Bitcoin (BTC) has not too long ago struggled to regain bullish momentum, remaining in a consolidation section simply above the essential $60,000 help. Regardless of reaching an all-time excessive three months in the past, the biggest cryptocurrency witnessed a dip to as little as $59,500 on Wednesday resulting from elevated promoting stress from miners.

BTC Promoting Spree

The continuing miner capitulation, the longest noticed for the reason that summer season of 2022 earlier than the FTX implosion, signifies the Bitcoin Halving supply-squeeze impact.

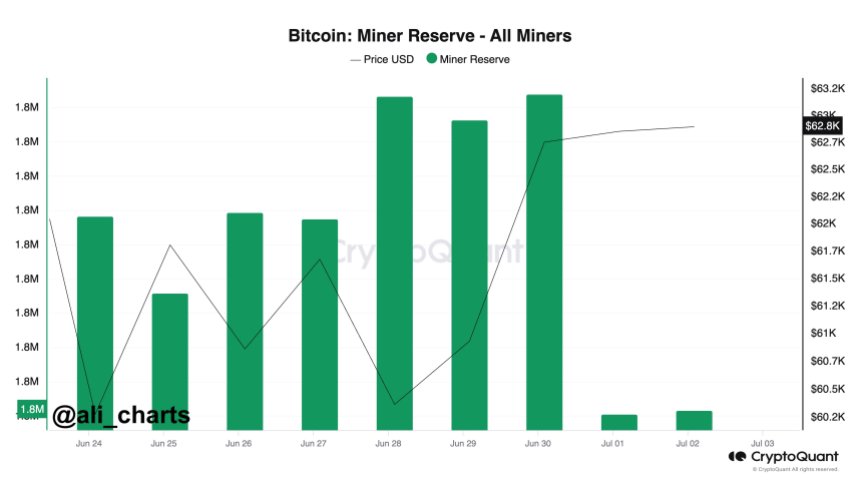

Crypto analyst Ali Martinez famous that Bitcoin miners have bought greater than 2,300 BTC up to now 3 days, amounting to roughly $145 million.

Associated Studying

This promoting stress from miners provides to the current BTC gross sales by the US and German governments, contributing to the market’s downward stress and preserving costs inside the decrease vary of the broader consolidation zone between $60,000 and $70,000 witnessed in current months.

Notably, addresses linked to the German and US governments have despatched $737 million value of BTC to exchanges, together with Coinbase, Bitstamp, and Kraken, in numerous transactions.

Because the promoting stress from governments and miners subsides over time, market observers count on a possible value restoration for BTC, following the standard sample noticed through the post-Halving interval, the place new all-time highs are sometimes achieved.

Bitcoin Value Outlook

Market knowledgeable Scott Melker factors out that the market could also be nearing an important sign, stating that if a day by day candle closes under the $60,300 stage, it might result in a bullish divergence.

This might contain the day by day RSI (Relative Power Index) shifting out of oversold territory, just like final August when the worth was round $26,000.

Melker emphasizes the necessity for an in depth under the talked about stage, adopted by a transparent upward transfer within the RSI with out making a decrease low. It could require a major downward transfer for the RSI to go decrease than its stage on June twenty fourth.

Associated Studying

Nevertheless, crypto analyst Andrew Kang highlights the importance of a possible lack of the four-month vary on Bitcoin, drawing parallels with the vary noticed in Could 2021 following a parabolic rally of BTC and altcoins.

Kang notes that over $50 billion in crypto leverage is presently at close to all-time highs, compounded by the truth that the market has been in a chronic consolidation section for 18 weeks with out experiencing excessive washouts, as seen through the 2020-2021 bull market.

Furthermore, Kang means that preliminary estimates of the low $50,000s could have been too conservative, and a extra vital reset to the $40,000s may very well be doable.

Such a pullback would considerably affect the market and sure necessitate a couple of months of uneven or downward value motion earlier than a reversal and an upward pattern may very well be established.

On the time of writing, BTC has recovered the $60,350 stage after its transient dip under this significant help for additional actions to the upside.

The most important cryptocurrency out there has erased all positive factors in wider time frames, and it’s presently recording a 12% value lower within the month-to-month time-frame.

Featured picture from DALL-E, chart from TradingView.com