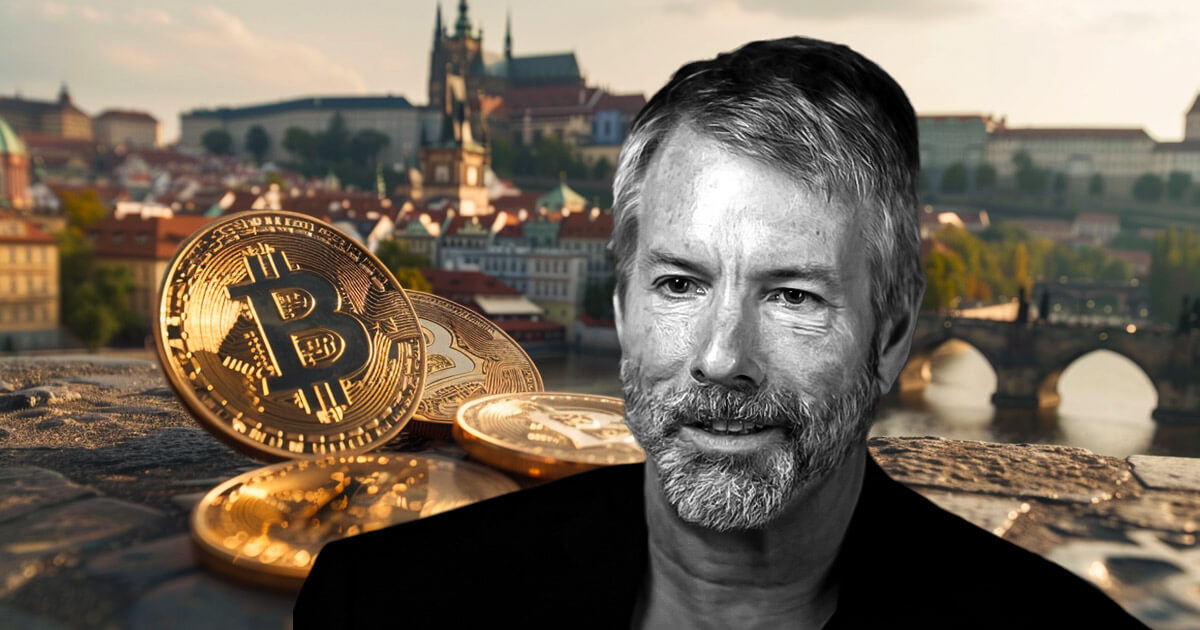

In his keynote at BTC Prague, MicroStrategy CEO Michael Saylor articulated a imaginative and prescient of Bitcoin because the world’s first excellent cash, a profound innovation with the potential to reshape financial and political techniques globally. Drawing parallels to historic scientific revolutions, Saylor positioned Bitcoin as a disruptive financial drive, ushering in a brand new period of monetary perception.

Saylor’s presentation was extra like a sermon than a keynote, harking back to a church pastor preaching to his flock about salvation. Not like a non secular chief, Saylor’s sermon was centered on reaffirming and inspiring the viewers to imagine in Bitcoin, not god, not himself, not his firm, a cultural character, nor something apart from the self-sovereignty and “perfection” of Bitcoin. Certainly one of his closing strains regarding those that promote Bitcoin was,

“Satoshi forgive them; they know not what they do.”

Saylor launched an idea he termed “21 Guidelines of Bitcoin.” Whereas he acknowledged the subjective nature of those guidelines, he framed them as guiding rules for understanding and embracing Bitcoin. In accordance with Saylor, those that comprehend Bitcoin invariably select to spend money on it, whereas those that don’t perceive it are likely to criticize it. This dichotomy emphasizes a elementary paradigm shift the place conventional views on cash and worth are challenged.

Michael Saylor’s 21 Guidelines of Bitcoin

- Those that perceive Bitcoin purchase Bitcoin. Those that don’t criticize Bitcoin.

- Everyone seems to be towards Bitcoin earlier than they’re for it.

