Fast Take

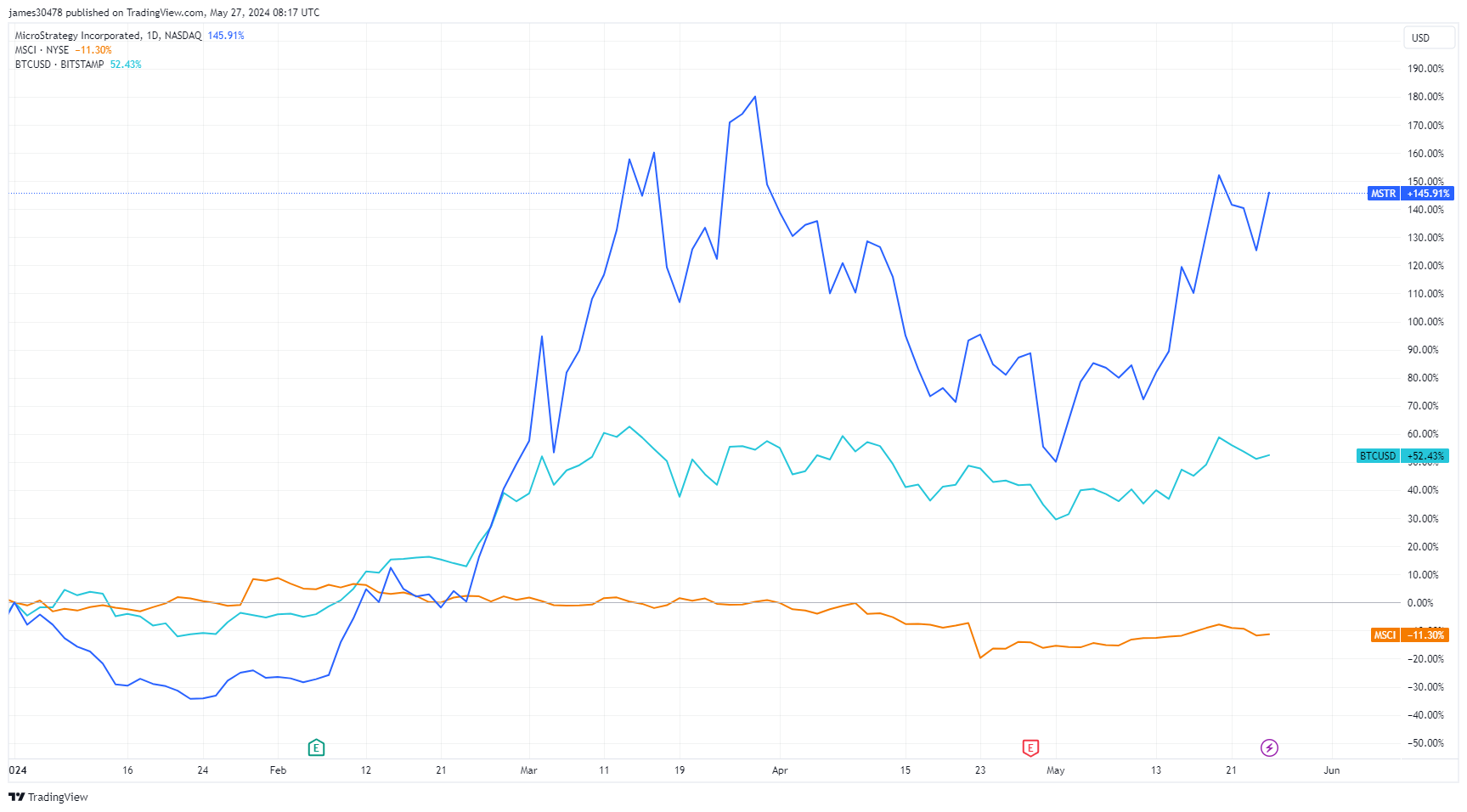

MicroStrategy, which holds a big 214,400 Bitcoin on its steadiness sheet, has skilled a exceptional 146% rise in share worth this 12 months, pushing its market cap to roughly $30 billion. This spectacular efficiency has earned the corporate inclusion in main inventory indexes.

On Could 15, Reuters reported that MicroStrategy (MSTR) can be added to the MSCI World Index, with adjustments set to take impact after market shut on Could 31. This addition comes whereas the MSCI World Index is down roughly 11% year-to-date.

