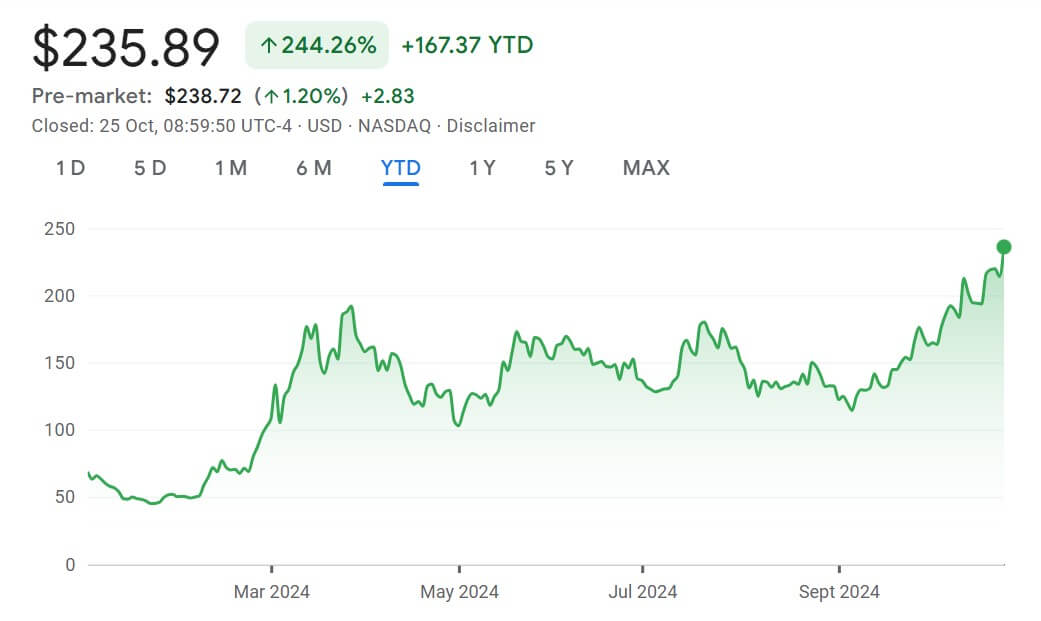

MicroStrategy’s (MSTR) inventory has reached a brand new 25-year peak amid Bitcoin’s potential climb in the direction of the $70,000 mark.

Google Finance knowledge reveals that MicroStrategy’s inventory, bolstered by its important Bitcoin holdings, has proven constant upward momentum all year long. As of press time, MSTR has soared by 244% year-to-date and climbed 55% over the previous month, reaching $235.89 as of the market shut on Oct. 24.

This spectacular inventory efficiency aligns with Bitcoin’s current rally. The highest digital asset has gained 6% over the previous month and edges nearer to the $70,000 mark amid growing institutional curiosity within the premier asset.

