Bitcoin is dumping when writing, cooling off from Could highs of practically $72,000. Down roughly 10% from all-time highs, there may very well be extra losses on the best way, at the least wanting on the candlestick association within the every day chart.

Now, Willy Woo, a Bitcoin on-chain analyst, thinks the drop is primarily due to the continued “miner capitulation.” Woo notes that the community is now actively “culling” out weak miners, forcing them to close down their operations.

As they exit, they promote their BTC holdings, operating into 1000’s, if not tens of 1000’s, of the coin.

Bitcoin Community “Culling” Weak Miners

Due to market dynamics, the upper the availability, the decrease the costs; Bitcoin is flushing decrease, squeezing out much more miners. It stays to be seen for the way lengthy this may proceed, however the affect of Halving is now more and more evident.

In Woo’s evaluation, miner capitulation is critical. Furthermore, weak miners’ pressured liquidation of BTC will solely make the community extra resilient. It is because the “cull” will eradicate much less environment friendly gamers from the community, in the end resulting in a extra strong system.

On April 20, the Bitcoin community Halved miner rewards from 6.25 BTC to three.125 BTC. Since miners depend upon rewards as their main earnings supply, their income was slashed by 50%.

In the event that they select to proceed working, they have to not solely compete with bigger mining companies, most of that are public, like Riot Blockchain and Mara Digital, however they have to even be very environment friendly, utilizing fashionable gear for a better hash fee.

Staying environment friendly is a main problem, and fairly than competing with public miners, some, because it seems, are folding and selecting to exit the enterprise.

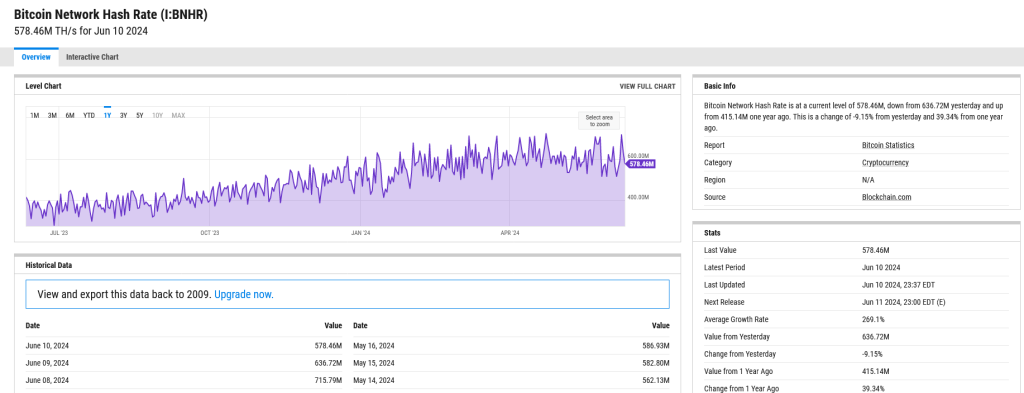

Curiously, whilst “weak” miners shut down operations, the community hash fee–a measure of the whole computing energy–continues to be at close to report highs. In keeping with YCharts, the hash fee is 578 EH/s, down from 721 EH/s registered on April 23.

Will BTC Costs Get well If Speculative Bets Are Purged?

Woo additionally thinks there’s a have to “purge the degen open curiosity in futures bets.” The analyst says extreme leverage buying and selling on perpetual platforms like Binance, OKX, and Bybit should drop. The spike in degen buying and selling has pushed up the “paper Bitcoin,” or speculative bets.

Woo explains that following the collapse of FTX in November 2022, speculative bets have been wiped, permitting for a swift restoration in BTC costs within the following months.

If the coin is to get well and reject the present makes an attempt for decrease lows, the clearance of the present “paper Bitcoin” overhang can be required for a sustained leg up.

Whether or not the “cleaning” of weak miners and speculative bets will assist drive up costs stays to be seen for now. Bitcoin is trickling decrease, confirming the losses of June 6.

The instant help lies at $66,000. If this stage is misplaced, BTC might flash crash to $60,000 and even Could 2024 lows of $56,500.