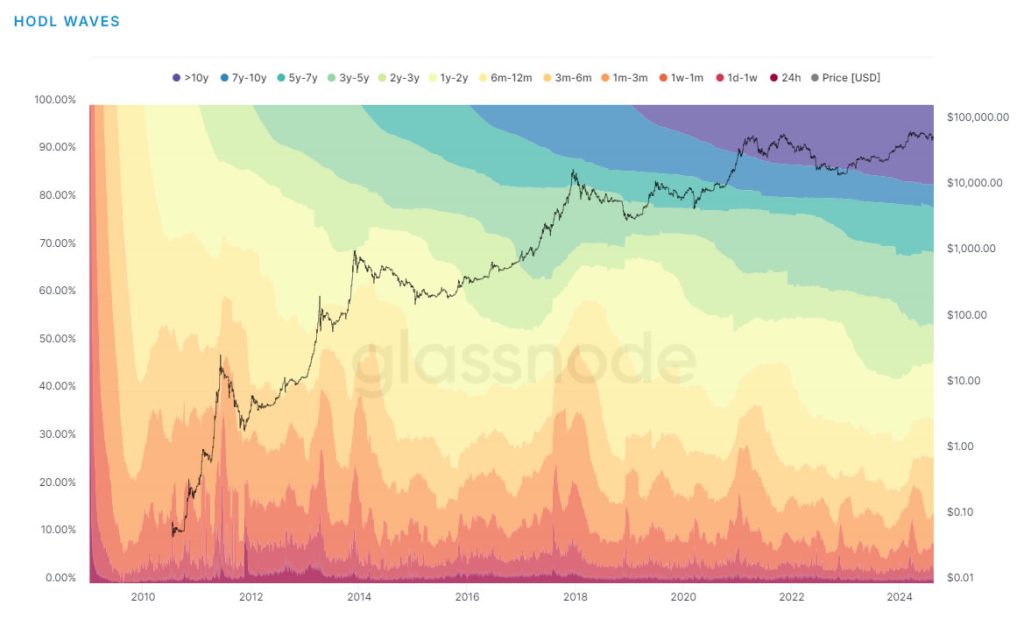

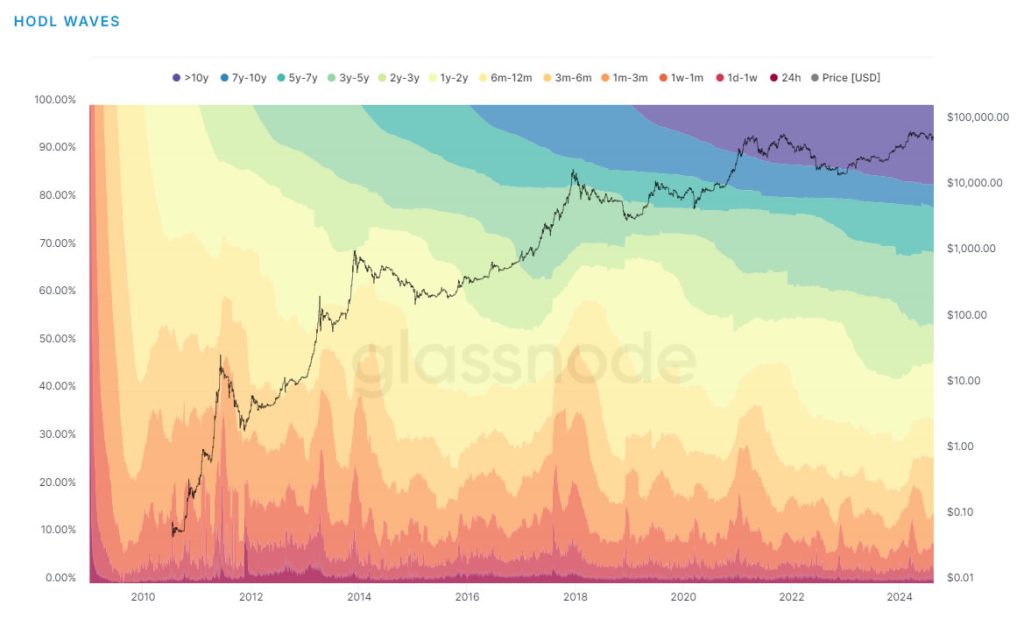

Bitcoin and its believers are staying sturdy it doesn’t matter what market situations they should face. Knowledge exhibits that 75% of Bitcoin’s circulating provide has not been moved within the final 6 months. This clearly represents that regardless of the bearish stress available on the market, bitcoin HODLERS will not be afraid. So, what this implies for the way forward for BTC, let’s discover out.

