Investigative journalist James Corbett has lately referred to the continuing international banking disaster involving SVB, Signature Financial institution, Credit score Suisse and others because the “Panic of 2023,” drawing comparisons to what he views as historic precedents, and pointing forward to an inevitable and bleak, technocratic surveillance future leveraging central financial institution digital currencies (CBDCs) ought to nothing be executed to cease it. The reply to the CBDC “whole nightmare of financial management,” as Corbett places it, is money, creativity, and to “select to tell ourselves about agorism and the countereconomy.”

James Corbett on Disaster, CBDCs, Money, and the Countereconomy

Investigative journalist and freedom activist James Corbett of The Corbett Report, a well-liked various information supply based mostly on the “precept of open-source intelligence,” has weighed in lately on the present international banking debacle and its echoes throughout current historical past. Additional, he has been cautioning his followers for years concerning the risks of giving up their monetary freedom, and uncritically accepting burgeoning state-created monetary applied sciences comparable to central financial institution digital currencies (CBDCs).

Bitcoin.com Information despatched Corbett some questions on the subject, asking for his views on the present disaster, its causes, and methods odd individuals can climate the present so-called banking contagion. Under are his responses.

Bitcoin.com Information (BCN): In your current work you’ve drawn similarities between the present banking debacle and the Panic of 1907 and the 2008 monetary disaster. How does what we’re witnessing unfold now with SVB, Signature Financial institution, Credit score Suisse, and others, examine to previous monetary crises?

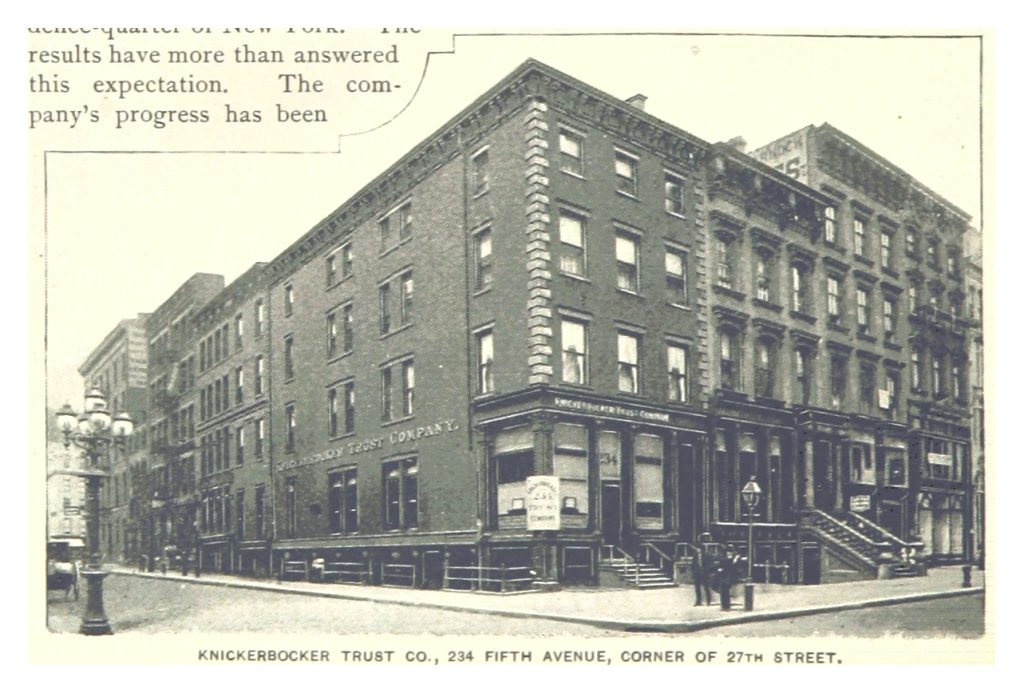

James Corbett (JC): In 1907, a run on Knickerbocker Belief, one in every of New York’s largest belief firms, precipitated a financial institution run and a 50% drop on the New York Inventory Trade. In its official web page on the occasion—dubbed “The Panic of 1907“—the Federal Reserve calls it the “first worldwide monetary disaster of the 20th century.” Based on the Fed, the panic was attributable to rumours about Knickerbocker Belief’s insolvency and the disaster was finally averted by the “legendary actions” of J.P. Morgan, who personally oversaw the bailout of the banking system.

