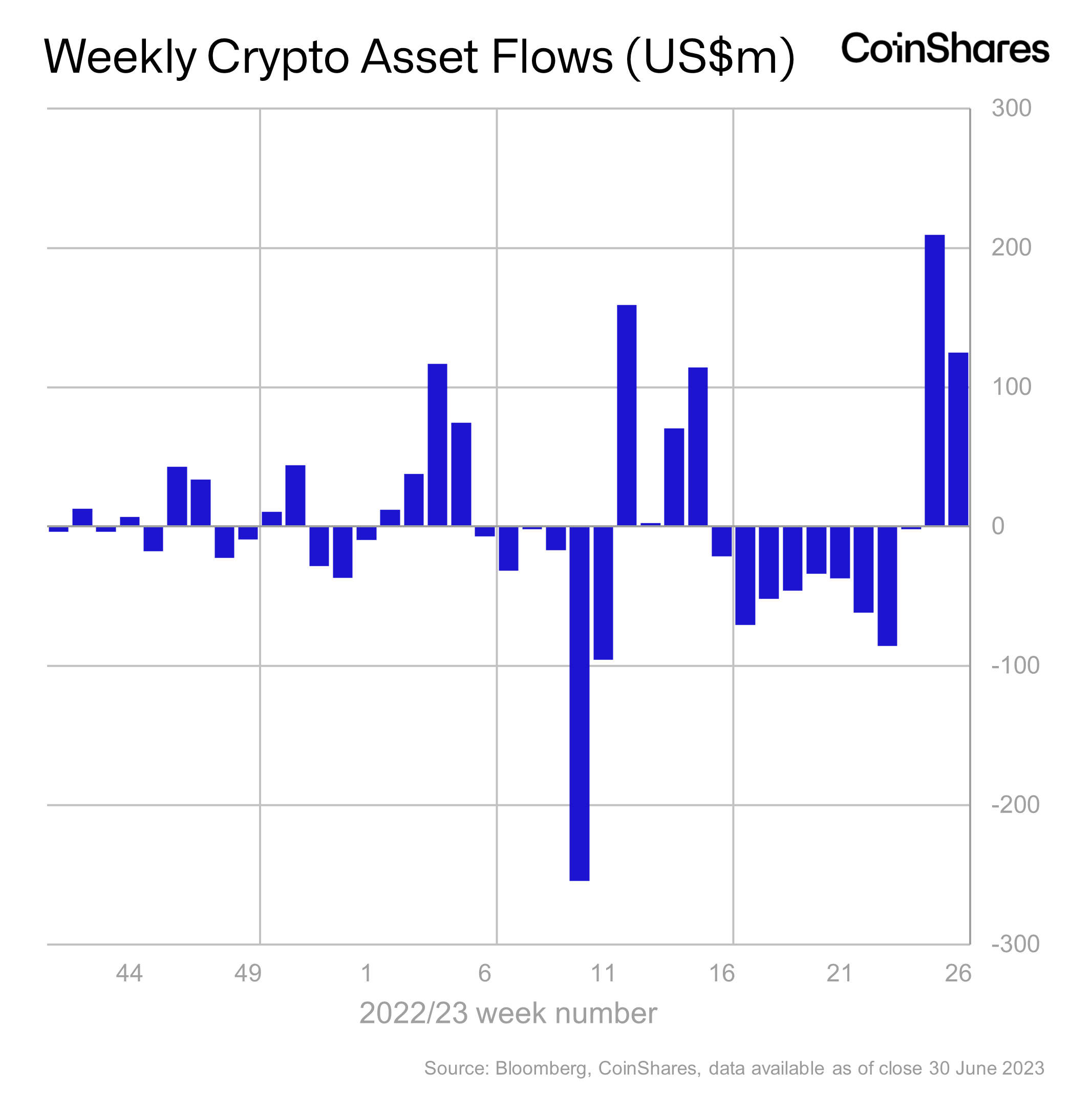

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional traders poured $125 million into the crypto markets final week, the second week of great inflows in a row.

“Digital asset funding merchandise noticed a second week of inflows totaling US$125m, bringing the final two weeks of inflows to US$334m, representing virtually 1% of whole belongings beneath administration (AuM). Current value appreciation noticed AuM rise to US$37bn in the course of the week, the very best level since early June 2022 and matching the common AuM for 2022. Buying and selling exercise remained excessive at US$2.3bn for the week, nicely above the US$1.5bn year-to-date common.”

BTC took the lion’s share of investor inflows to the tune of $123 million.

“Bitcoin remained the first focus of traders, seeing inflows of US$123m, with the final 2 weeks’ inflows representing 98% of all digital asset flows. Bitcoin funding merchandise are actually again to a internet influx year-to-date having been in a internet outflow place of US$171m simply 2 weeks in the past.

Regardless of latest value appreciation, short-bitcoin funding merchandise continued to see outflows totaling US$0.9m, representing its tenth week of outflows which now signify 59% of AuM. Regardless of this latest bearishness for short-bitcoin, it stays the second best-performing asset when it comes to inflows year-to-date at US$60m.”

Whereas multi-asset funding merchandise and Solana (SOL) noticed outflows of $1.8 million and $0.8 million, respectively, different altcoins like Ethereum (ETH), Litecoin (LTC), XRP and Cardano (ADA) loved inflows of $2.7 million, $0.3 million, $0.4 million and $0.9 million, respectively.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/Smartha