Lengthy Time period Bitcoin HODLING : A Signal of Confidence

In line with HODL Waves chart by Glassnode, virtually three quarters of the the bitcoin circulating provide has not moved wallets. This can be a signal that a lot of BTC traders consider in its long run worth. It’s fairly attention-grabbing to see the shift of huge establishments saying “Bitcoin is dangerous” to “Bitcoin is Useless” to now “Bitcoin is the Digital Gold.”

Despite the fact that, the value of bitcoin is down by round 21% from its all time excessive this yr, persons are holding their Bitcoin luggage. When a big quantity of Bitcoin is held in wallets and never traded, it reduces the quantity of BTC out there out there. With improve in demand, the value will increase. And all of us are seeing how large establishments are accumulating Bitcoin and including them to their portfolio.

Challenges For Quick Time period Buyers

Whereas Long run traders will not be affected by present situations, the brief time period traders are scared. A tweet from an on chain analyst 80% of the individuals who invested in Bitcoin since late February 2024, are at loss.

Not simply these, however there are extra individuals who purchased in 2021 peak time. These folks have purchased btc above present value. The latest market dips have put these brief time period traders in a troublesome spot. This isn’t taking place for the primary time. We’ve got seen related issues in earlier bull runs. Folks purchase at excessive costs and when the market takes a correction, these guys panic promote making a domino’s results. This deepens the market additional.

