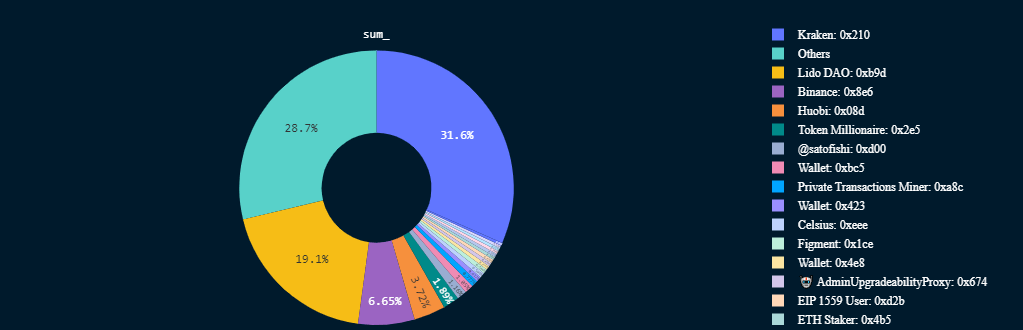

Kraken is main the second wave of full-staked Ethereum (ETH) withdrawals, in accordance with Nansen’s dashboard.

Nansen’s knowledge journalist Martin Lee stated the U.S.-based crypto change has withdrawn over 330,000 ETH. Lee added that “one other 175,000 in ETH left, which is basically principal withdrawals.”

Since withdrawals had been enabled, Kraken has led the desk of entities withdrawing belongings from the beacon chain. The change’s excessive withdrawal price is influenced by the regulatory stress from the U.S. Securities and Change Fee (SEC). The change paid a $30 million advantageous for failing to register its staking companies with the regulator.

Regardless of its withdrawals, Kraken continues to be one of many largest depositors on the Beacon Chain. The change nonetheless has round 935,488 ETH staked as of press time.

Different entities withdrawing staked ETH

Asides from Kraken, Lido DAO is answerable for most withdrawals. The liquid staking platform accounts for 25% of all withdrawals processed, in accordance with Nansen’s dashboard.

Lido is adopted by Binance — which has withdrawn 91,190 staked ETH, equating to six.65% of withdrawn ETH. Different centralized entities like bankrupt lender Celsius and centralized change Huobi are additionally among the many prime addresses which have withdrawn their staked tokens.

In the meantime, the highest three entities awaiting withdrawals are exchanges — Binance, Coinbase, and Kraken. The corporations wish to withdraw over 60% of the 1.37 million ETH ready for withdrawal.

Deposits outpace withdrawals

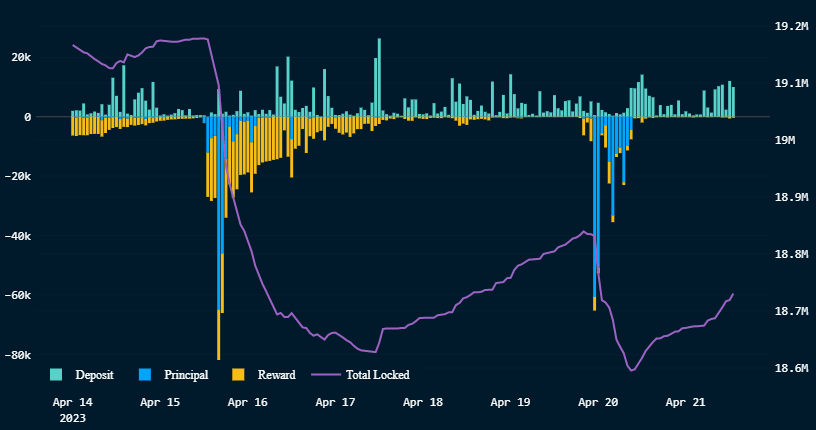

Staked Ethereum deposits have been outpacing withdrawals for the previous few days, in accordance with the Nansen dashboard.

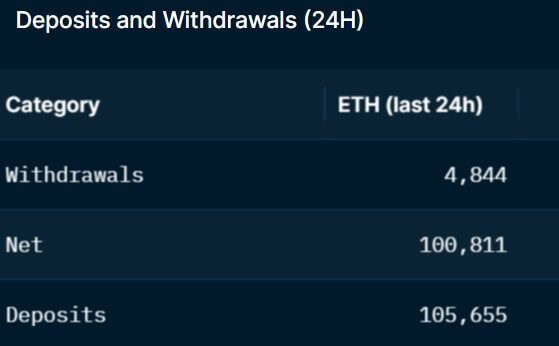

Based on the dashboard, over 100,000 ETH was deposited within the final 24 hours — whereas lower than 5,000 ETH had been withdrawn throughout the identical interval.

The publish Kraken withdraws 330k ETH amid regulatory stress – deposits outpace withdrawals in staking race appeared first on CryptoSlate.