Fast Take

Q2 2024 Highlights

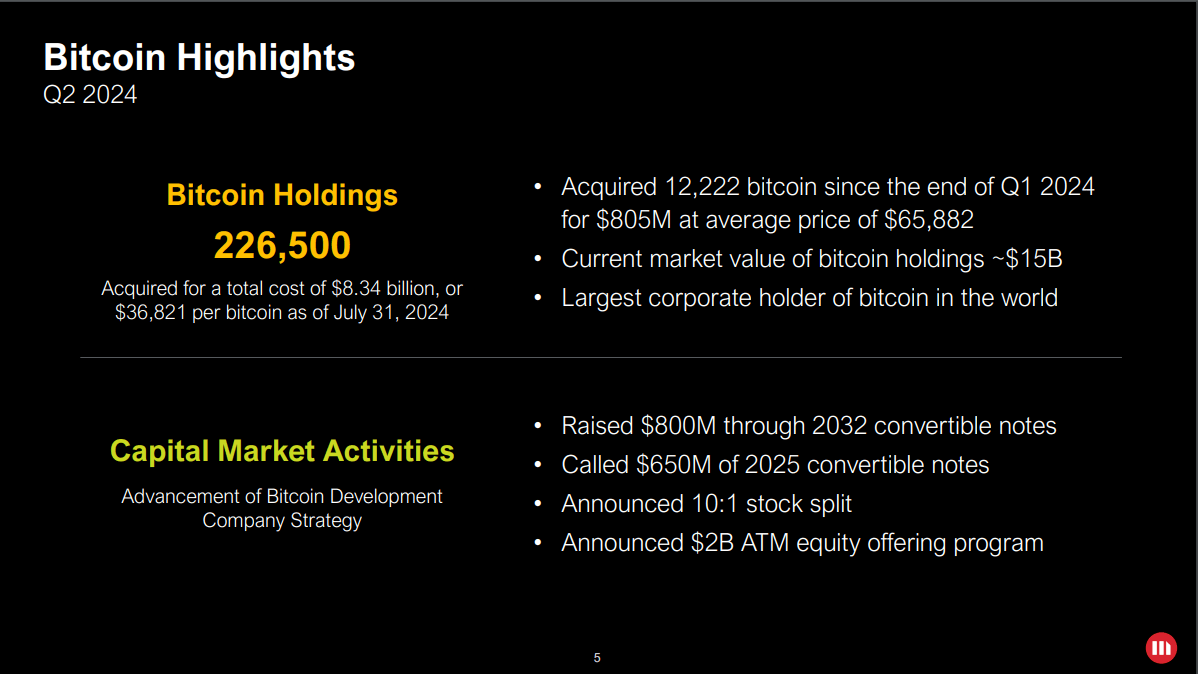

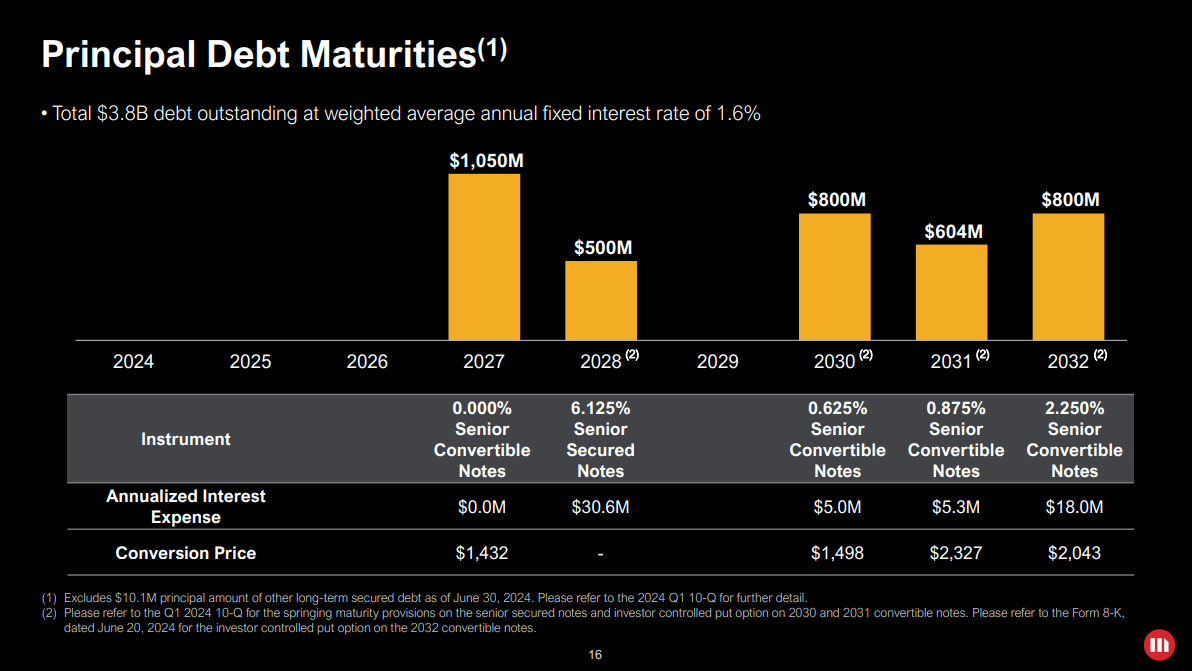

On Aug. 1, MicroStrategy introduced its Q2 outcomes, highlighting a major milestone as its whole Bitcoin holdings reached 226,500 BTC. The corporate reported a number of key monetary strikes in Q2 2024, based on their quarterly presentation, together with elevating $800 million by 2032 convertible notes, calling $650 million of 2025 convertible notes, and asserting a ten:1 inventory cut up efficient Aug. 7 alongside a $2 billion ATM fairness providing program.

