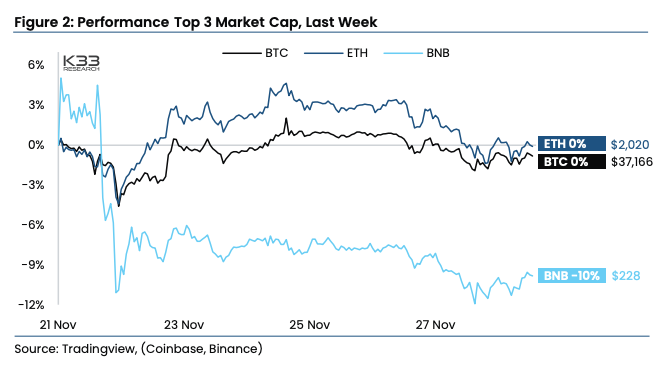

Main cryptocurrencies like Bitcoin and Ether traded flat over the previous week even after crypto trade large Binance agreed to a file $4.3 billion settlement with U.S. authorities, based on evaluation by analysis agency K33.

Analysts stated the landmark settlement unveiled on November twenty first confirmed sanctions violations and unlawful cash transfers however no mishandling of consumer funds. As such, it poses little danger of spreading contagion throughout digital asset markets, as occurred amid the FTX implosion final 12 months.

“The settlement has nothing to do with mishandling buyer funds and gained’t have any contagious results sooner or later,” wrote K33 senior analyst Vetle Lunde and vp Anders Helseth within the newest market replace.

Bitcoin and Ethereum costs stay buoyant at round $38,000 and $2,000, respectively, within the days after regulators publicized years-long investigations into Binance’s anti-money laundering procedures and sanctions compliance. The comparatively muted influence affirms that Binance’s transgressions appear remoted somewhat than systemic.

BNB plunged amidst Binance drama

Nonetheless, the agency’s BNB token did shed practically 14% following the announcement of the expensive settlement that cements a pivot away from the U.S. market. Binance founder Changpeng Zhao additionally stepped down as chief government whereas retaining a considerable possession stake.

However Lunde and Helseth contend that Binance, boasting over 120 million customers globally, nonetheless represents a pillar of crypto infrastructure more likely to rebound in 2024, even with its American operations winding down.

“Binance’s sturdy person base factors in the direction of Binance remaining a cornerstone of the crypto market construction as we advance into 2024,” the K33 report concluded.

That stated, the researchers highlighted that Binance already skilled a slipping market share in 2022 amid intensifying regulatory consideration. Its portion of non-U.S. trade volumes sank beneath 45% from round 70% beforehand, primarily based on information from analysis agency The Block.

For now, crypto markets appear reassured by the scope of penalties levied solely towards Binance, somewhat than foreshadowing one other existential disaster. Solely the approaching months will reveal whether or not depleted client confidence or frozen belongings destabilize the trade itself, regardless of its towering standing and nonetheless unmatched scale.