Knowledge exhibits that Litecoin long-term holders exited the asset earlier than the halving, whereas short-term holders had been left to panic on the halving day. The “halving” right here refers to an occasion the place the block rewards of Litecoin are completely minimize in half.

Litecoin Lengthy-Time period Holders Bought Throughout Worth Surge Earlier than The Halving

In accordance with information from the market intelligence platform IntoTheBlock, the long-term holders had been well-prepared for the “promote the information” halving occasion. The “long-term holders” (LTHs) typically embrace all traders who’ve been holding onto their cash since at the least six months in the past.

Associated Studying: These Bitcoin Metrics Are At Essential Retests, Will Bullish Development Prevail?

This group contains a few of the most resolute traders within the Litecoin market, who don’t simply react to no matter goes in on within the wider sector, as they normally maintain by way of FUD or profit-taking alternatives with out collaborating in any vital promoting.

Due to how uncommon actions from these traders will be, the few occasions that they do promote will be those to be careful for, as they could spell bother for the market.

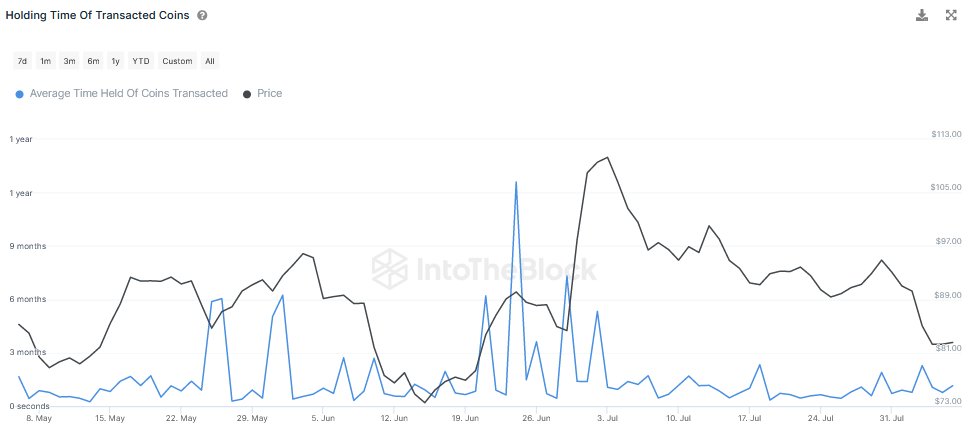

A solution to gauge whether or not the LTHs are collaborating in promoting or not is thru the “holding time of transacted cash” metric, which tells us concerning the common period of time that cash being transferred on the blockchain had been dormant previous to this motion.

When the worth of this metric is excessive, it signifies that the age of cash being bought on the community is excessive, which might naturally be an indication that the LTHs are energetic proper now. However, low values normally point out that the short-term holders (STHs) are those promoting at the moment.

Now, here’s a chart that exhibits the pattern within the Litecoin holding time of transacted cash over the previous few months:

The worth of the metric appears to have been comparatively low in current days | Supply: IntoTheBlock on X

As you’ll be able to see within the above graph, the Litecoin holding time of transacted cash spiked again in June, when the value of the cryptocurrency had been observing a pointy rally.

In the course of the largest of those spikes, the indicator’s worth had exceeded 1 12 months, implying that a few of the most skilled traders available in the market had damaged their silence.

This rally had occurred because the market had began getting hyped concerning the halving, which was solely a month and a half away at that time.

This occasion takes place each 4 years, with the newest one having occurred simply earlier this month. Not like what some could have hoped for, the occasion didn’t show to be bullish for LTC, because the aforementioned rally didn’t final for too lengthy and the cryptocurrency solely declined within the remaining leadup to the halving, till lastly it really sharply plunged on the day of the occasion itself.

It could seem that the skilled LTHs had already predicted one thing like this may increasingly occur, so that they had taken the sensible determination of promoting whereas the chance was there.

Within the post-halving selloff, the indicator’s worth has remained low, implying that it’s solely the short-term holders who’ve been panic promoting after they noticed {that a} bullish pattern couldn’t return to Litecoin with the occasion.

LTC Worth

On the time of writing, Litecoin is buying and selling round $84, down 8% within the final week.

LTC has plummeted for the reason that halving | Supply: LTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com