The winds of change are swirling round Ethereum, the world’s second-largest cryptocurrency. Regardless of a current worth dip, the community has witnessed a surge in new person exercise, sparking a wave of optimism. Nevertheless, the outsized affect of enormous holders, referred to as whales, continues to solid an extended shadow.

New Wallets Open For Enterprise

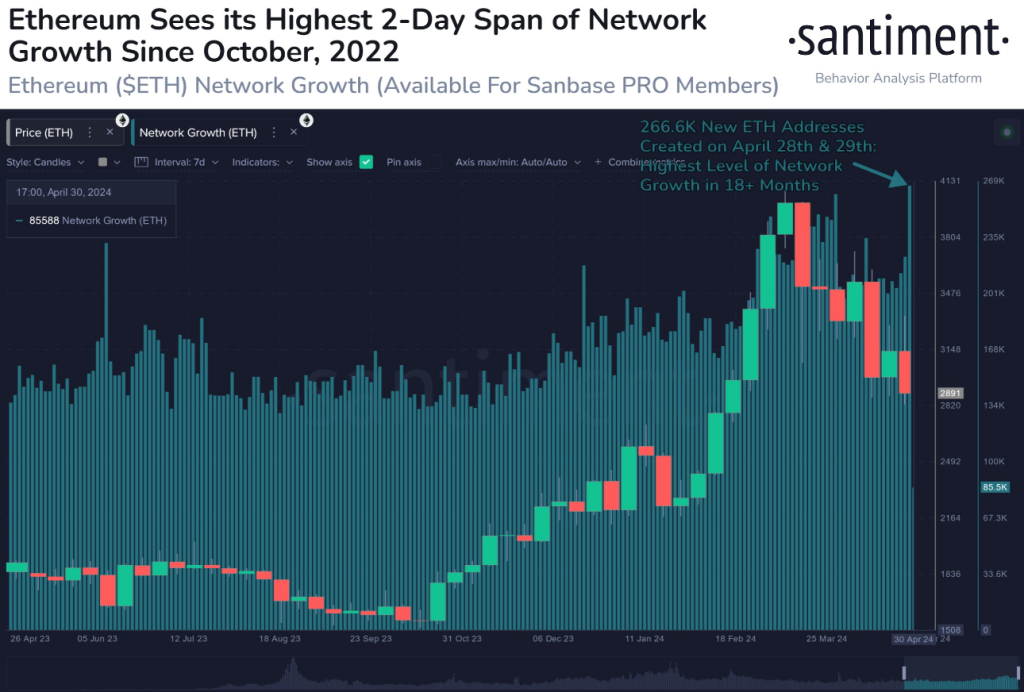

Knowledge from blockchain analytics agency Santiment reveals a surge in new Ethereum wallets, with a record-breaking 267,000 created on April twenty eighth and twenty ninth. This inflow marks the best two-day improve since October 2022 and suggests a possible resurgence of curiosity within the Ethereum community.

📈 #Ethereum noticed a milestone as April got here to an finish. 266.6K new wallets have been created on April twenty eighth and twenty ninth, the best 2-day stretch of community development since October eighth and ninth, 2022. It’s a robust that $ETH continues increasing regardless of dipping costs. https://t.co/SN6xqc3JXV pic.twitter.com/KDcjhY30y5

— Santiment (@santimentfeed) May 1, 2024

This pattern defies the present market downturn, with many cryptocurrencies experiencing important worth drops. Analysts speculate that the rise in new wallets might be fueled by a number of elements, together with:

- Anticipation of future development: Traders could also be trying in the direction of upcoming Ethereum upgrades that promise improved scalability and safety, betting on the community’s long-term potential.

- Discount hunters: The current worth dip could be seen as a horny entry level for brand spanking new buyers in search of a reduction on Ethereum.

On Minnows And Whales

Whereas the variety of new customers is encouraging, a better take a look at Ethereum’s deal with distribution reveals a stark disparity in holdings. Based on CoinMarketCap, a staggering 97% of Ethereum addresses maintain between $0 and $1,000 value of the cryptocurrency. This signifies a big pool of small-scale buyers, sometimes called “minnows.”

Nevertheless, the actual energy lies with a choose few. Whale monitoring platform Clank estimates that whales, representing solely 0.10% of all Ethereum addresses, management a whopping 41% of the entire circulating provide. This interprets to a median holding of almost 10 million ETH per whale, valued at a staggering $3.7 million.

Ether market cap at the moment at $362 billion. Chart: TradingView.com

Holding Regular: A Vote Of Confidence?

Regardless of the current worth decline, Ethereum seems to be weathering the storm higher than the broader crypto market. The truth is, Ether is up greater than 30% year-to-date (YTD) from a gap worth of about $2,282.

As of at the moment, Ethereum sits at $3,014, with a complete market capitalization of $362 billion. Notably, the market skilled a median decline of 8.75% over the past week, highlighting Ethereum’s relative resilience.

Supply: CoinMarketCap

Moreover, knowledge suggests {that a} majority of Ethereum buyers (74%) are long-term holders, demonstrating a robust perception within the undertaking’s future. This “hodling” mentality signifies a dedication to sustaining their Ethereum positions for the lengthy haul, even within the face of short-term market fluctuations.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site completely at your individual danger.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24830575/canoo_van_photo.jpeg)