Ethereum staking protocol Lido’s dominance of staking has the potential of placing all the blockchain prone to a centralized assault when it will definitely turns into a proof of stake community, an article from Danny Ryan, a researcher at Ethereum Basis, argued.

The article titled the dangers of LSD (Liquid Staking Derivatives), recommends setting a threshold restrict for all Ether stakers, warning that buyers ought to restrict their publicity to the protocol due to the inherent dangers of focus.

In accordance with the article, if an entity ought to acquire management of the distributed ledger due, it might mood with blocks recording.

“Lido passing 1/3 is a centralization assault on PoS. We’re unhealthy at assessing tail threat, however staking in Lido at these thresholds has lots of it.”

Lido builders disagree

Nonetheless, not everybody agrees with the decision for staking entities to restrict their publicity. Lido developer Vasiliy Shapovalov argued that the protocol exists to decentralize Ether staking in order that centralized exchanges gained’t dominate the scene.

In accordance with the Lido web site, it makes use of 21 validators. This sort of transparency isn’t one thing that almost all centralized exchanges present.

Founding father of DeversiFi DEX, Will Hawthorn, additionally disagrees. He believes that Lido limiting Ether staking doesn’t essentially imply that different initiatives will develop.

Alex Svanevik, the CEO of the blockchain analytics platform Nansen, stated, “I feel it’s too quickly to impose self-limitation, if ever.” Svanevik, additionally a Lido DAO member, added,

“You possibly can simply think about a extra centralized or extra malicious entity with no self-limitation racing previous Lido.”

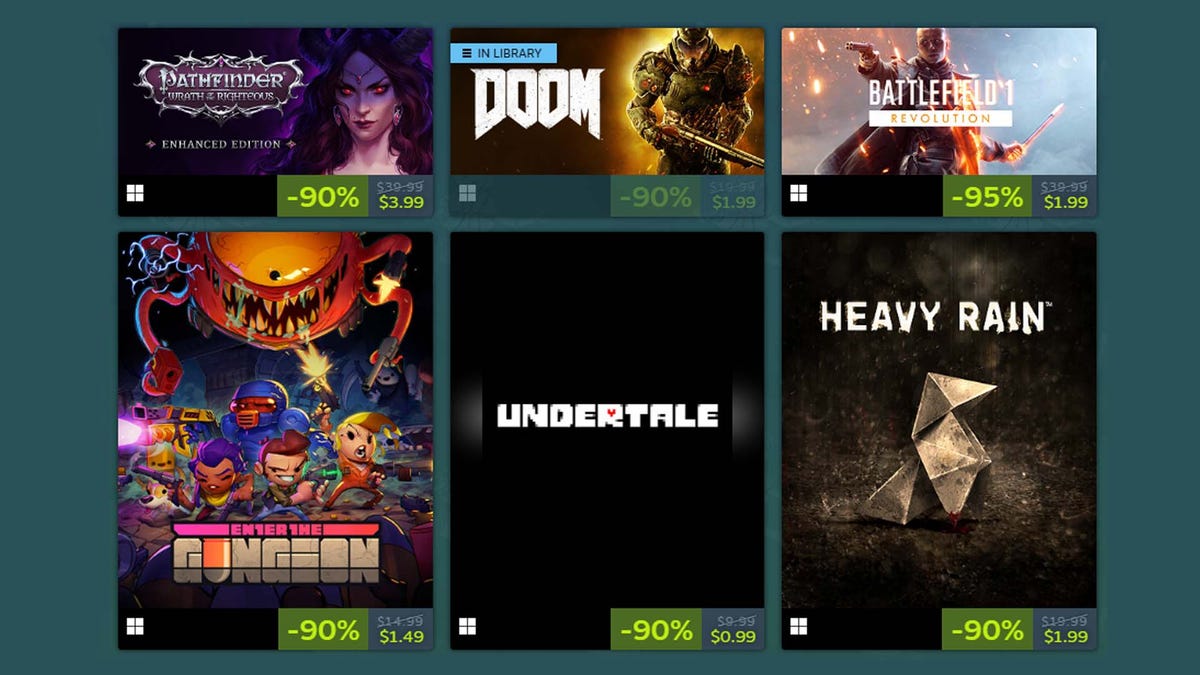

Presently, Lido is the largest supplier of staking providers on Ethereum. Though a number of centralized exchanges equivalent to Kraken, Coinbase, and Binance additionally provide this service, Lido has 32% of the full tokens staked.

Knowledge from Dune Analytics present that Lido has 90.8% of the ETH2 liquid staking stability with over 4 million ETH staked. The subsequent in line, Rocketpool, has solely 183,040 ETH staked.