CRV, the native token of the stablecoin decentralized trade Curve Finance, has been dumping in during the last yr or so. After final week’s plunge, the token fell by as a lot as 75% from March 2024 highs, an enormous concern for token holders.

CRV Recovers, Provides 45% After Plunging

Nonetheless, in keeping with one analyst who took to X, the underside may very well be in, arguing that favorable elementary occasions in roughly two months may propel the token to as excessive as $2. CRV is altering fingers at round $0.32, up 42% from final week’s lows.

Most significantly, costs are stabilizing, with the spectacular follow-through of June 13. After the flash crash that day, costs fell to as little as $0.22.

Associated Studying

Nonetheless, what was encouraging was the lengthy decrease wick, pointing to welcomed demand by the shut of the buying and selling day. This push was clear the following day when costs closed larger, with bulls extending positive aspects over the weekend.

Whether or not the June 13 plunge marked the tip of CRV woes stays to be seen. For now, the sharp 45% restoration from final week’s lows and the growth in Ethereum costs may create demand, additional propelling CRV to the $0.40 mark.

Curve To Change Token Emission As Erogov’s Unhealthy Debt Cleared

The analyst thinks one thing massive is within the pipeline for Curve Finance as a protocol and CRV as the first token priming platform. In mid-August, the token’s inflation price would fall from 20.37% to as little as 6.34%. This discount could be primarily due to the protocol’s shift to CRV distribution.

From August 12, Curve will mechanically stop allocating CRV to the core crew for vesting. As a substitute, gauges will distribute the token on to the group, drastically slashing inflation.

Curve gauges decide how CRV is distributed to varied liquidity swimming pools. Via gauges, Curve Finance stays decentralized. It is because token holders can now vote on how a lot the liquidity suppliers of a given pool can obtain CRV as an incentive.

Associated Studying

Moreover the shift in CRV distribution, the liquidation of Michael Egorov’s place eliminates the difficulty of dangerous debt. Accordingly, Curve can’t generate actual income for CRV holders, drawing worth.

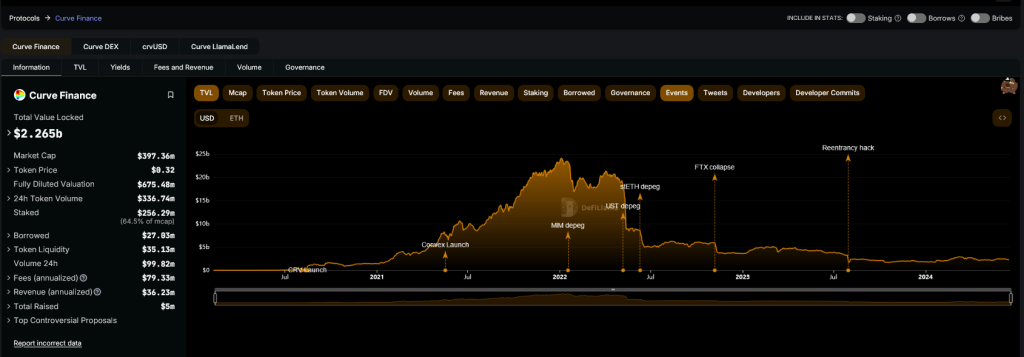

Based on the analyst, Curve may evolve to be a number one decentralized Foreign exchange market over the approaching years. The protocol is likely one of the largest decentralized finance (DeFi) platforms. Based on DeFiLlama, it instructions a complete worth locked of over $2.2 billion.

Function picture from DALLE, chart from TradingView