Glassnode’s mannequin for monitoring the “worth multiplier” impact for Bitcoin might present some hints about whether or not the asset is close to the highest or not to this point.

Bitcoin Is Observing A Multiplier Impact Of 4-5x Proper Now

In a brand new post on X, the lead on-chain analyst at Glassnode, Checkmate, has mentioned the “worth multiplier” impact of Bitcoin. This impact refers to the truth that the capital that flows into the cryptocurrency just isn’t at all times (actually, more often than not) the identical because the change mirrored out there cap.

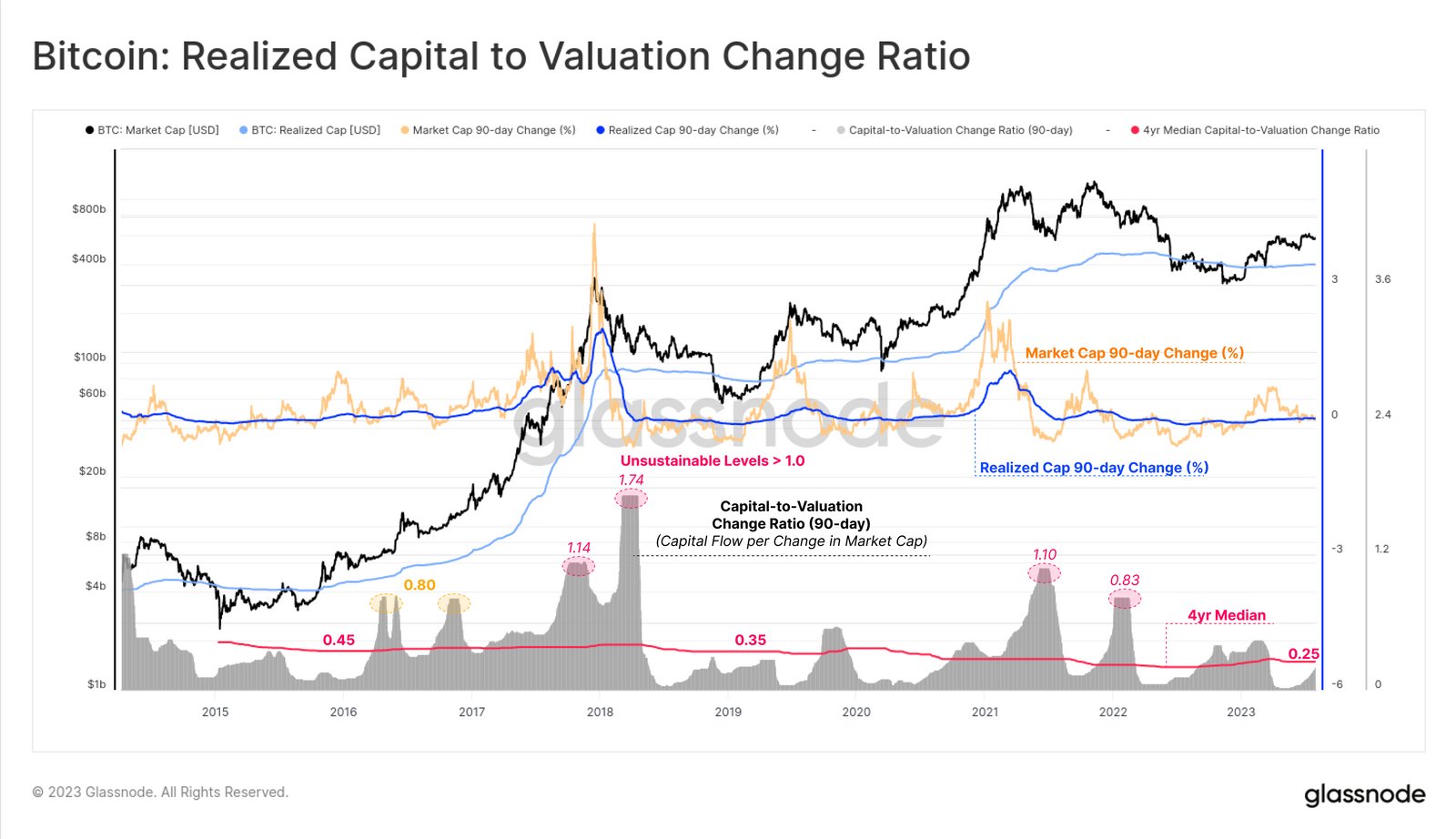

To trace the precise ratio between the 2, Glassnode has outlined the “Realized Capital to Valuation Change Ratio.” This indicator measures how a lot capital flows into the “Realized Cap” for each unit change out there cap.

The Realized Cap refers to a capitalization mannequin for Bitcoin that assumes that the true worth of every coin in circulation just isn’t the present spot worth however the worth on the time it was final transferred on the blockchain.

This final switch could possibly be thought-about the earlier second the coin modified palms, so the Realized Cap provides up the associated fee foundation or acquisition worth of all cash in circulation. Put one other manner, the Realized Cap is a mannequin that measures the overall quantity of capital the traders have used to purchase Bitcoin.

Now, here’s a chart that reveals the pattern within the BTC Realized Capital to Valuation Change Ratio over the previous a number of years:

The information for the 90-day change within the metric | Supply: @_Checkmatey_ on X

The above graph reveals that the Bitcoin Realized Capital to Valuation Change Ratio (90-day) has lately been beneath the 4-year median of 0.25. As Checkmate notes, this mannequin suggests the present multiplier impact of BTC is round 4 to five occasions.

Which means that for each $0.20 to $0.25 going into the realized cap, the market cap is transferring by $1. From the chart, it’s obvious that the multiplier has typically shot up throughout bull markets.

“Bull market tops typically correspond with $0.80 to over $1.0 in capital inflows wanted to realize a $1 change out there cap (unsustainable < 1x Multipler),” explains the Glassnode lead.

However, bear markets “typically see heightened volatility with $0.2 in capital flows having a $1.0 impression on MCap (5x Multipler),” in accordance with the analyst.

Suppose this historic sample is something to go by. In that case, the present Bitcoin multiplier continues to be at comparatively low values, which might indicate the cryptocurrency nonetheless has a number of room to go earlier than a possible prime is encountered.

One other curious sample within the ratio can be seen in the identical chart. It seems that the 4-year median has been happening because the years have handed. This might imply that BTC’s market cap has, on common, been turning into simpler to shift with time.

BTC Worth

Prior to now day, the Bitcoin spot ETFs had been lastly cleared by the US SEC, and it will seem that the market has reacted by shopping for this information, as the value has now breached the $48,000 stage.

Seems like the value of the coin has shot up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Dmytro Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site totally at your individual danger.