There are a lot of totally different approaches merchants can check out looking for the one which fits their wants. Technical evaluation is one among them: it includes analyzing previous market efficiency utilizing technical instruments, equivalent to pattern strains and indicators. With this methodology merchants can select totally different devices, mix them for optimum outcomes and make choices based mostly on their evaluation and danger tolerance. Nonetheless, if you’re a novice dealer, it might be onerous to make use of all these instruments from the get-go. Studying about some floor guidelines is likely to be a great place to start out.

Right this moment we are going to check out 10 legal guidelines of technical buying and selling proposed by John Murphy – a famend technical evaluation skilled. He wrote a number of books on this topic, together with “Technical Evaluation of the Monetary Markets”. John Murphy’s 10 legal guidelines of technical buying and selling could are available in helpful for each skilled and novice merchants, so let’s check out what they’ve to supply!

Pattern is the Key

John Murphy provides a powerful checklist of concepts and instruments for technical evaluation of monetary markets. Nonetheless, most of them are targeted on the idea of market pattern. He claims that pattern is important to the technical evaluation method. Furthermore, the vast majority of the devices used within the course of are aimed toward measuring the pattern and collaborating in it. So don’t be too stunned while you notice that the next guidelines are additionally related to this idea in a technique or one other.

Map the Pattern

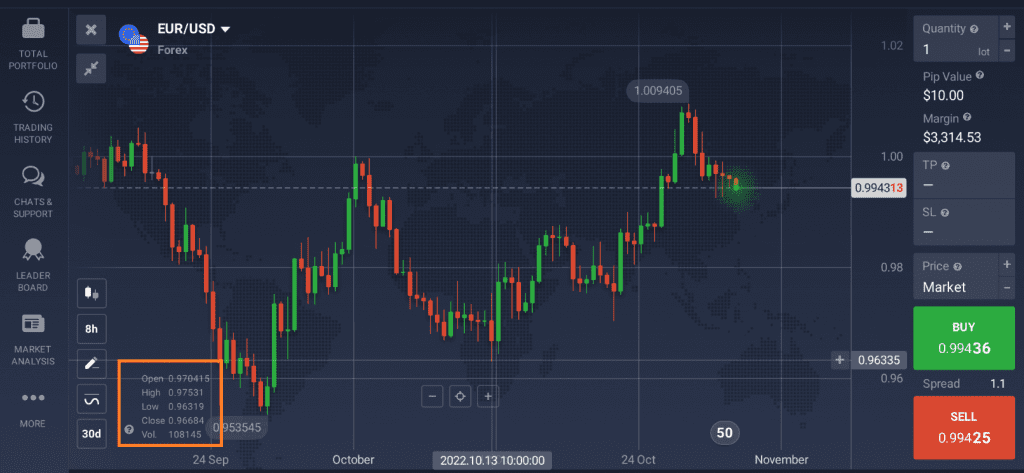

Some novice merchants would possibly underestimate the worth of finding out the worth charts. Nonetheless, they could be a terrific supply of buying and selling concepts. John Murphy proposes to start your technical evaluation of monetary markets with extra long-term timeframes (weekly and month-to-month charts going again a number of years). It might offer you a extra in-depth understanding of the traits, and provide a perspective on how an asset would possibly carry out sooner or later.

After you have analyzed the asset’s long-term efficiency, chances are you’ll flip to extra short-term traits (weekly and day by day value charts). Remember that short-term value fluctuations can typically be deceptive. So it might be helpful to think about the long-term asset efficiency when making buying and selling choices.

Spot the Pattern

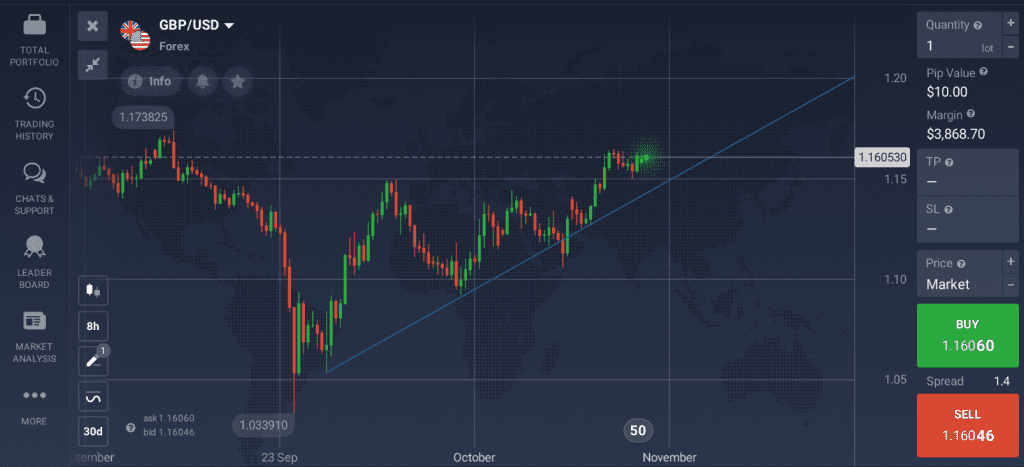

After analyzing the lengthy and short-term value fluctuations, you might be able to spot a pattern – a route of the worth motion. It might level to potential buying and selling alternatives. The secret’s to commerce within the route of this pattern. As an illustration, if there’s an upward pattern, you would possibly decide up this asset throughout the subsequent dip. Quite the opposite, if the chart factors to a downward pattern, chances are you’ll think about promoting. Nonetheless, it is best to all the time think about the dangers that buying and selling entails and remember that even buying and selling within the route of a pattern doesn’t assure revenue.

