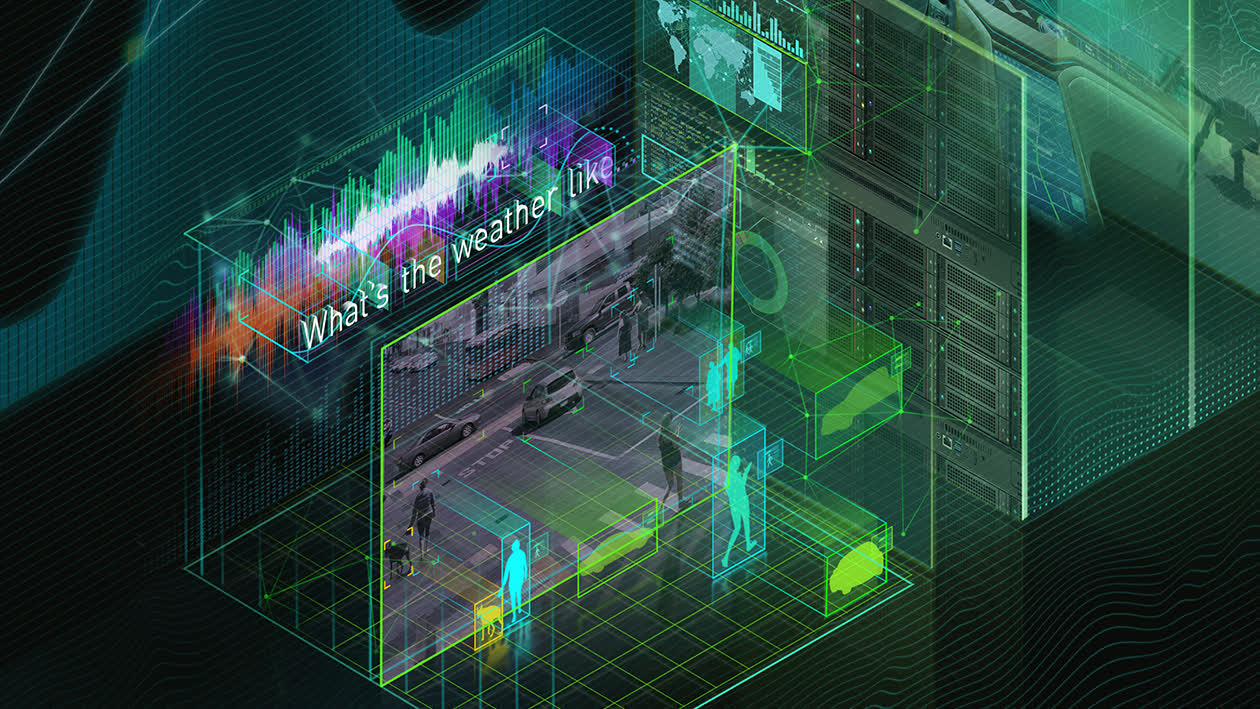

The large image: The world has gone mad for AI. Setting apart what the newest AI fashions are literally good for, it’s not stunning that traders are on the lookout for shares with “AI publicity.” Sadly, this seems to be a reasonably quick record in the intervening time, and on the high of that record is Nvidia.

Nvidia has largely captured all the marketplace for chips used for coaching AI fashions and can be performing nicely with chips for inference. The corporate is strategically well-positioned, which is mirrored in its inventory worth, at the moment buying and selling at 167x trailing twelve months earnings and 67 occasions this yr’s estimated EPS. These are vital multiples that will give many traders pause.

Editor’s Notice:

Visitor creator Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed progress methods and alliances for corporations within the cellular, networking, gaming, and software program industries.

