In a current interview with CNBC, billionaire hedge fund supervisor and legendary investor Paul Tudor Jones expounded on his bullish stance on Bitcoin amidst mounting world tensions and financial uncertainties.

Jones, an influential determine within the funding world, highlighted the present geopolitical setting as probably the most “threatening and difficult” he has ever witnessed and emphasised the significance of diversifying funding portfolios with belongings like Bitcoin and gold.

Jones advised CNBC, “I like gold and bitcoin collectively. I believe they in all probability tackle a bigger share of your portfolio than they’d [historically] as a result of we’re going to undergo each a difficult political time right here in the USA and we’ve clearly obtained a geopolitical state of affairs.”

Now Is The Time To Purchase Bitcoin And Gold

Latest world occasions have exacerbated these sentiments. Over the weekend, the Israeli authorities launched a navy response in opposition to Hamas following an assault on Israel, escalating tensions in an already fragile Center Japanese area. Moreover, Russia’s current invasion of Ukraine and rising discord between China and the US have additional rattled world markets and economies.

In the identical breath, Jones remarked on the US’s alarming fiscal place, stating it’s “in all probability in its weakest fiscal place since World Struggle II.”

Responding to considerations concerning the potential influence of excessive rates of interest on Bitcoin, Jones delved deeper into the dynamics of gold and market trades previous a recession. He stipulated, “I believe on a relative foundation what’s occurred to gold, it has been clearly suppressed. However you realize that extra doubtless or not we’re going right into a recession.”

Jones underscored just a few hallmarks of recessionary buying and selling environments, indicating, “There are some fairly clear recession trades. The simplest are: the yield curve will get very steep, dwelling premium goes into the backend of the debt market and the 10-year, 30-year, 7-year paper, the inventory market sometimes proper earlier than recession declines about 12%.” This decline, based on Jones, is not only believable however prone to transpire at a sure juncture.

Moreover, he emphasised the potential bullish marketplace for belongings like Bitcoin and gold throughout financial downturns, stating, “And if you have a look at the massive shorts in gold, extra doubtless or not in a recession, the market is usually very lengthy; belongings like Bitcoin and gold.”

Jones additional prognosticated a considerable inflow into the gold market, speculating, “So there’s in all probability $40 billion value of shopping for coming in gold sooner or later prior to now and when that recession truly happens.” Expressing his asset choice amidst the aforementioned situations, Jones concisely famous, “So, I like Bitcoin and I like gold proper now.”

Jones’s endorsement of Bitcoin isn’t new because the investor had beforehand championed the digital forex in a number of interviews, citing its potential as a hedge in opposition to inflation and lauding its immutable mathematical properties.

He as soon as remarked, “Bitcoin is math, and math has been round for 1000’s of years.” By mid-2021, Jones even elevated his Bitcoin allocation from 1-2%, labeling it as a “wager on certainty amid unsure financial situations.”

Jones’s remarks got here at a time when the cryptocurrency noticed an approximate 63% improve yr so far, making it the best-performing asset in 2023.

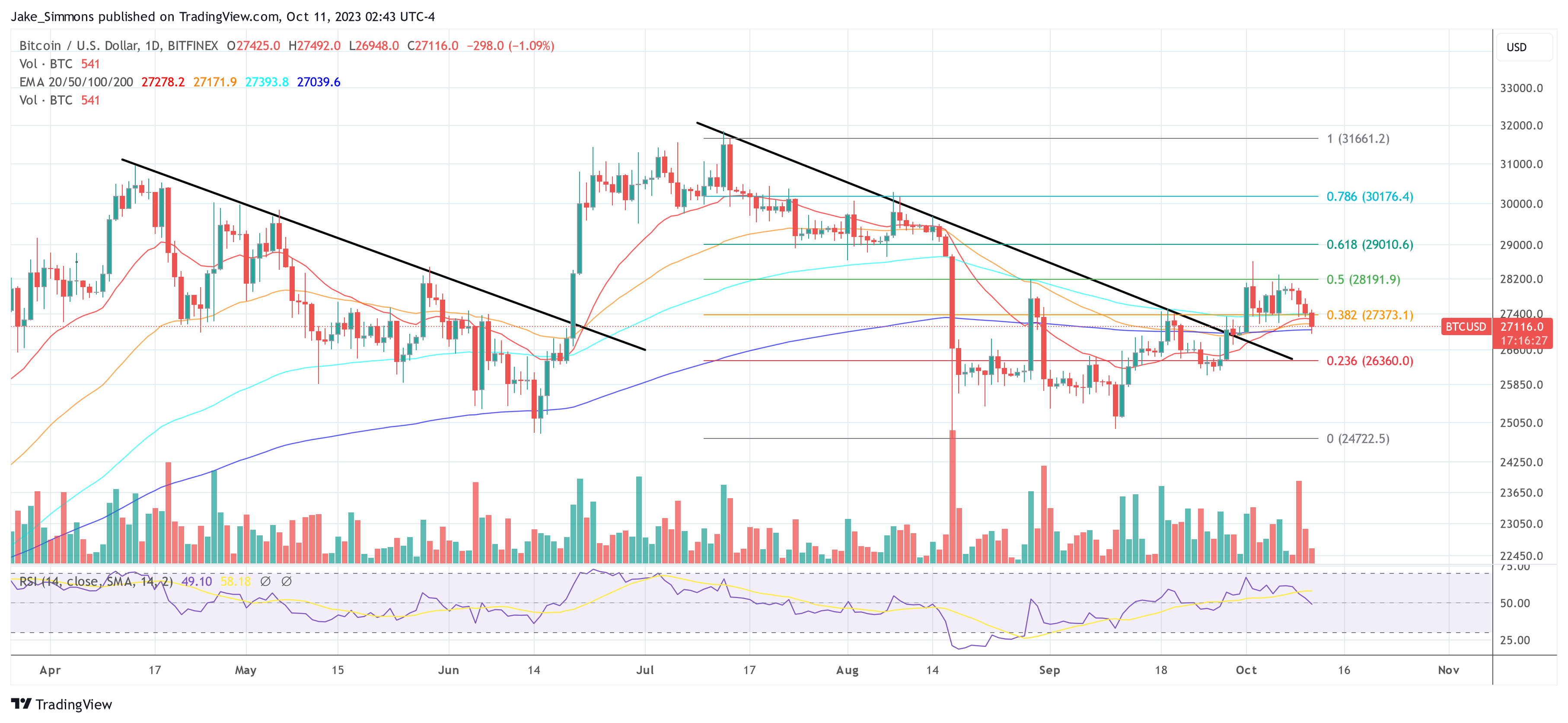

At press time, Bitcoin was buying and selling at $27,116, down roughly 2% over the previous 24 hours. Amidst the current worth drop, BTC initially discovered assist on the 200-day EMA (blue line), which the bulls ought to maintain in any respect prices to keep away from additional downward momentum.

Featured picture from iStock, chart from TradingView.com