Lido (LDO), a distinguished participant within the decentralized finance (DeFi) house, has emerged as a frontrunner within the quickly increasing Liquidity Staking Derivatives (LSD) sector.

Amidst the turbulence attributable to the extremely controversial lawsuit filed by the US Securities and Change Fee (SEC) in June, the decentralized finance (DeFi) sector has discovered itself in a state of uncertainty and warning.

This authorized battle has prompted many tasks to reevaluate their methods and has made traders extra cautious of their strategy. Nonetheless, even on this difficult local weather, the LSD house has managed to expertise substantial development and defy the percentages.

LSD Sector’s Dominance And Lido’s Outstanding Efficiency

As per data from Messari, the LSD sector has demonstrated important dominance within the cryptocurrency markets. One of many main contributors to the sector’s enlargement has been Lido, which has showcased spectacular efficiency over latest months.

SEC lawsuits towards @BinanceUS and @Coinbase trigger #DeFi TVL to plummet beneath $60B. However amidst the chaos, liquid staking protocols are thriving turning into DeFi’s dominating power by TVL. pic.twitter.com/RL9Qy8cwLE

— Messari (@MessariCrypto) July 3, 2023

CoinGecko experiences that at the moment, the worth of Lido’s native token, LDO, stands at $2.16. Whereas there was a slight decline of 1.7% up to now 24 hours, the token has skilled a strong 15.7% improve in worth over the past seven days.

Supply: Coingecko

The surge in LDO’s value has additionally resulted in a noticeable improve within the MVRV ratio of the token. This signifies {that a} appreciable variety of addresses holding LDO have grow to be worthwhile up to now few days, indicating a constructive sentiment amongst traders and additional fueling the success of Lido within the aggressive DeFi panorama.

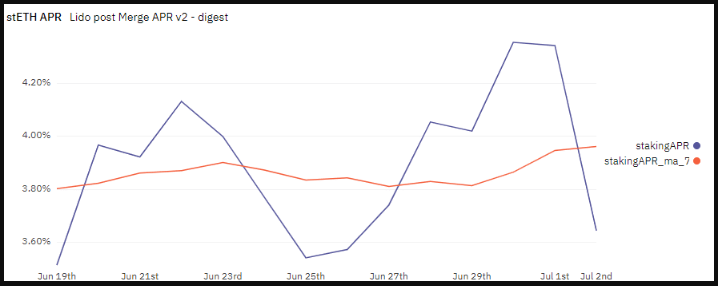

Progress Amidst Issues: Lido Declining APR

Regardless of the notable development and success witnessed by Lido, there was a latest decline within the Annual Proportion Return (APR) provided by the platform. In line with a latest LDO value report, his decline in APR over the previous few days raises considerations concerning the attractiveness of utilizing Lido for staking, probably main customers to hunt various choices.

Supply: Dune Analytics

The declining APR signifies that the rewards and returns generated from staking LDO tokens on the Lido platform have decreased. This growth might discourage some customers who prioritize maximizing their staking yields from persevering with to make use of Lido.

LDO market cap at the moment at $1.9 billion. Chart: TradingView.com

As staking rewards play an important position in incentivizing customers to take part in networks and safe their protocols, a sustained decline in APR would possibly immediate people to discover various platforms that provide extra aggressive and probably larger returns.

To take care of its place as a number one participant within the LSD sector, Lido would wish to deal with the declining APR and discover avenues to reinforce the rewards provided to stakers, making certain they continue to be aggressive and interesting to their person base.

Featured picture from The Market Periodical

:contrast(5):saturation(1.16)/https%3A%2F%2Fprod.static9.net.au%2Ffs%2Fa521a821-8701-47e1-a6c6-ab251c2e75ff)