- You realize you grasp Bitcoin when you’ll by no means absolutely perceive Bitcoin. You’ll by no means be accomplished studying about Bitcoin.

- Bitcoin is powered by chaos.

- Bitcoin is the one recreation within the on line casino the place we will all win.

- Bitcoin received’t shield you should you don’t put on the armor.

- Bitcoin is the one factor within the universe which you could really personal.

- Everybody will get Bitcoin on the worth they deserve.

- Solely purchase Bitcoin with the cash you possibly can’t afford to lose.

- Tickets to flee the matrix are priced in Bitcoin.

- Bitcoin perception is restricted to those that must know.

- All of your fashions might be destroyed.

- The remedy for the financial unwell is the orange capsule.

- Be for Bitcoin, not towards fiat.

- Bitcoin is for everyone.

- Be taught to suppose in Bitcoin.

- You don’t change Bitcoin; it modifications you.

- Laser eyes shield you from infinite lies.

- Respect Bitcoin, or it would make a clown out of you.

- Don’t promote your Bitcoin.

- Unfold Bitcoin with love.

Certainly one of Saylor’s key factors was the intrinsic worth of Bitcoin as “excellent cash,” contrasting it with historic and up to date types of forex like seashells, tobacco, and fiat cash. He emphasised that Bitcoin’s worth lies not within the appreciation of property however in realizing its absolute worth in a distorted monetary panorama. This shift in perspective, akin to a scientific revelation, compels people to interrupt from typical considering and embrace Bitcoin’s progressive framework. He reiterated that everybody will get Bitcoin on the worth they deserve and appeared content material with lacking out on Bitcoin at $950.

“I received the value I deserved, and I began shopping for at $9,500, however that’s okay’ll be shopping for it at $95,000 and $950,000, and I’ll purchase it at $8 million.”

Saylor additionally highlighted Bitcoin’s distinctive place as an “financial virus” that may permeate by way of layers of society and know-how over time. He argued {that a} correct understanding of Bitcoin requires an appreciation of its long-term potential and affect on future generations. This angle necessitates steady studying and adaptation, acknowledging that Bitcoin’s affect will evolve with technological developments and societal constructions.

Addressing conventional investments’ volatility and inherent danger, Saylor introduced Bitcoin as a hedge towards chaos and entropy. He likened Bitcoin to a haven in a world characterised by instability, drawing a historic analogy to the soundness of Swiss banks throughout World Struggle II. This angle frames Bitcoin as a resilient asset able to withstanding and benefiting from international financial turmoil.

“Are you within the enterprise of making the most of chaos or stopping it? You may’t cease entropy […] Bitcoin is the home of chaos – anybody who desires to play in that recreation can preserve successful.”

Saylor additional articulated that Bitcoin represents true possession in a world the place exterior entities management most property. He emphasised the decentralized and safe nature of Bitcoin, making it the primary asset in human historical past that people can genuinely personal with out reliance on intermediaries. This precept of possession is key to understanding Bitcoin’s worth proposition. He argued towards the idea of solely investing what you can afford to lose, as a substitute advocating for investing the cash you can’t afford to lose in Bitcoin.

“Whenever you say solely make investments with cash you possibly can afford to lose you’re making an ethical equivalence to playing with the chances towards you […] Nobody says solely put the children on the college bus that you just dont want me to return.”

In closing, Saylor emphasised the significance of spreading Bitcoin adoption by way of constructive engagement moderately than confrontation. He advocated for a compassionate method to educating others about Bitcoin, emphasizing that resistance usually stems from a lack of awareness. By selling Bitcoin with love moderately than hate, advocates can foster broader acceptance and speed up the worldwide adoption of this revolutionary know-how.

Saylor’s keynote at BTC Prague was a name to embrace the transformative energy of Bitcoin. His “21 Guidelines of Bitcoin” is a roadmap for understanding and navigating this new financial paradigm, emphasizing steady studying, resilience towards chaos, and a compassionate method to spreading Bitcoin’s advantages.