In a collection of tweets, Jurrien Timmer, the worldwide macro director at Constancy Investments, drew parallels between the crypto market and the tech bubble of the late Nineteen Nineties. Timmer means that simply as some tech shares emerged as winners from the dot-com bubble, sure digital property within the crypto trade will rise whereas others might fade away.

Notice that even stalwarts like Apple suffered a big draw-down when the bubble burst, however recovered to change into a dominant power, whereas so many also-rans fell into oblivion. Time will inform what’s in retailer for Bitcoin. /6

— Jurrien Timmer (@TimmerFidelity) May 31, 2023

May Bitcoin be the “Apple” of digital property, beating the chances and ushering in a brand new period of dominance? Learn on!

The New Apple Of The Crypto World

Timmer particularly highlights Bitcoin (BTC) as a possible “Apple” of the crypto world. He explains that just like how Apple and Amazon survived and thrived after the tech bubble, Bitcoin may additionally not solely survive but additionally take market share from different digital property.

Crypto’s boom-bust cycle might be in comparison with the dot-com bubble of the late Nineteen Nineties. The web bubble took many unqualified shares to astronomical heights, solely to see them lose most or all their worth when the bubble burst. /3

— Jurrien Timmer (@TimmerFidelity) May 31, 2023

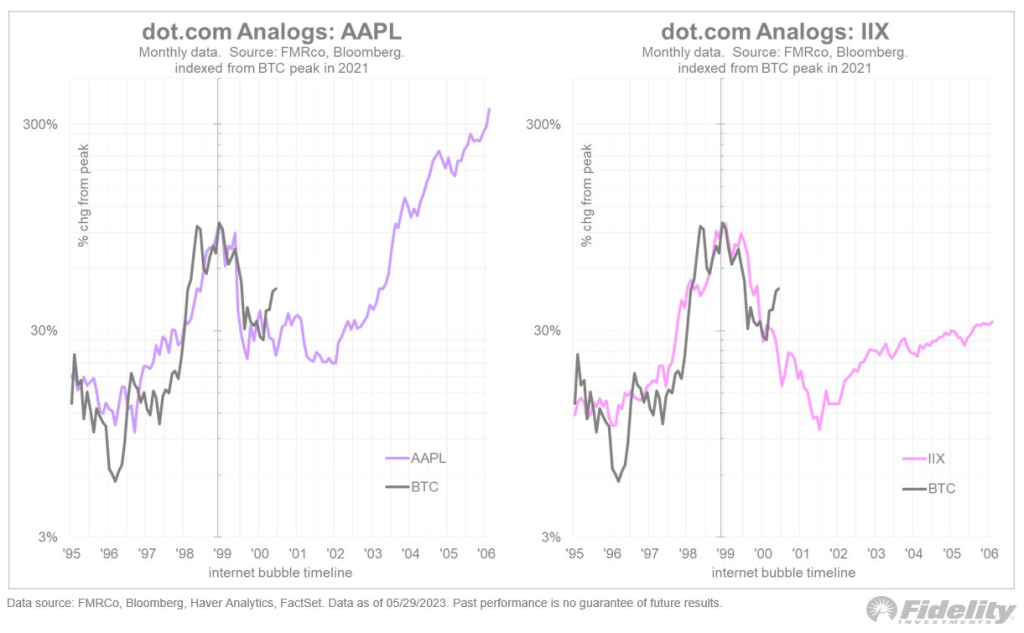

As an example his level, Timmer overlays Bitcoin’s present chart with that of Apple’s inventory and an web inventory index from twenty years in the past. The charts appear to exhibit related value patterns, implying a attainable correlation between Bitcoin and the profitable trajectory of Apple through the dot-com bubble.

Learn: Analyst Predict BTC Value Can Surge 200% Forward of Bitcoin Halving – Coinpedia Fintech Information

A Bumpy Highway To Dominance

He additional notes that even Apple skilled a major decline through the bubble burst, however in the end recovered and have become a dominant power within the tech trade. Whether or not Bitcoin will observe the same path stays to be seen.

As of the writing, Apple (AAPL), buying and selling at $0.22 in 2002, has risen to $177.25, reflecting a staggering achieve of roughly 80,345%.

Beneath, I present an overlay of Bitcoin at the moment vs. Apple twenty years in the past (left), and Bitcoin vs the Interactive Web Index (IIX) on the fitting. The IIX was a now-defunct index of web shares that noticed its worth come full circle from nothing to bubble again to nothing. /5 pic.twitter.com/GCpoODZKuK

— Jurrien Timmer (@TimmerFidelity) May 31, 2023