Bitcoin Per Share

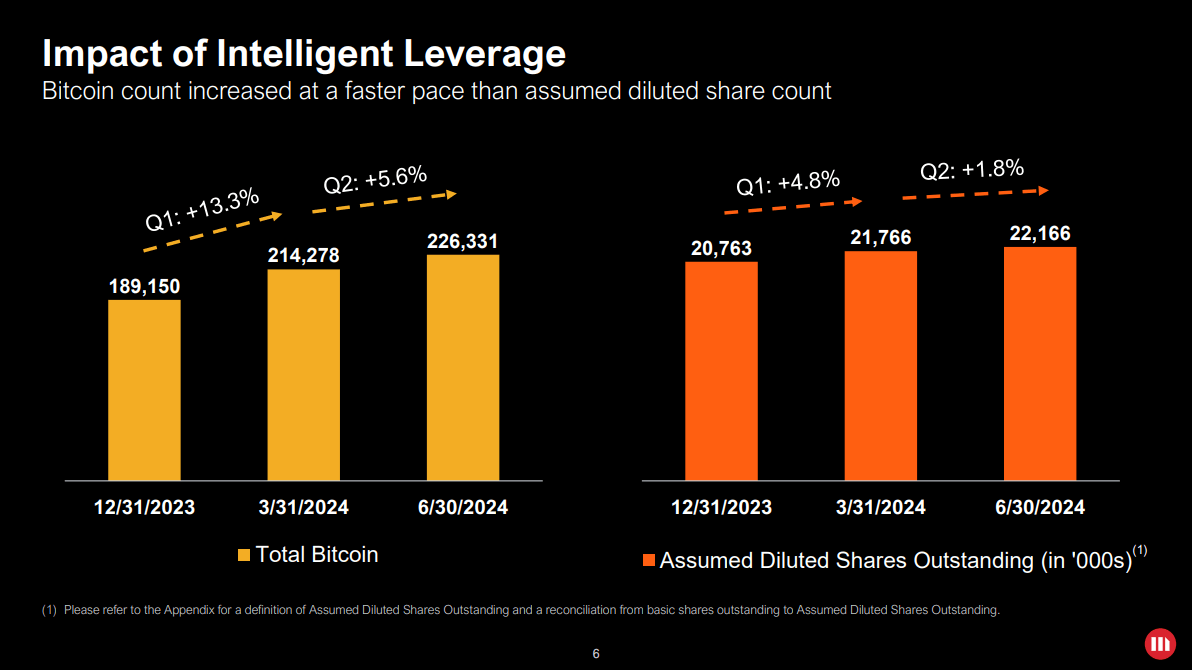

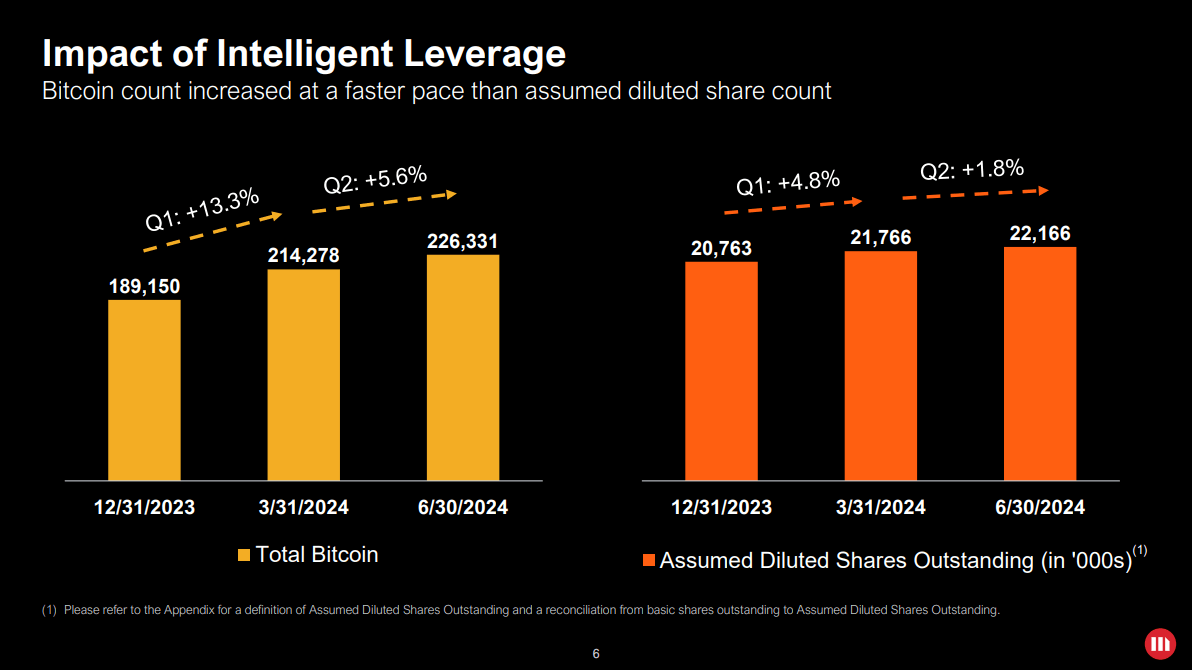

As beforehand mentioned by CryptoSlate, an important metric for evaluating Bitcoin accretion to shareholders is the Bitcoin per share ratio, calculated as BTC holdings divided by shares excellent. At the moment, this ratio stands at roughly 0.012, indicating that shareholders proceed to accrue extra Bitcoin per share over time.

The Q2 presentation highlighted that since Dec. 31, 2023, MicroStrategy’s Bitcoin holdings have elevated by roughly 20%, rising from 189,150 BTC to 226,500 BTC. Concurrently, the assumed diluted shares excellent have grown by roughly 7%.

