Right here’s what the Bitcoin community fundamentals need to say relating to whether or not the cryptocurrency might see a bull run quickly or not.

Month-to-month Common Bitcoin New Addresses Have Shot Up Not too long ago

In a brand new post on X, analyst Ali mentioned the opportunity of a bull run beginning quickly for the cryptocurrency. In keeping with the analyst, “a bull run is usually characterised by elevated on-chain exercise.”

To measure the exercise, Ali has used the “new addresses” metric, which retains monitor of the entire variety of new addresses coming on-line on the Bitcoin blockchain day by day.

When the worth of this metric is excessive, it implies that many customers have joined the community in the course of the previous day. This might recommend that the cryptocurrency is observing excessive adoption proper now.

Then again, low values suggest not many newcomers are at the moment drawn to the blockchain, doubtlessly an indication of a scarcity of curiosity out there across the coin.

Now, here’s a chart that exhibits the development within the Bitcoin new addresses, in addition to the 30-day and 365-day easy transferring averages (SMAs) of the indicator over the previous few years:

The info for the every day new addresses on the community since January 2018 | Supply: @ali_charts on X

The elevated exercise, which can be related to a bull run, may be “noticed when the month-to-month common of recent wallets (pink) surpasses the yearly common (blue), which signifies strengthened community fundamentals and elevated use,” as defined by the analyst.

The graph exhibits that the 30-day SMA of the Bitcoin new addresses had been beneath the 365-day SMA in the course of the bear market, however with the rally this yr, the previous had managed to interrupt above the latter.

The reverse cross had occurred in the course of the slowdown in Could-June, however as the following rebound within the value had occurred, the month-to-month common new addresses had damaged again above the yearly common, and it has since stayed there.

Not too long ago, regardless of the battle within the value, the 30-day SMA of the metric has solely continued to rise sharply. This might naturally be a constructive signal for the asset, and going by historic priority, it could even imply a return towards bullish momentum.

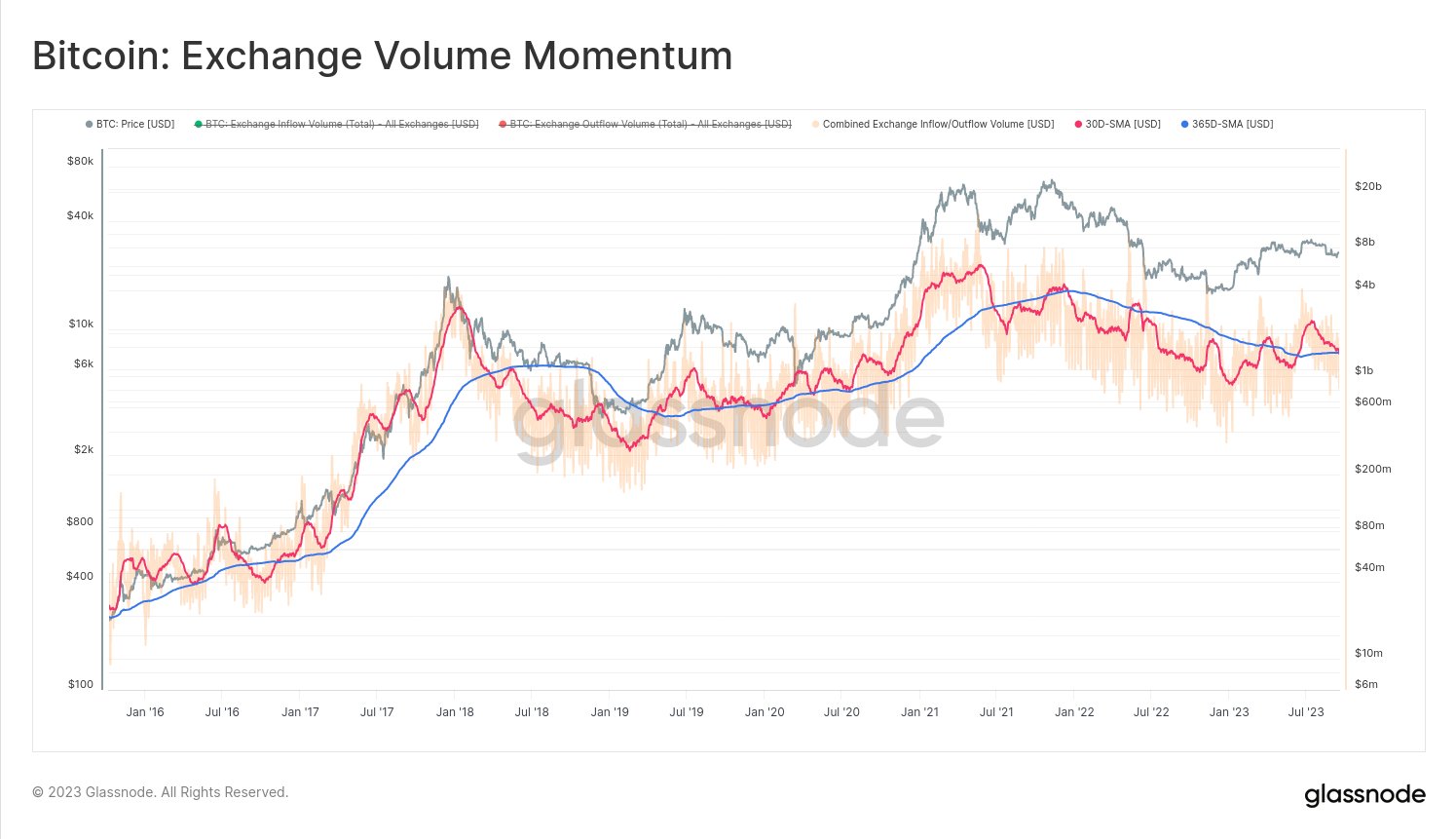

The lead on-chain analyst at Glassnode, @_Checkmatey_, nevertheless, has replied to Ali’s submit, saying, “with the arrival of ordinals, it’s at all times a terrific thought to pair ‘addresses,’ and ‘transactions’ metrics with ‘quantity’ metrics.”

“Ordinals” right here check with inscribing knowledge immediately into the Bitcoin blockchain. They’re utilized in varied functions, together with making non-fungible tokens (NFTs) on the community.

Such chain functions can skew the address-related metrics, as new ones could also be created solely for utilizing the blockchain on this approach and never for truly buying and selling the coin itself.

The Glassnode lead explains that they assign a barely larger weight in direction of the quantity metrics as a result of the Ordinals-related transactions don’t contain a lot quantity.

The alternate quantity over the previous couple of years | Supply: @_Checkmatey_ on X

Not like the brand new addresses metric, the bullish sample isn’t but forming for the alternate quantity (which incorporates each inflows and outflows). This could recommend that the exercise on the community might not be at a bull run stage proper now.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $27,000, up 3% over the previous week.

BTC has stagnated across the $27,000 mark | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com