Apple CEO Tim Prepare dinner

Funding agency JP Morgan has minimize its Apple value goal by $10 following the corporate’s earnings report that confirmed iPhone declining in China.

General, Apple’s earnings report confirmed a bounce again from its 2023 dip, however the element within the bulletins has JP Morgan predicting future declines. The analysts had been notably unimpressed with how Apple tried to spin its earnings outcomes by stressing a number of causes that direct yr on yr comparisons couldn’t be achieved.

“Apple seemed to elucidate the F2Q income outlook for a roughly -5% decline y/y via the harder compares on account of the iPhone provide fill-in throughout F2Q final yr,” wrote JP Morgan in a be aware seen by AppleInsider, “excluding which revenues are anticipated to trace flat y/y regardless of a troublesome macro backdrop.”

“Nevertheless, placing apart the comparables, the important thing driver of the weaker outlook for the corporate in F2Q relative to expectations, which has extra reaching penalties to the outlook past F2Q, is primarily the headwinds to Macs, iPad, and Wearables,” it continues.

JP Morgan says that “the outlook for iPhone revenues to say no by about -10% y/y” and Companies solely expanded by “low double-digit share.”

“[But] the headwinds to iPad, Mac and Wearables, which in mixture declined y/y in F1Q and are anticipated to say no materially once more in F2Q,” mentioned the analysts, are driving the first variance in relation to the macro impression on the Product classes and with extra far reaching penalties in relation to the revision of our income forecasts past F2Q.”

JP Morgan notes that in line with Apple, iPhone gross sales in China declined in “solely mid-single digits,” however the earnings report’s figures say total revenues declined round 11% yr on yr within the nation.

This means “a a lot stronger decline in the remainder of the Product classes,” say the analysts, “difficult the outlook for the corporate within the area within the medium-term.”

“The better income challenges are main us to now forecast a modest income decline for FY24E, reversing our prior expectations of modest development,” continued JP Morgan.

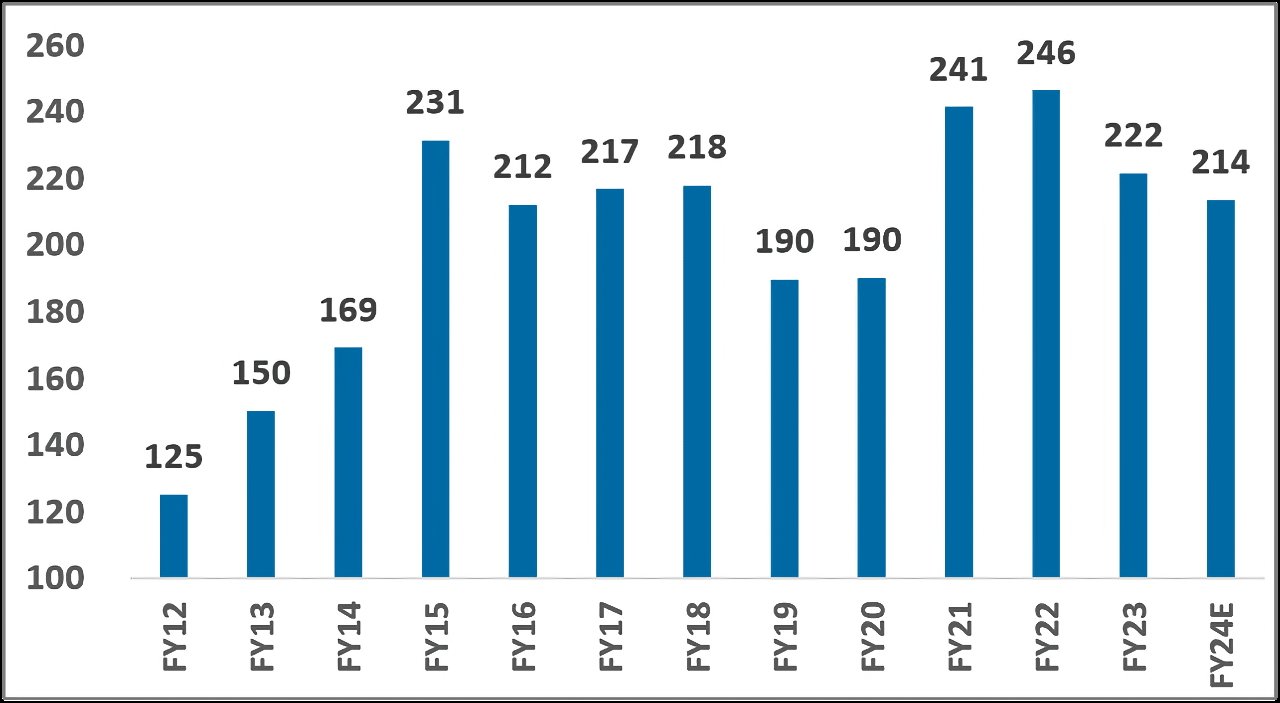

Predicted iPhone shipments (Supply: JP Morgan)

On the identical time, nevertheless, JP Morgan notes that “Apple continued to shock buyers with margin supply, with mixture margins monitoring to 45.9% in F1Q – on the high-end of the guided 45%-46% vary, and is now guiding to gross margins larger than 46% (steerage vary of 46%-47%), which can be a brand new file for the corporate.”

The analysts additionally anticipate that Apple’s gross margins will proceed to broaden due to this margin, plus “the upper income mixture of Companies.”

Consequently, JP Morgan says that the “iPhone nonetheless showcases resilience, though in income,” however says it is the “outlook for iPad and Macs raises broader issues.”

“Whereas iPhones contribute a big majority of Product revenues for the corporate, and minor variances even in relation to comparables drive a major variance within the financials,” it says, “we consider the larger issues from the EPS print can be demand for the opposite {Hardware} product classes.”

JP Morgan expects Apple to “nonetheless monitor about ~$2 bn and ~$4 bn larger in FY24 over FY19 ranges in relation to revenues in Macs and iPads respectively.” It notes that this leaves “room for a return to pre-pandemic ranges of demand/income.”

The report doesn’t embrace any predictions particularly regarding the Apple Imaginative and prescient Professional, whose first gross sales figures will characteristic within the subsequent quarterly earnings report. Individually, JP Morgan has cautioned buyers to not learn an excessive amount of into how the Apple Imaginative and prescient Professional offered out rapidly.