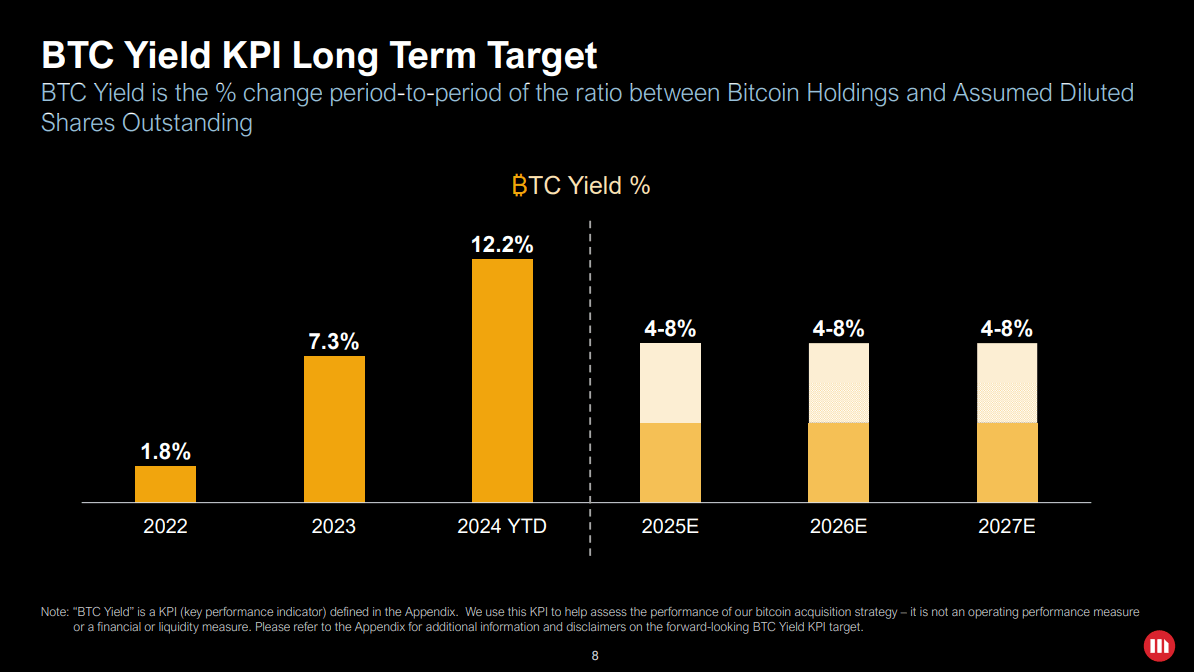

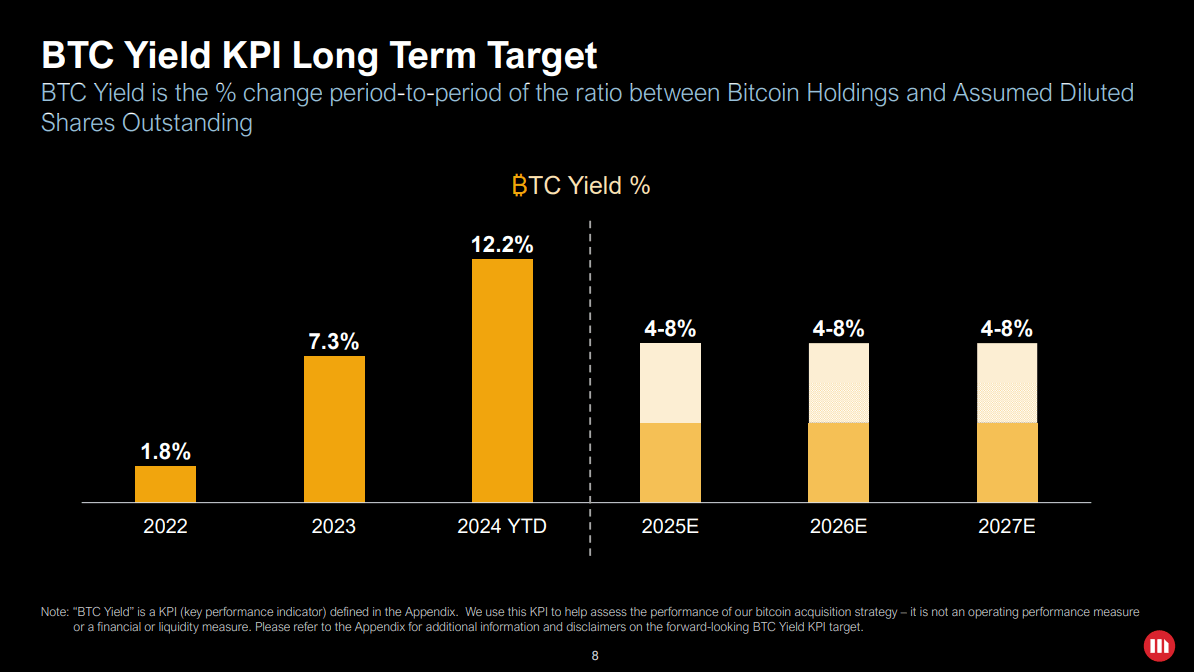

The corporate’s use of clever leverage has resulted in a “BTC Yield” of 12.2% year-to-date, a measure of the period-to-period share change within the ratio between Bitcoin holdings and assumed diluted shares excellent. MicroStrategy maintains a longer-term concentrate on BTC yield by 2027, concentrating on a 4-8% vary.

Debt Maturities

MicroStrategy’s monetary technique features a whole debt of $3.8 billion excellent, with a weighted common annual fastened rate of interest of 1.6%. Notably, $2.2 billion of this debt is due in 2030 or later.

These strategic monetary maneuvers and the growing Bitcoin holdings highlight MicroStrategy’s dedication to enhancing shareholder worth by substantial BTC accrual and clever debt administration.