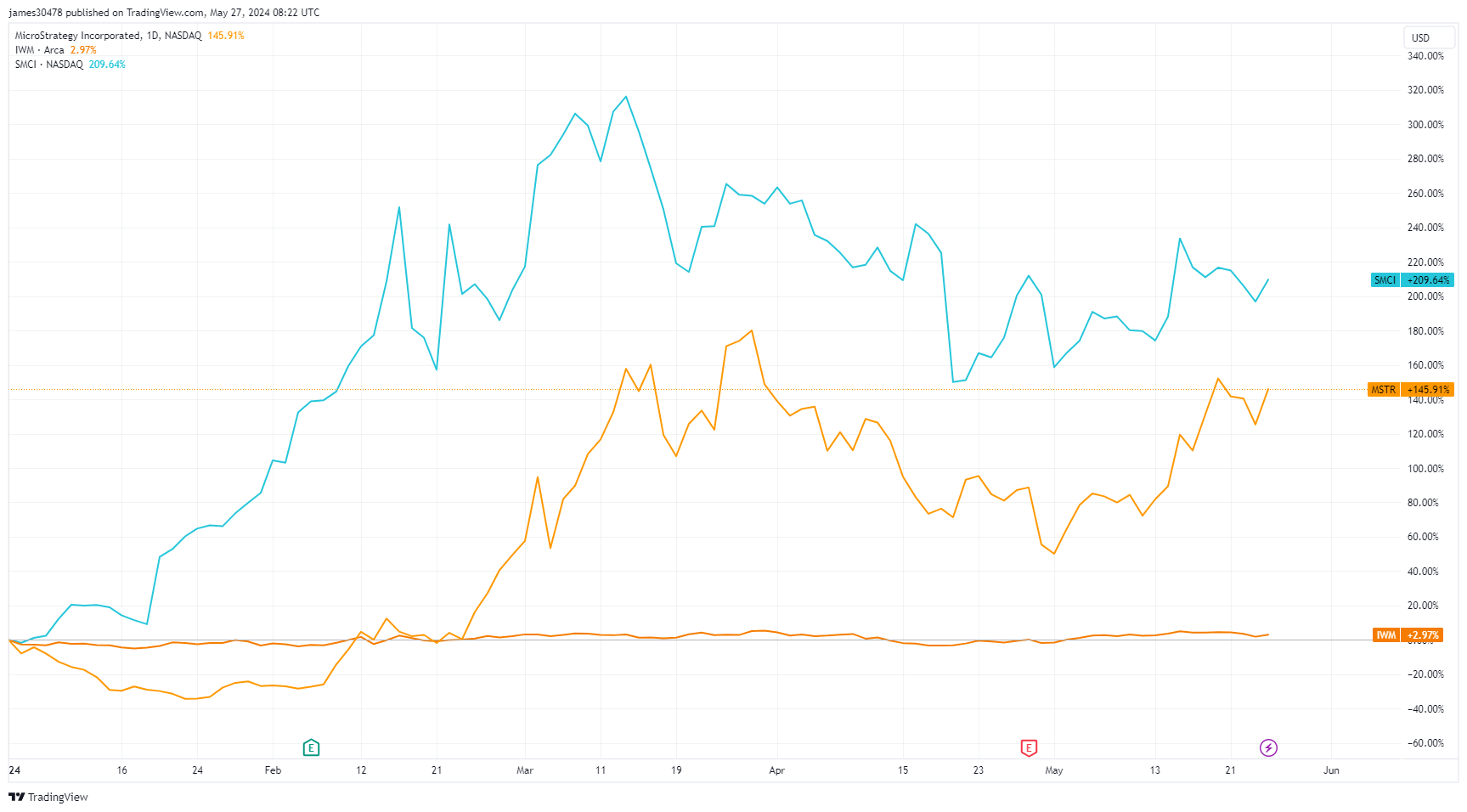

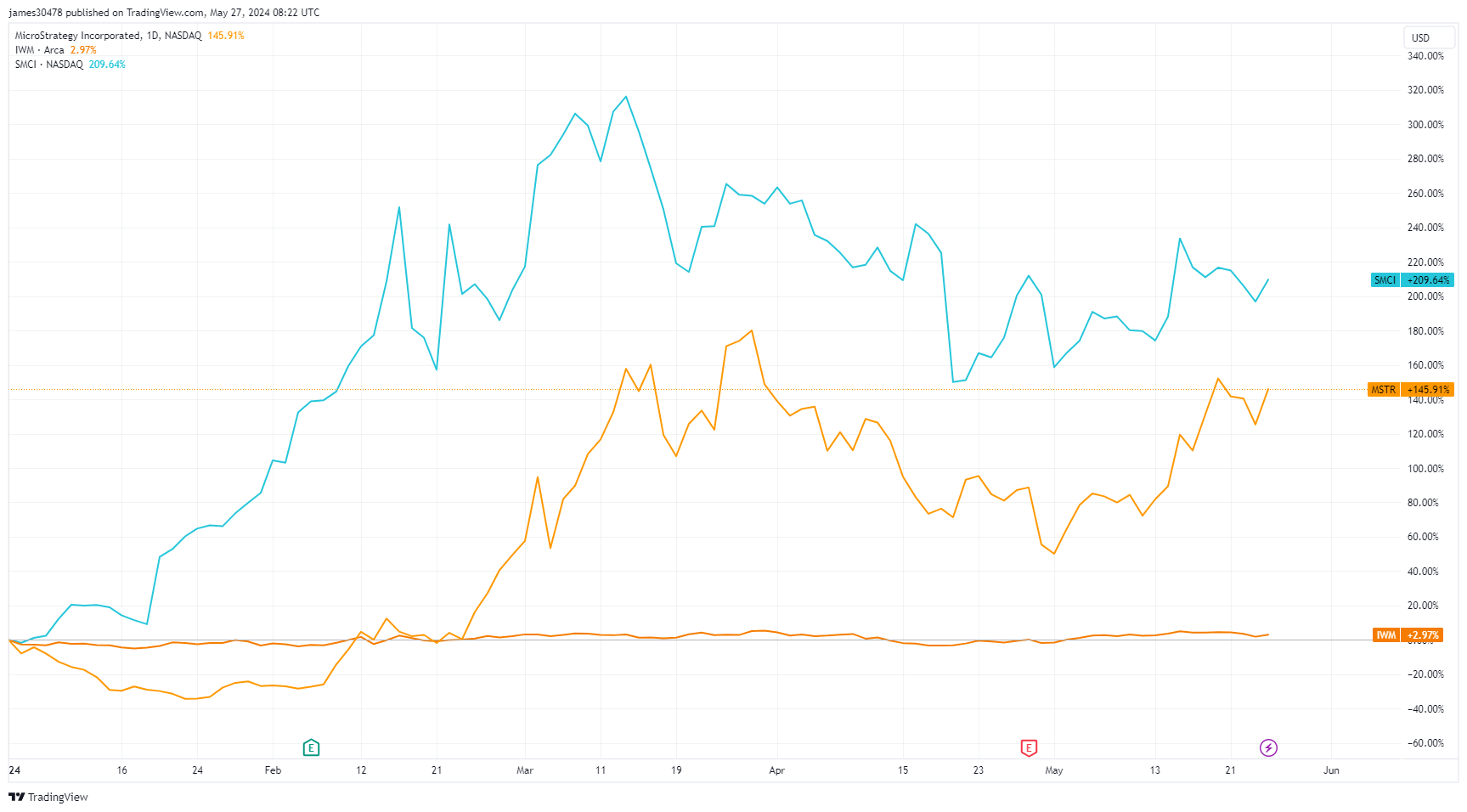

Moreover, Investing.com revealed that MSTR can also be set to affix the Russell 1000, which tracks the highest 1,000 shares within the Russell 3000 Index. MSTR will transition from the Russell 2000 to the Russell 1000 alongside SuperMicro Computer systems (SMCI). The Russell 2000 is up a modest 3% year-to-date, whereas SMCI has surged an astonishing 210% in the identical interval. In accordance with Yahoo Finance, the pair has been nicknamed “The Two Micros” resulting from their distinctive market efficiency.

In accordance with Forbes, MicroStrategy (MSTR) might be included within the Russell 1000 on June 28.

“Yearly on the fourth Friday of June, the Russell 1000, Russell 2000, Russell 3000 and different Russell indexes are reconstituted”.

If Bitcoin continues its upward trajectory, MicroStrategy stands to achieve considerably resulting from its substantial Bitcoin holdings. This might drive additional share worth progress, rising its presence in main indexes and attracting extra passive funding flows. CEO Michael Saylor might leverage this chance to buy extra Bitcoin. The last word purpose for MicroStrategy can be to safe a spot within the prestigious S&P 500.