What the Federal Reserve doesn’t notice in its official historical past of the 1907 panic is that—as even Life Journal conceded a long time later—the rumours that sparked the complete affair have been themselves planted by George W. Perkins, one in every of J.P. Morgan’s enterprise companions. Additionally lacking from the Fed’s whitewashed historical past lesson is the truth that Morgan used it as an excuse to remove his banking competitors (the Knickerbocker Belief) and rescue his banking associates (the Belief Firm of America, which had intensive ties to a lot of Morgan’s shoppers.)

Quick ahead to 2023 and it’s fascinating to notice that even Bloomberg is reporting an eerily comparable sample of rumours and Morgan-as-saviour within the collapse of Silicon Valley Financial institution:

“Distinguished enterprise capitalists suggested their tech startups to withdraw cash from Silicon Valley Financial institution, whereas mega establishments comparable to JP Morgan Chase & Co sought to persuade some SVB clients to maneuver their funds Thursday by touting the protection of their property.”

And, as The Monetary Occasions later confirmed, the instant impact of SVB’s bother and the ensuing regional financial institution instability was to ship depositors flocking to the perceived security of the most important banks, together with, after all, JPMorgan Chase.

BCN: In your newest episode of New World Subsequent Week with James Evan Pilato, “Crypto Contagion Banks Get the Runs,” you allude to discrepancies within the official story surrounding the current collapse of Silicon Valley Financial institution, referencing audits of the establishment simply previous to its demise. Equally, Signature Financial institution board member Barney Frank mentioned lately he was stunned on the collapse of Signature financial institution as nicely, and that regulators have been making an attempt to ship an “anti-crypto message.” In your view, is what we’re seeing now engineered?

JC: Sure, this financial institution “contagion” is an engineered phenomenon. However with the intention to perceive that phenomenon, we have to ask an additional query: On what stage has it been engineered?

Because it seems, though there are a number of components that contributed to SVB’s downfall—together with its focus on ESGs and DEI and different types of “woke” investing—the instant proximal reason behind the financial institution’s crash was its bizarre predicament: it had an excessive amount of money.

Because it seems, though there are a number of components that contributed to SVB’s downfall … the instant proximal reason behind the financial institution’s crash was its bizarre predicament: it had an excessive amount of money.

You see, banks make cash by lending out their clients’ deposits . . . and once I say “make cash” I imply they actually make cash. Within the topsy-turvy world of banking, a excessive loan-to-deposit ratio (LDR) is seen as factor, with an 80-90% LDR held up as a perfect determine. Nonetheless, SVB, with simply $74 billion in loans towards $173 billion in buyer deposits, discovered it had an excessive amount of money sloshing round its coffers.

So it determined to park that cash within the most secure (however not likely secure), risk-free (however not truly risk-free), good-as-gold (bur not actually good-as-gold) funding: long-term US Treasuries. In spite of everything, the one method it might probably lose cash in US Treasuries is that if the Fed began mountaineering charges like loopy, and so they haven’t executed that in a long time! What might go unsuitable?

Oh, wait…

So, lengthy story brief, SVB loaded up on almost $120 billion price of long-term Treasuries after they have been at 1.78% yield and the climb to five% yield meant SVB needed to guide billions in losses. The truth is, their 2022 Annual Report, which got here out in January, confirmed that the financial institution was sitting on $15 billion in “unrealized losses” from their dangerous bond wager, which, for a financial institution with $16 billion in whole capital, is type of a foul factor.

So sure, the autumn of SVB was engineered . . . by the Fed. This disaster is the direct results of the Fed trying to again out of the disastrous, decade-and-a-half-long synthetic bond bubble it blew to cease the International Monetary Disaster of 2008. And what brought about the International Monetary Disaster? The disastrous, nearly-decade-long synthetic housing bubble that the Fed blew to cease the dotcom bust and the 9/11 slowdown and the Enron/Worldcom fraud fallout.

