Bitcoin (BTC) and U.S. shares have proven a unfavorable correlation these days, with Bitcoin usually transferring in the other way of conventional markets. This divergence has caught the eye of analysts and buyers, particularly because the cryptocurrency enters a interval of consolidation together with the broader crypto market. Historically, shifts on this correlation—from unfavorable to constructive—have usually signaled a bullish pattern for Bitcoin.

Associated Studying

As each markets face challenges, the altering dynamics between BTC and U.S. shares might present essential insights into the place the market is headed. Traders are carefully watching this relationship, anticipating {that a} shift might point out a possible breakout for Bitcoin.

Bitcoin Information Suggests Potential Uptrend

The unfavorable correlation between Bitcoin (BTC) and the U.S. inventory market, notably the S&P 500 (SPX), has change into more and more evident. Distinguished analyst and dealer Daan on X not too long ago highlighted this phenomenon by overlaying the BTC/USDT futures chart with SPX costs.

His evaluation reveals that whereas conventional markets just like the SPX have skilled a swift restoration, Bitcoin has not adopted swimsuit. This divergence underscores the decoupling between these two markets, with Bitcoin lagging behind the broader inventory restoration.

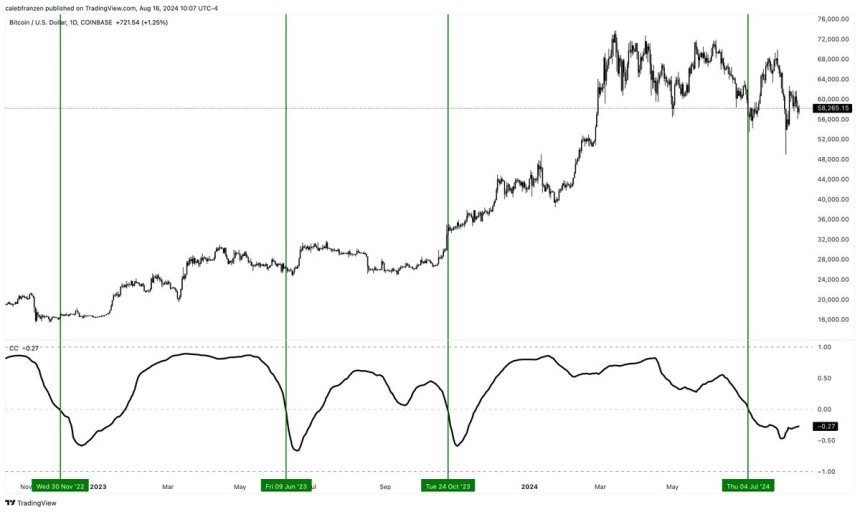

One other key analyst, Caleb Franzen, introduced consideration to this pattern, sharing information revealing Bitcoin’s unfavorable correlation with main inventory indices. Particularly, Franzen factors out that the 90-day correlation between Bitcoin and the Nasdaq-100 ($QQQ) at the moment stands at -27%. This unfavorable correlation means that as tech shares get well, Bitcoin has been transferring in the other way, which may signify distinctive market dynamics.

Whereas durations of unfavorable correlation between Bitcoin and shares should not inherently bullish, historic proof means that constructive market shifts usually comply with such phases. The important level for buyers is to watch a possible reversal of this correlation—when Bitcoin begins to maneuver in tandem with the Nasdaq-100 ($QQQ) as soon as once more.

If Bitcoin’s correlation with tech shares turns constructive, it might sign a strengthening market and a attainable uptrend for BTC. This shift might present a key indicator for timing potential entry factors available in the market.

BTC Worth Buying and selling Under A Key Indicator

Bitcoin trades at $59,350, beneath the important each day 200-day transferring common (MA) at $62,915. This transferring common is a key indicator many analysts use to gauge market tendencies. When BTC’s worth is beneath the each day 200 MA, it usually suggests a downtrend or a big correction. Conversely, buying and selling above this degree signifies market energy and bullish momentum.

For Bitcoin to verify the continuation of its bull market, it must reclaim the each day 200 MA and persistently shut above it. This is able to sign a possible shift in pattern, offering confidence to merchants and buyers that the bullish section continues to be intact.

At present, BTC is hovering round the important thing psychological degree of $60,000, and the market stays in a consolidation section after enduring months of uncertainty and volatility.

For the bullish state of affairs to unfold, Bitcoin should break above $63,000, retaking the each day 200 MA and surpassing the August eighth native excessive of $62,729. This is able to mark a big restoration and point out that the market is regaining its energy.

Associated Studying

Then again, if BTC fails to shut above $57,500 within the coming days, it might sign additional draw back strain, probably resulting in a pullback to sub-$50,000 ranges. The approaching days shall be essential in figuring out whether or not Bitcoin can regain its upward momentum or if extra bearish strain lies forward.

Cowl picture from Dall-E, charts from TradingView.