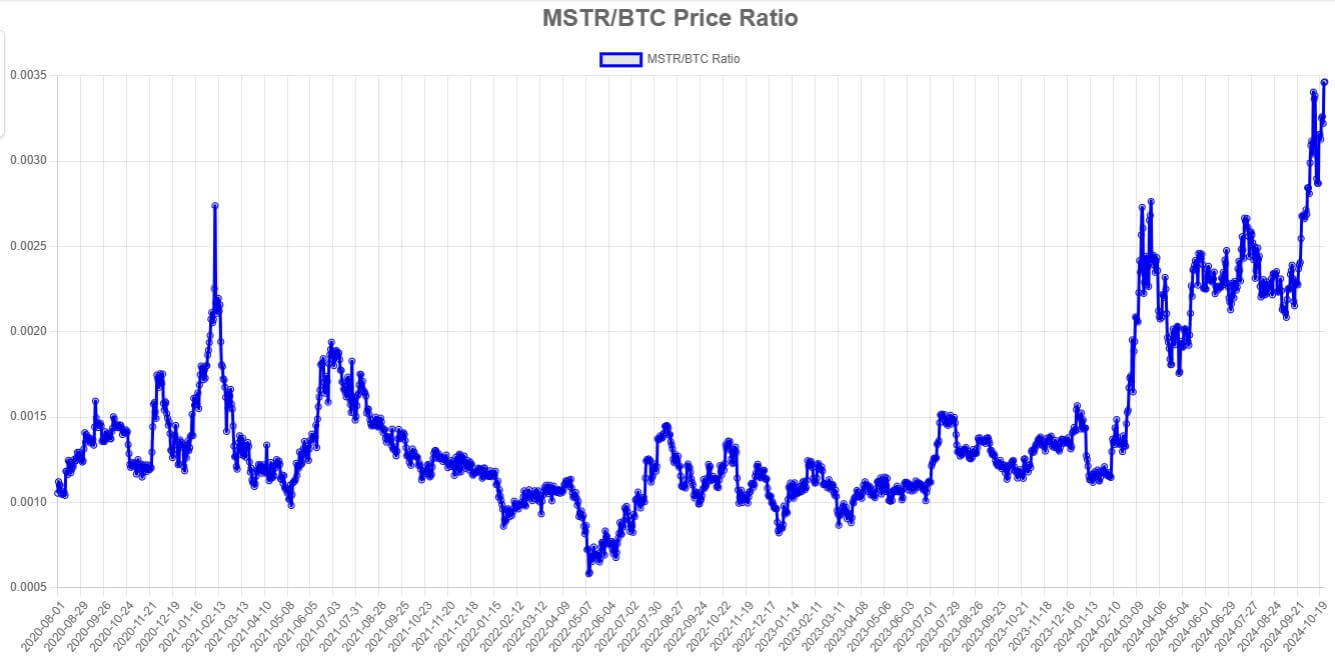

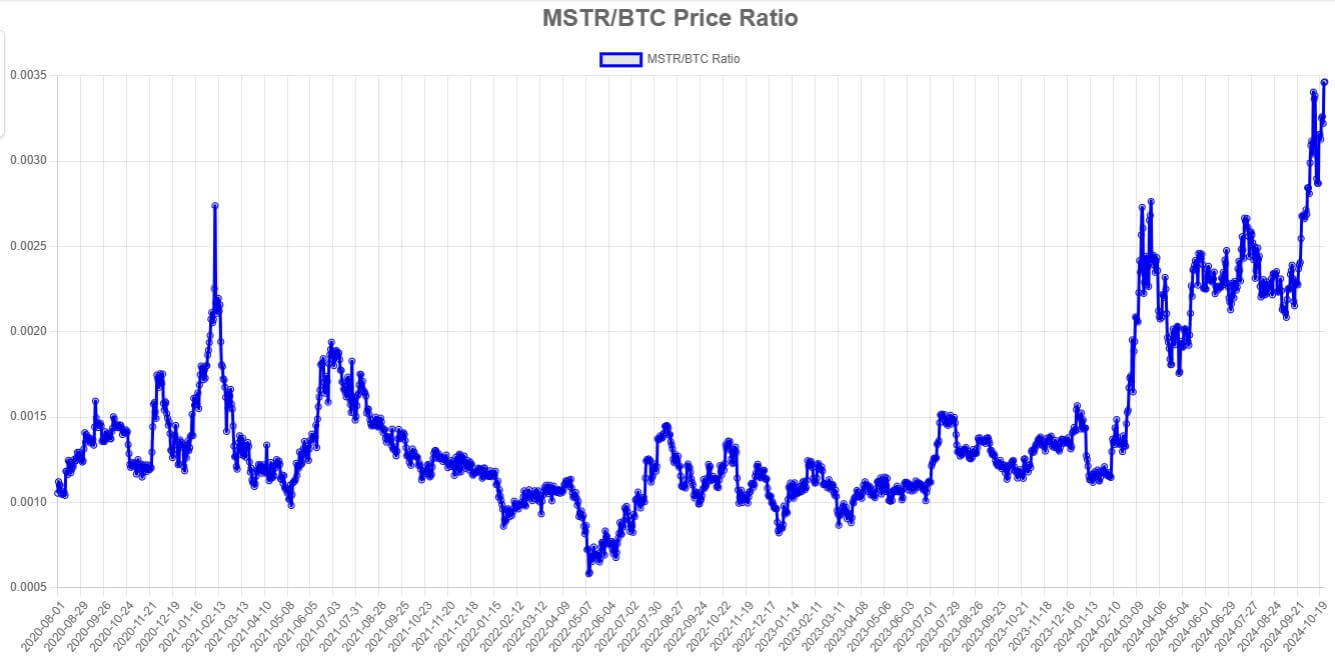

Information from the MSTR tracker unsurprisingly highlights that two key metrics have risen in tandem with these value rallies. The “MSTR/BTC Ratio” chart, which compares MicroStrategy’s inventory worth with Bitcoin’s value, hit an all-time excessive of 0.00346. This marks a better degree than throughout Bitcoin’s 2021 bull run.

