Welcome to The Interchange, a tackle this week’s fintech information and tendencies. To get this in your inbox, subscribe right here.

Greetings from Austin, Texas, the place the temps have been over 100 levels for days now and we’re making an attempt laborious simply to not soften.

The worldwide funding growth in 2021 was not like something most of us have ever seen earlier than. Whereas nations all around the world noticed surges in enterprise capital investments, Latin America particularly noticed an enormous bump in {dollars} invested. Unsurprisingly — with so many individuals within the area being underbanked or unbanked and digital penetration lastly taking off — fintech startups have been among the many largest recipients of that capital.

The development continued within the first quarter of 2022, in keeping with LAVCA, the Affiliation for Personal Capital Funding in Latin America, which discovered that startups within the area total raised $2.8 billion throughout 190 transactions throughout that 3-month interval ending March 31. This marked the fourth largest quarter on report for funding within the area, the info confirmed, and represented a 67% enhance in comparison with the $1.7 billion raised within the first quarter of 2021. It additionally was up 375% versus the $582 million raised within the first quarter of 2020.

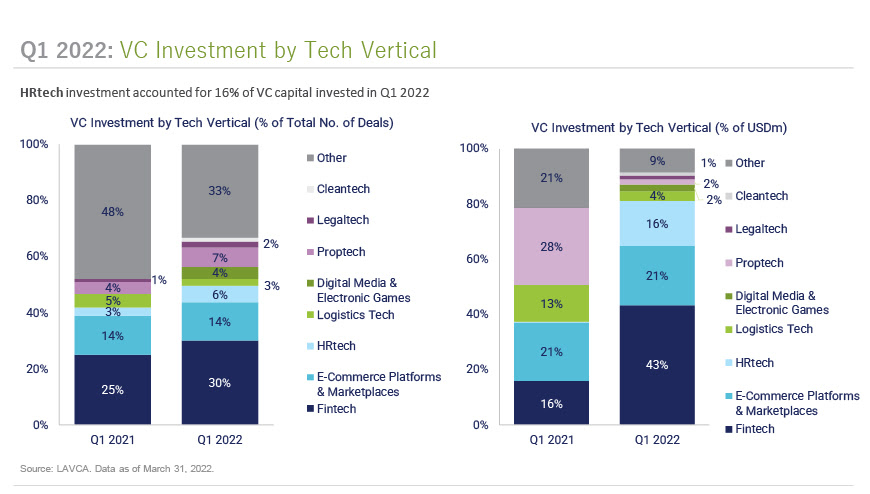

Notably, fintech startups have been by far the most important recipients of enterprise capital funding within the 2022 first quarter, with 43% of {dollars} raised — or $1.2 billion – having flowed into the class. That’s up from 16% within the first quarter of 2021. In the meantime, investments into fintechs made up 30% of all offers within the second quarter, in comparison with 25% in Q1 2021.

Picture Credit: LAVCA

Carlos Ramos de la Vega, director of enterprise capital of LAVCA, advised TechCrunch: “We’ve continued to see the cross-pollination of enterprise fashions inside the sector: Cost platforms are more and more incorporating BNPL alternate options, lending platforms have turn into full-service digital banks, challenger banks have expanded their product suite to incorporate embedded credit score merchandise and dealing capital services.”

Now, with the worldwide enterprise slowdown beneath means, it’s notable that Latin American fintechs proceed to lift giant rounds within the second quarter of this yr. For instance, this previous week, Ecuador received its first unicorn when funds infrastructure startup Kushki raised $100 million at a $1.5 billion valuation. And, Mexico Metropolis–primarily based digital financial institution Klar landed $70 million in fairness funding in a spherical led by Common Atlantic that valued that firm at round $500 million. I first wrote about Klar again in September 2019, when it aspired to be the “Chime of Mexico.” You possibly can examine how its mannequin has developed right here.

Does all this imply that LatAm is an outlier? Not essentially. Nevertheless it does sign that investor urge for food within the area stays.