Whereas Nvidia is definitely the chief within the hottest new market, and there are not any indicators of anybody difficult their dominance, it is vital to notice that the corporate has skilled increase/bust swings all through its 40-year historical past. Though their CEO has completed an unimaginable job in bringing them so far, combining deep technical understanding, a eager strategic thoughts, and eloquence to persuade others of their imaginative and prescient, the Road has typically turn out to be overexcited about their numbers, typically simply earlier than a serious stock correction. There are at the moment no indicators of a downturn, however, to place it politely, Nvidia typically struggles to precisely forecast its finish markets and successfully talk its expectations to the market.

So what’s Nvidia value?

An enormous a part of the disconnect proper now could be that for the primary time Nvidia’s sturdy market place relies on software program greater than its {hardware}. For years, the corporate needed to compete with AMD for management within the GPU Feeds and Speeds race. Nvidia emerged because the winner in most of these contests, however there was at all times some competitors to problem them. The AI market is completely different. Nvidia has maintained its lead because of its CUDA software program. Though not an working system per se, CUDA’s ubiquity and relative ease of use have made it the de facto frequent software program layer for AI software program assembly silicon.

An enormous a part of the disconnect proper now could be that for the primary time Nvidia’s sturdy market place relies on software program greater than its {hardware}.

AMD has by no means had something to rival CUDA, and from what we will inform they don’t seem to be even attempting. Whereas there are software program libraries making an attempt to displace Nvidia, these are owned or largely supported by software program corporations that do not care sufficient in regards to the intricacies GPU firmware intricacies to create a real different. Maybe a couple of years of close to monopoly may change that, however at the moment, there does not appear to be something on the horizon.

Contemplating Nvidia’s software program as their true aggressive benefit, ought to they be seen as a software program firm? This concept could appear mildly outlandish however is value contemplating. We carried out some tough comparisons for Nvidia’s inventory, that are proven within the desk beneath.

| Share worth (5.8.23) | FY1 EPS | FY2 EPS | FY1 PE | FY2 PE | |

| NVDA | 291.51 | 4.53 | 6.05 | 64.4x | 48.2x |

| AMD | 95.04 | 2.55 | 3.66 | 37.3x | 26.0x |

| QCOM | 108.31 | 8.38 | 9.77 | 12.9x | 11.1x |

| MRVL | 41.01 | 1.52 | 2.3 | 27.0x | 17.8x |

| CRM | 197.9 | 6.36 | 7.92 | 31.1x | 25.0x |

| MSFT | 308.65 | 9.67 | 10.92 | 31.9x | 28.3x |

| ADBE | 344.06 | 13.83 | 15.7 | 24.9x | 21.9x |

| SNOW | 160.42 | 0.6 | 1.01 | 267.4x | 158.8x |

| DDOG | 78.54 | 1.18 | 1.56 | 66.6x | 50.3x |

| AAPL | 173.5 | 5.32 | 5.85 | 32.6x | 29.7x |

Nvidia is already buying and selling at greater than double the worth of its large-cap semiconductor friends. It additionally carries a hefty premium in comparison with large-cap established software program corporations like Microsoft, Salesforce, and Adobe. The closest comparable group can be new, high-growth software program corporations like Snowflake and Datadog. That’s a powerful peer group.

Whereas the Road expects Nvidia’s earnings to double over the following two years, Snowflake’s earnings are projected to double in only one yr. If Nvidia traded at Snowflake’s a number of, the inventory can be value roughly $600, greater than double its present worth of $291. The truth that we’re even contemplating an organization like Snowflake on this dialogue is sufficient motive to lift severe questions on Nvidia’s valuation.

One other manner to consider Nvidia is by evaluating it to corporations that monetize their distinctive software program by way of {hardware} gross sales, similar to Apple. Some might argue that the 2 corporations are very completely different, however conceptually, they share the commonality of {hardware} costs with software program differentiation. Nevertheless, even Apple trades at a reduction of virtually 40% in comparison with Nvidia.

As a lot as we imagine Nvidia is executing extremely nicely, it’s troublesome to really feel snug with the present share worth.