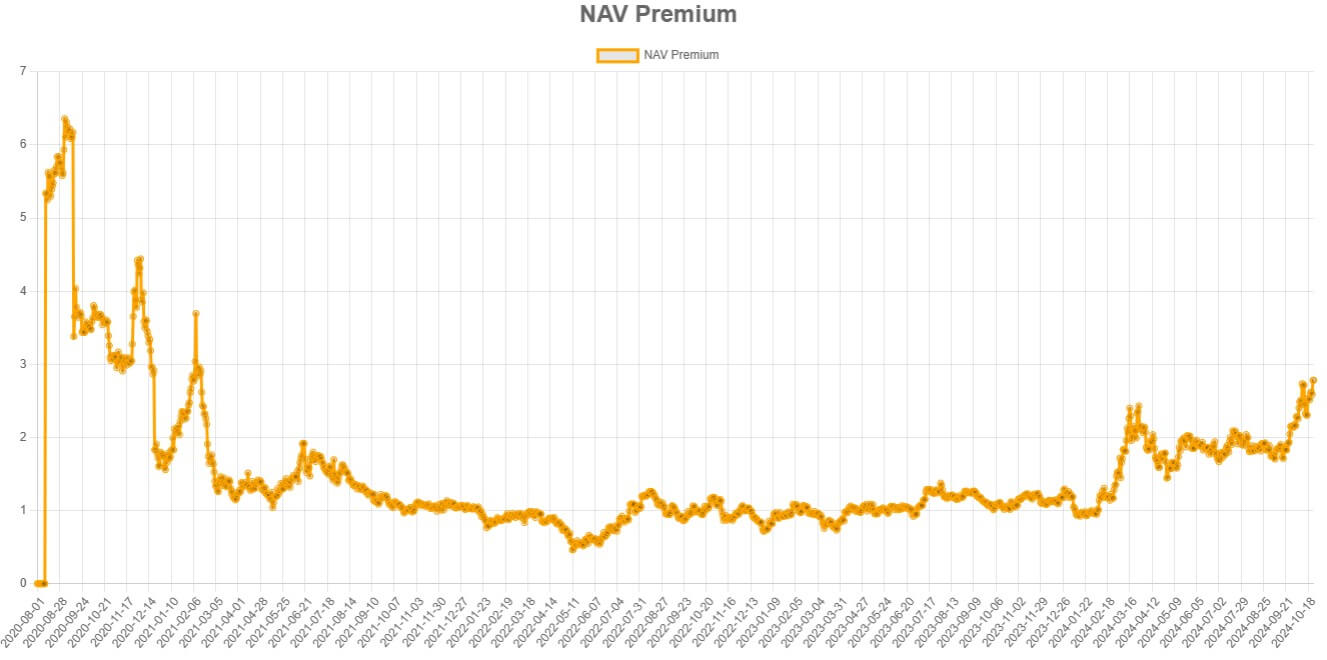

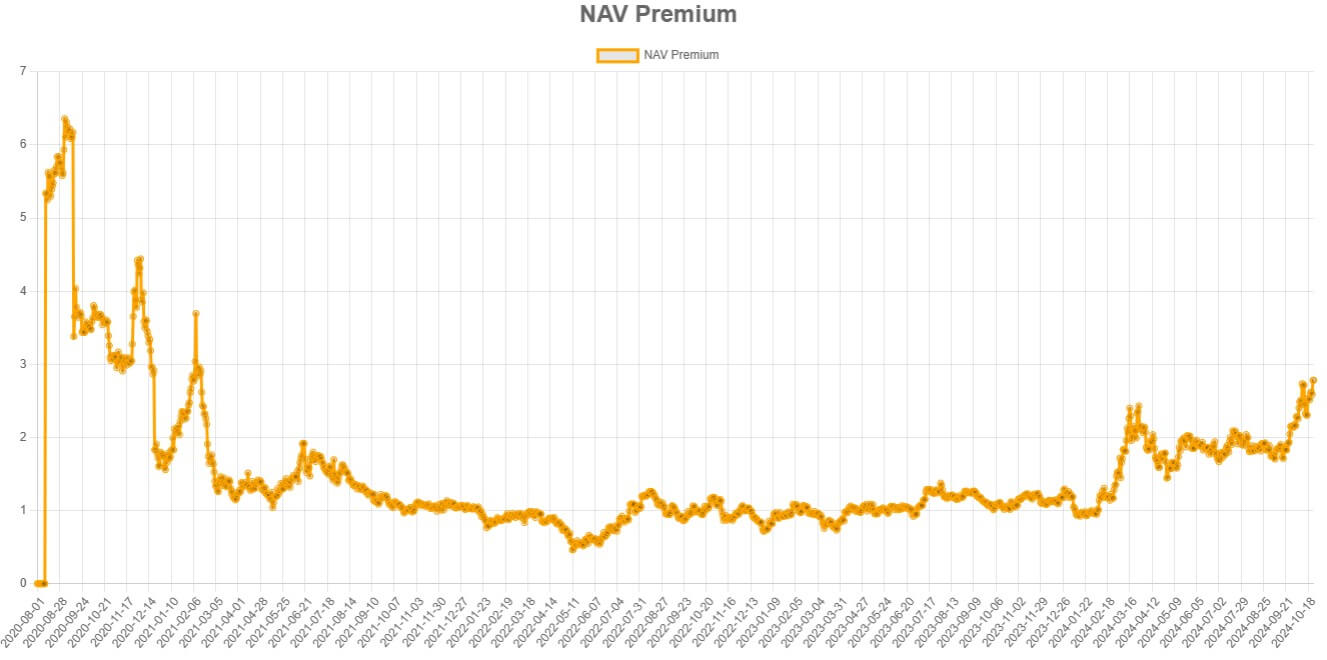

Likewise, the “NAV Premium” chart exhibits that MicroStrategy’s inventory is at present buying and selling at its highest premium over its Bitcoin holdings in three years. This premium suggests the market values the corporate’s inventory at 2.783 occasions its Bitcoin-equivalent internet asset worth.