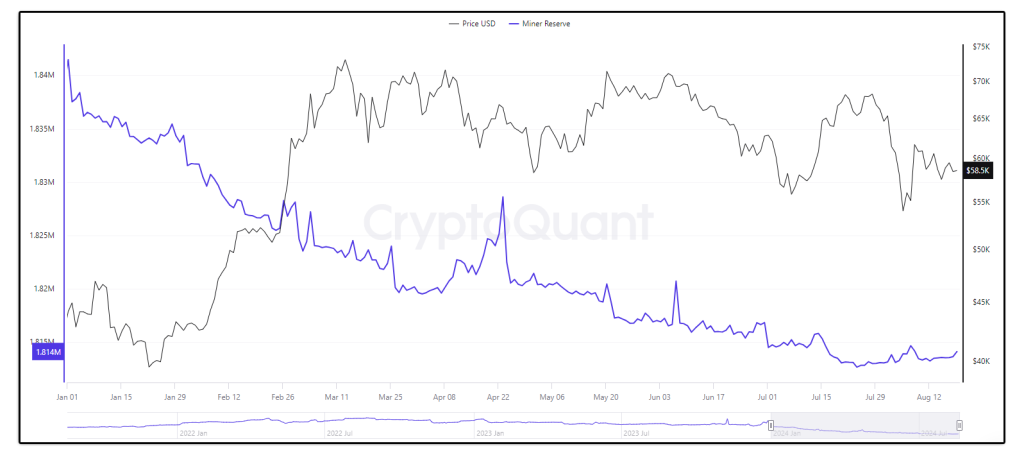

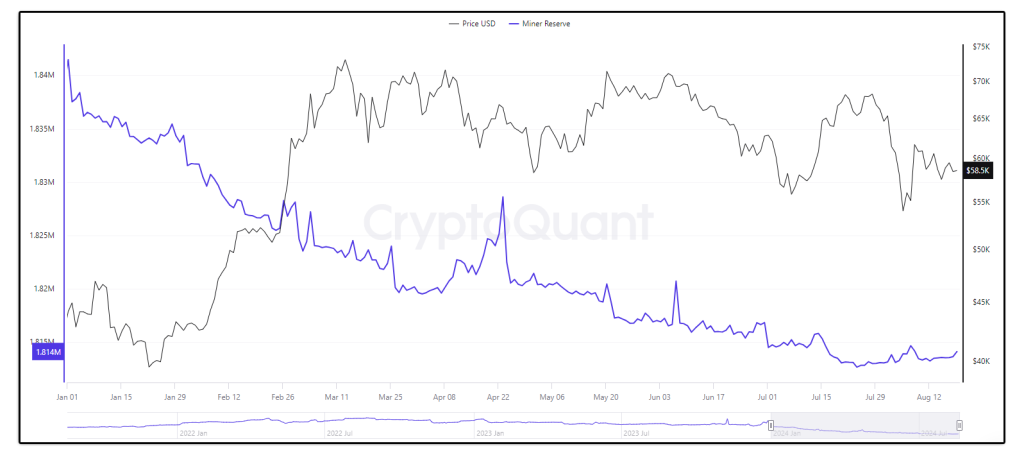

Bitcoin Miner Beneath Strain

Bitcoin miners are additionally not immune to those market situations. They’re additionally feeling the squeeze. CryptoQuant information exhibits that miners at the moment are working with revenue margins which have dropped to the bottom ranges since January. Miners have been promoting their Bitcoin reserves to proceed their enterprise. This may appear alarming, nonetheless the market has recovered from such conditions in historical past.

Fearful Market Sentiments

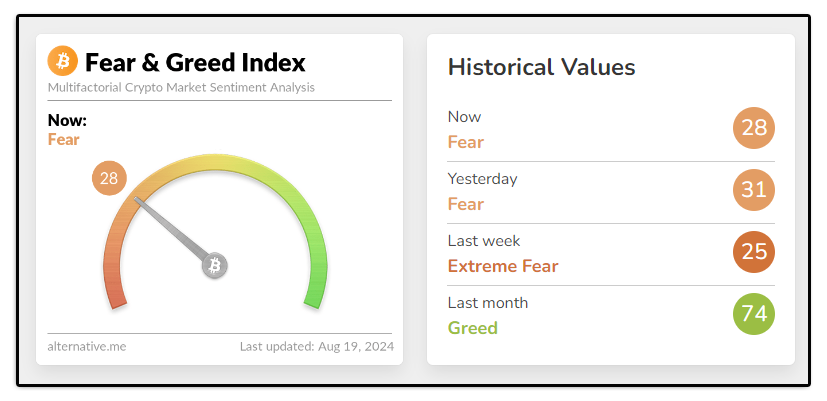

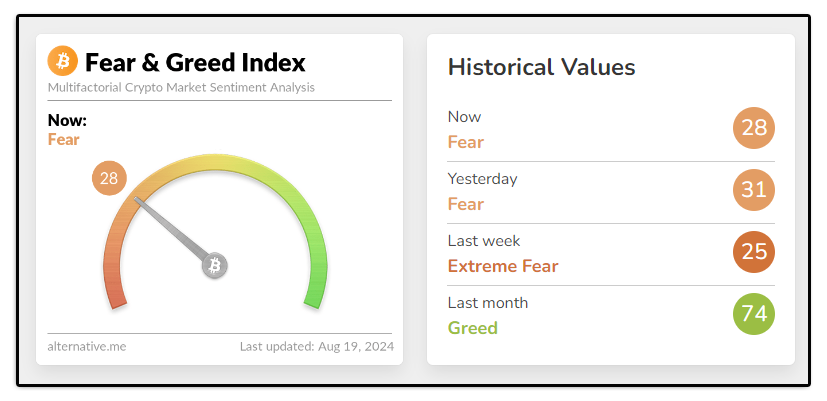

The market temper may be very cautious. The Crypto Worry and Greed index has fallen to a worry issue at 28 from its final month greed issue at 74. Because the begin of August, this index has been solely pointing to market worry.

In my earlier article I’ve shared info why Bitcoin may check the $48,000 zone because of market worry. These causes are nonetheless legitimate as we’ve not seen any constructive flip within the Bitcoin value. A number of components like the usgovernment transferring 10,000 BTC to Coinbase suggests one other dip.

The Massive Image

The historic information of Bitcoin exhibits that earlier than a correct bull run, the market all the time runs into related situations. At current, BTC is in a consolidated zone. The months of August and September have been bearish months for the market during the last 12 years and October provides a excessive leap. Following these patterns and information being displayed by the charts, we are able to say that earlier than the rise close to October, the market may take one other dip. It will wash the panic sellers and open new accumulation alternatives to those that perceive the true worth of Bitcoin. Numerous specialists are giving completely different numbers for a bull run, nonetheless one factor is widespread, everybody believes to witness Bitcoin value crossing $100k within the subsequent six months.