Amid the continuing unsure cryptocurrency market sentiment, Chainlink (LINK) is poised for a worth decline because it has fashioned a bearish worth motion sample on its every day time-frame. Along with LINK’s bearish outlook, its worth has began declining alongside different main cryptocurrencies.

LINK Value Momentum

At press time, LINK is buying and selling close to the $10.52 degree and has skilled a worth decline of over 2.7% up to now 24 hours. Throughout this era, its buying and selling quantity has dropped by 19%, indicating decrease participation from merchants and traders, probably because of the bearish worth motion sample.

LINK Technical Evaluation and Upcoming Degree

In accordance with knowledgeable technical evaluation, LINK has fashioned a bearish head-and-shoulder worth motion sample on the every day time-frame. Moreover, with the current worth drop it has damaged its essential descending trendline help, which has been in place since August 2024.

Based mostly on the current worth momentum, if LINK breaches the neckline of this bearish sample and closes a every day candle under the $10.30 degree, there’s a sturdy risk that the asset might expertise a 13% worth decline, probably reaching the $9 degree within the coming days.

As of now, LINK is buying and selling under the 200 Exponential Shifting Common (EMA) indicating a downtrend. Merchants and traders typically watch the 200 EMA when constructing positions, whether or not on the lengthy or brief facet.

Bearish On-Chain Metrics

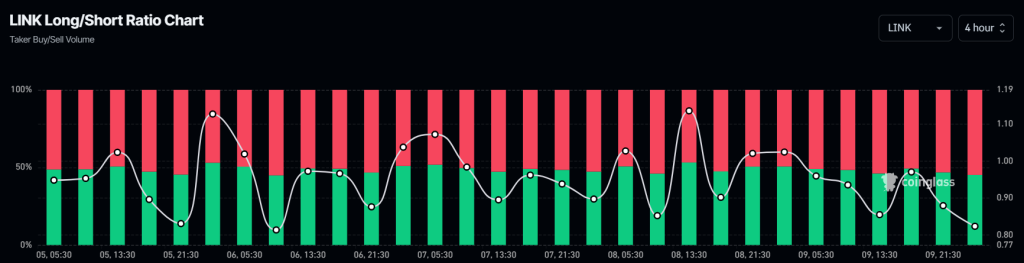

LINK’s bearish outlook is additional supported by on-chain metrics. In accordance with the on-chain analytics agency Coinglass, LINK’s Lengthy/Quick ratio at the moment stands at 0.82 degree, indicating sturdy bearish market sentiment amongst merchants. Moreover, its future open curiosity has elevated by 5.2% up to now 24 hours, which is at the moment a bearish signal for LINK holders.

At any time when the lengthy/brief ratio is under 1 and open curiosity will increase, it signifies that merchants have began shorting.

Presently, 54.84% of high merchants maintain brief positions, whereas 45.16% maintain lengthy positions. It seems that merchants have began betting on the brief facet as they imagine that the worth will go down.