In an unprecedented case that underscores the complicated regulatory setting within the European Union, Jupiter Asset Administration was compelled to divest its XRP Change Traded Product (ETP) funding valued at roughly $2.5 million. This choice underscores the complexities and regulatory discrepancies inside the European Union regarding cryptocurrency investments.

The Pressured XRP ETP Sale

The incident, which was initially reported by the Monetary Occasions, concerned Jupiter’s Eire-domiciled Gold & Silver fund. The fund had invested $2,571,504 in 21Shares’ Ripple XRP ETP through the first half of 2023, a transfer that was subsequently flagged by Jupiter’s compliance division.

“The commerce was made, picked up by our common oversight course of after which cancelled,” a Jupiter spokesperson articulated, emphasizing the rigorous inside overview processes that led to the identification and rectification of the regulatory misalignment.

Eire’s agency stance towards incorporating crypto property into Undertakings for Collective Funding in Transferable Securities (UCITS) funds mandated the reversal of this funding. Consequently, the cryptocurrency ETP holding was offered for $2,570,670, leading to a nominal lack of $834, which the agency addressed.

“Jupiter offered the cryptocurrency ETP holding for $2,570,670, at a lack of $834, in keeping with a monetary assertion. The agency has made up the distinction,” confirmed a spokesperson from Jupiter.

This growth is especially noteworthy because it contrasts with the regulatory positions of different EU international locations. For example, Germany’s regulator permits a extra versatile method, permitting crypto ETP publicity in UCITS funds below particular situations, as demonstrated by DWS’s Fintech fund sustaining an funding in an Ethereum exchange-traded word.

Inconsistent Directives Inside The EU

The incident has sparked a broader dialogue on the necessity for a harmonized regulatory method inside the EU. The discrepancy not solely impacts funding methods but additionally impacts the general funding ecosystem, making a fragmented market.

That is additional difficult by the various interpretations and functions of the UCITS directive throughout totally different member states, resulting in an absence of readability and uncertainty for fund managers trying to innovate their funding portfolios.

Regulatory our bodies in Eire and France have lately affirmed their positions towards the inclusion of crypto property in UCITS funds, underscoring a cautious method in direction of investor safety inside regulated fund buildings. In the meantime, the UK and Germany undertake distinct stances, with the latter permitting sure crypto exposures below outlined standards.

This incident is just not solely highlighting the complexities concerned in navigating the regulatory panorama for crypto investments but additionally emphasizes the necessity for a unified regulatory framework inside the European Union.

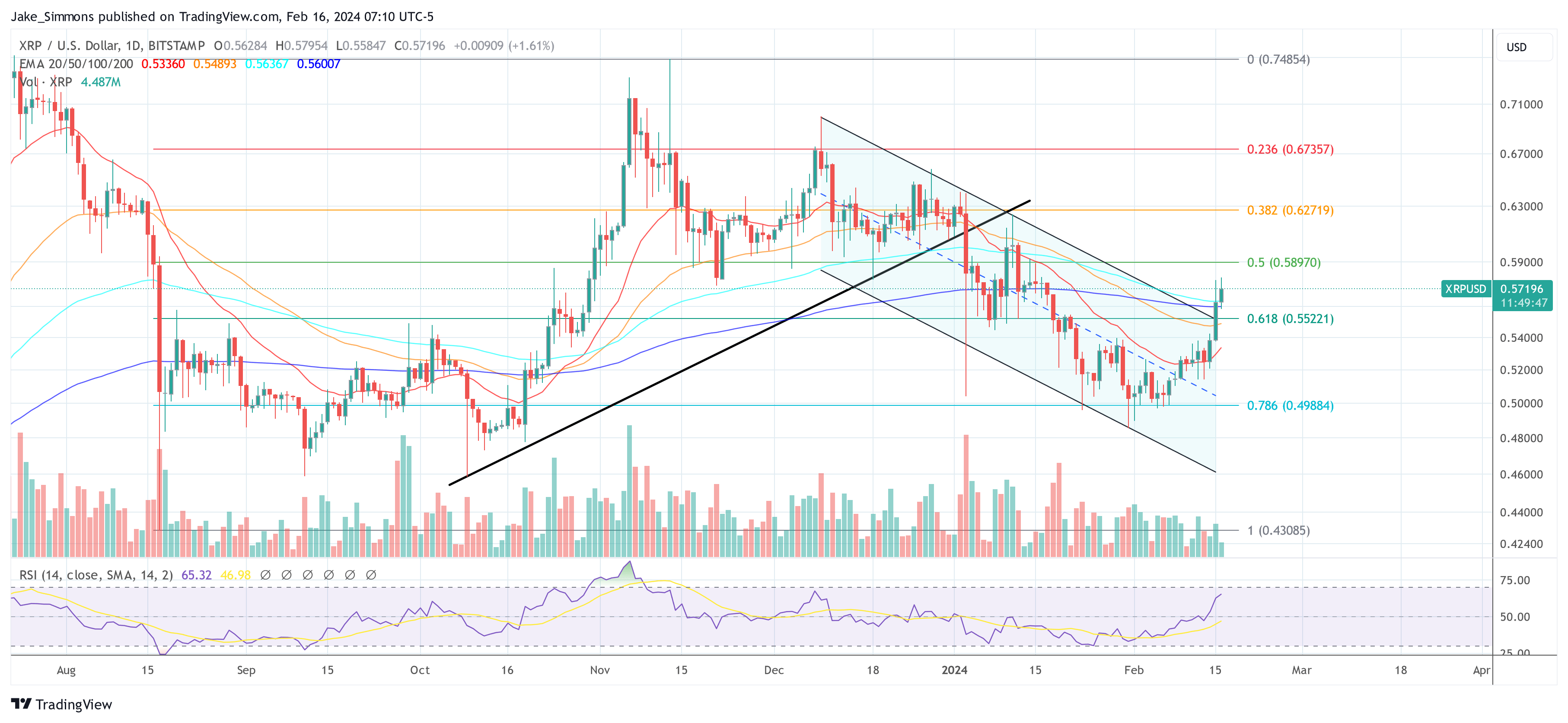

XRP Worth Confirms Breakout

At press time, the XRP value stood at $0.57196. As predicted yesterday, XRP has managed to interrupt out of the descending channel and rise above the 20-, 50-, 100- and 200-day EMA cluster. Because of this the XRP bulls have a great probability of gaining the higher hand once more. A breakout above the 0.5 Fibonacci degree at $0.5897 can be one other essential step.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.