To be sure to are recognizing the appropriate traits, think about using pattern strains. Right here’s the place rule #3 is available in.

Draw the Line

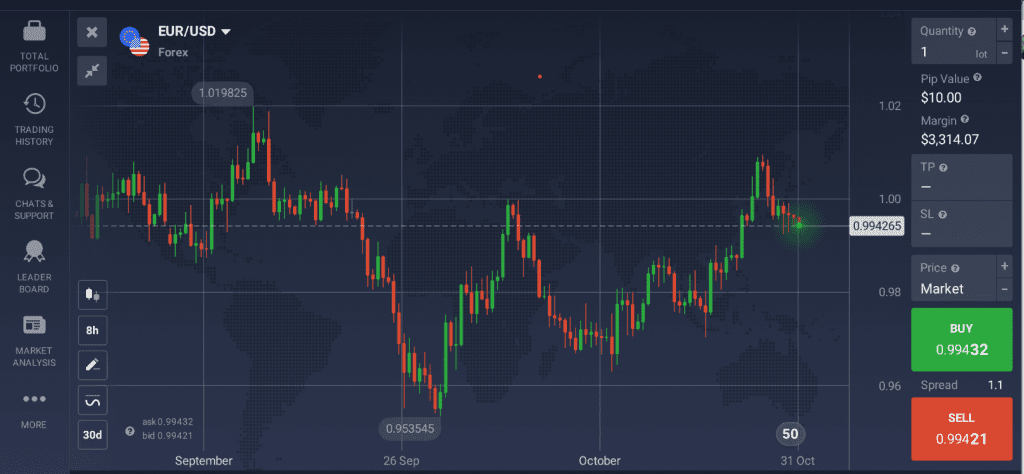

Pattern strains are one of the crucial straight-forward technical evaluation instruments. To use them, join a number of factors on the costs chart (latest lows for the potential uptrend and highs for the downtrend). Remember that the road ought to contact the chart not less than thrice.

There could also be breakouts: typically they’ll level to a change within the pattern. Nonetheless, the worth could pull again, and the pattern would possibly resume after a while. So it is best to think about totally different outcomes and buying and selling choices based mostly by yourself technical evaluation of the monetary markets.

Use Assist and Resistance

For those who managed to attract the pattern strains, chances are you’ll then create help and resistance ranges for the asset’s value. The help degree may be seen because the decrease threshold for the worth line. The resistance degree is the alternative – it’s the higher barrier, pointing to the best value factors.

When the worth line reaches the help degree, merchants would possibly anticipate it to cease and bounce again. Conversely, if the worth touches the resistance line, it might then go down to remain within the value hall. You could use these alternatives to open both lengthy or brief positions, when you anticipate the pattern to proceed.

Typically the worth strikes past these ranges, and a breakout happens. If the worth breaks via the help line, it might change into the subsequent resistance degree. The identical may be mentioned for the resistance degree – it will possibly shortly flip into the subsequent help degree.

Check out this video tutorial to discover ways to apply help and resistance ranges on the worth charts.

