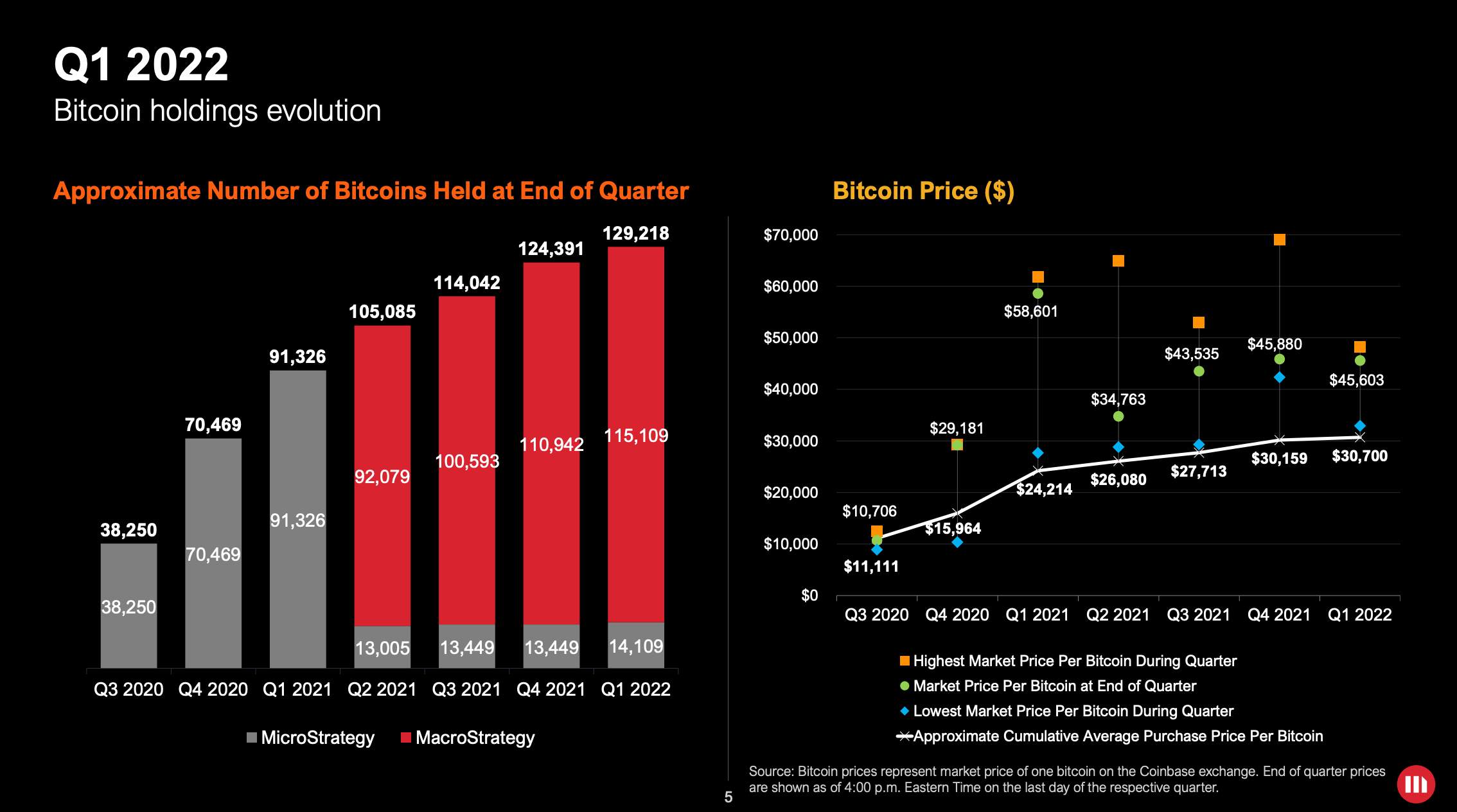

The MicroStrategy Q1 earnings name has revealed that they’ve a vested curiosity in conserving Bitcoin above $21,000 ought to there be a market capitulation. MicroStrategy at the moment owns 129,200 bitcoins, in accordance with their CEO, Michael Saylor, who is likely one of the largest supporters of Bitcoin. The corporate not too long ago took out a $205 million mortgage backed by their bitcoin holdings to buy extra Bitcoin.

Within the earnings name, Phong Le, the CFO of MicroStrategy, defined that they’ve an LTV on the mortgage of 25%, which means that they’ve put up 19,466 Bitcoin as collateral. Subsequently, if the value of Bitcoin had been to fall to $21,000, then they might be a margin name because the LTV would rise to 50%.

Nonetheless, there isn’t a suggestion that there can be an automated liquidation. MicroStrategy can be required so as to add extra to the collateral held below custody. As they’ve round $4.9 billion in Bitcoin below their possession, this must be attainable so long as that Bitcoin is liquid and never additionally earmarked as collateral for one thing else.

Nonetheless, Cointelegraph has recommended that MicroStrategy may additionally buy extra Bitcoin at a reduced worth so as to add to the collateral bundle. They don’t have to take Bitcoin from their present reserves to help their mortgage. Saylor tweeted not too long ago that “individuals who perceive #bitcoin purchase it. Individuals who don’t perceive #bitcoin discuss it.”

Given how bullish Saylor has been on Bitcoin, it’s exhausting to consider that, if they’ve the liquidity, he’ll implore MicroStrategy to buy extra Bitcoin for $21,000. That is very true on condition that Saylor revealed earlier this yr that their common value worth per Bitcoin is $30,200.

It’s unknown whether or not MicroStrategy would proceed to buy Bitcoin to defend decrease resistance ranges or transfer their at the moment held Bitcoin to cope with a margin name. Nonetheless, it will be a divergence from Saylor’s strategic narrative not to take action if they’d funds out there. They could even have the choice to place up extra Bitcoin as collateral for a good greater mortgage. With regards to Bitcoin, he appears very single-minded;

“#Bitcoin is a financial institution in our on-line world, run by incorruptible software program, providing a world, reasonably priced, easy, & safe financial savings account to billions of folks that don’t have the choice or want to run their very own hedge fund.”