BCN: You’ve famous that the present disaster may very well be used as an excuse to usher in central financial institution digital currencies extra rapidly. In your view, how may such an occasion play out and who could be the largest winners and losers?

JC: To reply this query, let’s ask one other query: Why is the Fed so enthusiastic about The Panic of 1907, anyway? It’s as a result of, as they themselves assert, the disaster attributable to that specific banking panic “impressed the financial reform motion and led to the creation of the Federal Reserve System.”

In fact, like all the pieces else that comes out of the banksters’ mouth, that assertion is a lie. Truly, it’s two lies.

First, it’s a lie of fee: the financial reform motion—which grew to become a well-liked political power after The Crime of 1873 and encompassed the Free Silver motion and bimetallism and William Jennings Bryan and the cross of gold and, sure, The Wizard of Oz—was most actually not “impressed by” The Panic of 1907.

And secondly, it’s a lie of omission: the Fed conveniently leaves out the opposite a part of its creation story, not simply the Morgan-backed rumours that precipitated the panic within the first place, but additionally the notorious Jekyll Island assembly that really led to the creation of the Federal Reserve System.

These reservations however, the final level stands: the generated disaster of The Panic of 1907 did result in an upending of the prevailing financial order and the creation of the Federal Reserve.

Equally, it could be onerous to think about a full-scale revolution within the banking system right this moment that didn’t originate with some type of banking disaster. What’s past doubt is that governments the world over wouldn’t hesitate to make use of any such disaster as an excuse to implement their new digital financial order. In spite of everything, the Home Monetary Companies Committee tried to slide the creation of a digital greenback into the unique COVID stimulus invoice. Do we actually assume that emergency laws for a brand new digital foreign money isn’t ready within the wings, able to be unleashed on the general public within the occasion of the subsequent disaster?

When that disaster does result in the pre-planned CBDC “resolution,” we will count on that it’s going to play out in a broadly comparable vogue as The Panic of 1907 and the International Monetary Disaster of 2007—08. In each circumstances the fallout simply so occurred to learn sure pursuits. In 1907, Morgan managed to consolidate his banking pursuits, remove his competitors, act because the benevolent saviour of the economic system and persuade the general public of the necessity to hand the financial reins over to the banking cartel. In 2008, it was croney-connected establishments like AIG and (after all) JP Morgan that benefited from the unprecedented banking “bailout,” and the disaster helped cement the rise of latest monetary giants like BlackRock. So it could not be shocking to search out sure banking pursuits utilizing the chance of a generated banking disaster to remove their competitors and consolidate their management within the banking world.

And, as I’ve talked about earlier than, not each banker stands to learn from the implementation of a retail CBDC. The truth is, to the extent that CBDCs lower the business banking middlemen out of the prevailing financial circuit, it truly goes towards the pursuits of the business bankers.

However, after all, the true losers within the occasion of such a disaster, as at all times could be us: most people. Within the worst-case state of affairs, the central banksters would seize the chance to implement the “programmable cash” nightmare of whole financial management.

BCN: If nothing is completed to verify the implementation of CBDCs and the monetary surveillance and spying they probably afford, when will we see them attain international ubiquity?

JC: I can’t provide you with a date. However I can say that if nothing is completed to verify their implementation, CBDCs will attain international ubiquity.

If I have been to make a forecast about their implementation, my prediction could be that we’ll not go from a zero-CBDC financial system to a 100%-CBDC financial system abruptly. CBDCs will co-exist alongside different types of cost for some time period, and they’ll look and performance in another way in numerous jurisdictions. Some will probably be full retail and wholesale CBDCs, some will serve one perform or different, some retail CBDCs could also be administered immediately by the central financial institution, others will certify banks and different monetary establishments to behave as intermediaries, issuing wallets to the general public.

However in no matter kind they arrive and at no matter time they arrive, the preliminary CBDC implementation would be the proverbial camel’s nostril within the tent. From that time, it’s solely a matter of time earlier than CBDCs begin to turn out to be devices of financial surveillance and management.

BCN: How can on a regular basis people assist preserve and enhance their monetary privateness and financial sovereignty within the present chaotic local weather of so-called banking contagion?