Weekly Information

Now, everyone knows insurtechs have taken a beating within the public markets. And final week, I coated a big spherical of layoffs within the sector. So it’s additional attention-grabbing {that a} startup within the area not solely continues to lift capital and enhance its valuation, however additionally is reportedly actively working towards changing into cash-flow constructive.

I wrote about Department, a Columbus, Ohio–primarily based startup providing bundled dwelling and auto insurance coverage, which raised $147 million in Sequence C funding at a postmoney valuation of $1.05 billion. I first heard/wrote about Department in the summertime of 2020, and it’s been wild watching the corporate steadily develop its enterprise.

With the newest information, I needed to drill down on what differentiates Department from the opposite struggling insurtechs on the market. CEO and co-founder Steve Lekas advised me in an interview: “Now we’re at a scale the place we’re promoting extra product than most of those who got here earlier than us. I feel the factor we’ve made is the factor that everybody thought they have been investing in to start with.” To be taught extra, learn my story on the subject from June 8.

TC’s Kyle Wiggers and Devin Coldewey dug into Apple’s greatest transfer into monetary companies up to now — changing into a formidable participant within the more and more crowded purchase now, pay later (BNPL) area. This text coated the information to start with. This one took a have a look at how Apple is doing its personal lending. And this one drilled down deeper into how different BNPL suppliers are reacting to the information. And ICYMI, the week earlier than, Sq. introduced it will start to help Apple’s Faucet to Pay expertise later this yr. It was a partnership that MagicCube founder Sam Shawki predicted regardless of buzz that Apple would kill Sq.. In his view, that partnership solely continues to extend the necessity to present an equal cost acceptance answer for Android.

Additionally, this previous week, two giant gamers introduced huge crypto-related strikes. I took a have a look at how PayPal customers will (lastly) be capable of switch cryptocurrency from their accounts to different wallets and exchanges. “This transfer exhibits we’re on this for the long run,” an exec advised me in an interview. And Anita Ramaswamy — who was on the bottom at Consensus within the inferno that’s presently Austin, Texas — reported on American Specific’s new partnership with crypto wealth administration platform and pockets supplier Abra. The cardboard will permit customers transacting in U.S. {dollars} to earn cryptocurrency rewards on their purchases by means of the Amex community. Amex customers have been ready for an announcement like this for a while, as its rivals Visa and Mastercard have already launched their very own crypto rewards bank cards by means of partnerships with digital asset firms.

It seems like not more than a few weeks can go by with out Higher.com making headlines but once more. This time, the digital mortgage lender is being sued by a former government who alleges that she was pushed out for numerous causes, one in every of which incorporates expressing issues that the corporate and its CEO Vishal Garg misled buyers when it tried to go public by way of a SPAC.

Different attention-grabbing reads:

Banks and tech giants are dropping expert workers to versatile fintechs

Bolt, dealing with challenges, cuts prices and lowers progress goal

Out of Cash 20/20 Europe

‘The temper could be very grim’: As soon as-hot fintech sector faces IPO delays and consolidation

Stripe co-founder hits again at rivals accusing the corporate of unfair competitors

Picture Credit: Department/CEO Steve Lekas

Fundings

Seen on TechCrunch

With hundreds of thousands in backing, SecureSave is Suze Orman’s not-so-surprising debut into startups

Fruitful emerges from stealth with $33M in funding and an app that goals to gasoline wholesome monetary habits

Ivella is the newest fintech centered on {couples} banking, with a twist

Backbase raises its first funding, $128M at a $2.6B valuation, for instruments that assist banks with engagement

And elsewhere

PayShepherd secures $3 million USD in funding to refresh contractor billing programs

That’s it for this week! Now excuse me whereas I am going to the pool with my household to attempt to cool off. Get pleasure from the remainder of your weekend, and thanks for studying. To borrow from my colleague and expensive pal Natasha Mascarenhas, you’ll be able to help me by forwarding this text to a pal or following me on Twitter.