Apply the Shifting Common

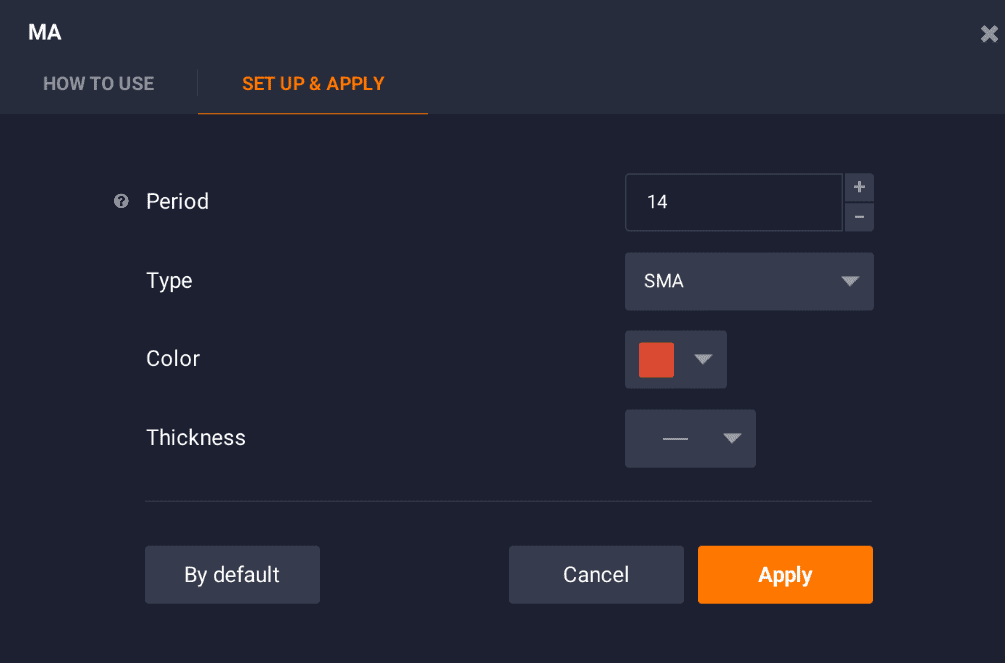

One other one among John Murphy’s 10 legal guidelines of technical buying and selling has to do with the Shifting Common. It’s one other nice technical evaluation software chances are you’ll use in your buying and selling.

The primary aim of utilizing the shifting common is to decide the pattern route. It may well additionally assist merchants determine the optimum entry and exit factors. This software has totally different setting choices, so you possibly can modify it relying in your buying and selling targets.

Take a look at this text to be taught extra about this efficient technical evaluation software and perceive apply it for optimum outcomes.

Know Your Retracements

Typically the market can appropriate itself, with the worth shifting up or down from the present pattern. You could measure these short-term value actions by utilizing instruments like Fibonacci Strains. If you apply this instrument, you will notice a group of horizontal strains that correspond to totally different Fibonacci ratios. In the course of the uptrend, Fibonacci Retracement could level to a shopping for alternative throughout a pullback. On the subject of the downtrend, Fibonacci strains would possibly assist decide the optimum short-selling positions.

Catch Pattern Reversals

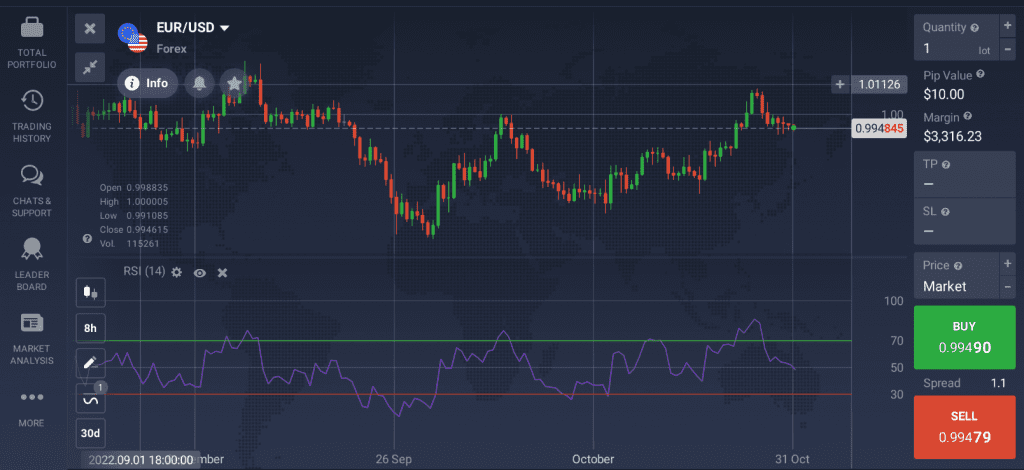

There all the time comes a time while you face pattern reversals. To identify them on time and alter your method, John Murphy’s 10 legal guidelines of technical buying and selling counsel utilizing oscillators. These are widespread technical indicators that assist monitor oversold and overbought ranges. Commonest ones are RSI (Relative Power Index) and the Stochastic Oscillator.

RSI can are available in helpful in assessing the energy of the present pattern. It might additionally level to potential value reversals. This software provides readings on a scale from 0 to 100. If the road strikes above 70, the asset could also be thought of overbought. If it declines under 30 – oversold.

On the subject of the Stochastic Oscillator, the dimensions for readings is analogous – 0 to 100. Nonetheless, on this case, the asset is likely to be seen as overbought at 80 and oversold at 20.

You can too apply these instruments together with different technical evaluation devices. Learn this materials to study a triple menace evaluation methodology: RSI + SMA + MACD.

Monitor the Quantity

Yet one more issue to remember when utilizing technical evaluation for buying and selling is quantity. It represents the whole quantity of buying and selling exercise over a time frame. If you discover growing commerce quantity within the route of the present uptrend, it might function extra affirmation. If the commerce quantity is on the decline, the present pattern is likely to be coming to an finish.

Change with the Pattern and Maintain Studying

Lastly, it is best to be prepared to regulate your method if the pattern modifications. There are a lot of instruments obtainable for technical evaluation of monetary markets, so chances are you’ll hold attempting new strategies to boost your efficiency. John Murphy’s 10 legal guidelines of technical buying and selling may be helpful for asset evaluation, however you don’t should comply with them on a regular basis. As a substitute, consider them as floor guidelines that you could be flip to when conducting technical evaluation and searching for buying and selling alternatives. Additionally, remember that even essentially the most correct asset evaluation doesn’t assure constructive outcomes. So fastidiously think about totally different outcomes and ensure to make use of risk-management instruments to handle potential losses.