JC: Are you prepared for some excellent news? We don’t want some elaborate plan or high-level entry to high-tech devices to thwart the CBDC agenda. The only instrument for preserving our financial independence is already in our wallets: it’s money.

As I mentioned above, CBDCs will virtually actually co-exist with different types of cost when it’s first launched, so money will nonetheless be an choice except and till the general public is conditioned to simply accept a totally cashless economic system.

The only instrument for preserving our financial independence is already in our wallets: it’s money.

In fact, the continuing Struggle on Money is already making it increasingly tough to make use of money for conducting sure transactions and “coin shortages,” the concern of “soiled cash” and incentives for utilizing digital cost are additional attractive individuals away from utilizing money. That’s why now we have to make a acutely aware determination to help companies that settle for money and commit ourselves to utilizing money regularly. Quite a few such concepts have been proffered lately, from agorist.market‘s “Black Market Fridays” to Solari.com‘s “Money Friday.”

That’s to not say that money is our solely (and even our greatest) choice. I’ve lengthy advocated a “Survival Forex” method the place individuals experiment with totally different types of cash to search out out what works for them. There are group currencies, barter exchanges, native alternate buying and selling techniques, treasured metals, crypto, The miracle of Wörgl and plenty of different examples of ways in which individuals can transact outdoors of the purview of the central bankers.

So long as you might be a part of a group of like-minded individuals which might be prepared to take part in free alternate, there will probably be no scarcity of financial concepts to check out.

BCN: And talking of contagion, there are some connecting the current banking turmoil with the World Financial Discussion board’s Nice Reset initiative, designed ostensibly to deal with the so-called Covid-19 pandemic — basically asserting it’s all half of a bigger plan to arrange a worldwide monetary surveillance grid. Is there any foundation for such concepts, in your view, or is that this simply the stuff of untamed conspiracy concept?

JC: On one stage, the extraordinary concentrate on the World Financial Discussion board’s Nice Reset and its supposed risk that “You’ll personal nothing and you can be comfortable” is misplaced. Sure, Klaus Schwab and his cronies are actually power-hungry schemers, however the Nice Reset is solely the newest rebranding of a really outdated recreation of worldwide management, and the World Financial Discussion board is just one (comparatively minor) participant on the desk.

Name it the New World Order or the Worldwide Guidelines-Based mostly Order or the Worldwide Financial Order or The Nice Reset or no matter you need, and pin it on the Bilderbergers or the Trilaterals or the World Financial Discussion board or whoever you need, the risk is identical: a world during which humanity is on the mercy of a clique of unaccountable technocrats.

I don’t invoke the title of technocracy loosely. I imply it in the true, historic sense of the time period, as “a system of scientifically engineering society” that’s predicated on an financial system during which each transaction is monitored, calculated, databased, tracked, surveilled and allowed or disallowed by a central governing “technate” in actual time. Such a system will contain digital IDs for each citizen, and, after all, a digital foreign money that may be programmed to perform on the whims of the technocrats.

That such a system of management is now technologically attainable is now plain. That there are pursuits just like the World Financial Discussion board which might be working towards the implementation of such a system is just deniable by those that refuse to take heed to the technocrats’ personal pronouncements.

BCN: From the place you sit, is there a cryptocurrency white tablet in all this?

JC: The promise of cryptocurrency continues to be what it has at all times been: a cryptographically safe instrument for transacting within the countereconomy.

But when individuals don’t know what the countereconomy is (not to mention why they’d need to be transacting in it), then what good is it? If it’s seen as simply one other get-rich-quick funding, simply one thing whose measure is to be valued in {dollars}, simply one other asset that needs to be regulated by the SEC and dutifully listed in your tax kind, then it will likely be nothing greater than a handy stepping stone to the CBDC nightmare.

We are able to both select to tell ourselves about agorism and the countereconomy or we will proceed buying and selling within the bankster-approved mainstream economic system and settle for no matter financial order the banksters thrust on us.

The selection is ours. For now.

What are your ideas on James Corbett’s statements on the present banking disaster, the worldwide economic system, and the character of CBDCs? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Rokas Tenys / Shutterstock.com, corbettreport.com

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.