As Bitcoin (BTC) continues hovering across the $20K zone, market sentiment could be altering from concern to capitulation.

“Bitcoin goes from $69,000 to $17,600, and individuals are nonetheless searching for indicators of capitulation? There could be one other downswing to $16,000-$14,000, however remember that you’ll by no means time the BTC backside. DCA all the way in which,” Market analyst Ali Martinez explained.

Bitcoin slipped to lows of $17K over the weekend, but it surely has been in a position to reclaim the $20K stage. The main cryptocurrency was hovering round $20,203 throughout intraday buying and selling, in response to CoinMarketCap.

Martinez had beforehand noted:

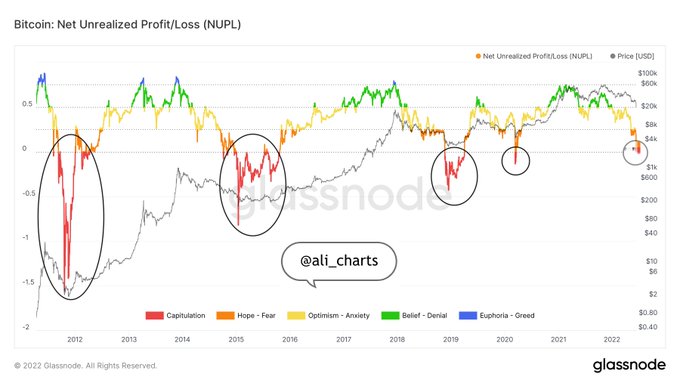

“The market sentiment round Bitcoin seems to have shifted from “Concern” to “Capitulation.” This represents the final stage of a bearish cycle earlier than the market sentiment shifts into “Hope” to sign the start of a brand new bull market.”

Supply: Glassnode

Capitulation available in the market occurs when traders have given up on attempting to get better misplaced good points primarily based on falling costs. Consequently, analysts consider that it signifies a market backside.

Then again, Bitcoin wants to remain above the numerous assist zone of $20K as a result of this can improve its possibilities of constructing momentum. Martinez famous:

“Over 400K addresses purchased 516K BTC at $19,200, which ought to function assist. Nonetheless, transaction historical past additionally reveals that 700K addresses had beforehand bought 520K BTC between $20,300 and $21,500. These are a very powerful assist and resistance areas it’s best to take note of.”

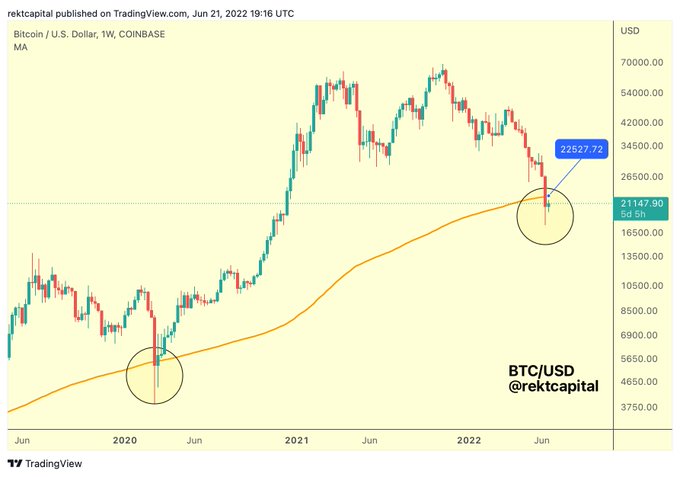

In the meantime, Bitcoin wants to interrupt above $22,500 to reclaim the 200-week shifting common (MA) as assist, says crypto analyst Rekt Capital.

Supply: TradingView/RektCapital

The 200-week MA displays a long-term measure that reveals 4 years of an asset’s value motion. Beforehand, it acted because the final defend throughout BTC bear cycles.

Picture supply: Shutterstock