The well-known enterprise intelligence agency, MicrosStrategy is reinforcing its Bitcoin technique with a decided plan to supply $700 Million in convertible senior notes. Why is it doing so? As a result of the corporate is dedicated to rising its Bitcoin holdings. MicroStrategy is a publicly traded firm that holds the biggest quantity of Bitcoin amongst all companies. It needs to purchase much more BTC, let’s break down what this implies for MicroStrategy and for the crypto market.

What’s the Plan?

MicroStrategy’s providing is focused at institutional traders, permitting them to buy unsecured senior notes. These notes will mature in 2028, and consumers can have the choice to transform them into money, MicroStrategy inventory, or a mixture of each. What makes this much more fascinating is that a part of the proceeds from this providing will go towards redeeming $500 million value of present secured notes. The remaining funds? They’re headed straight into Bitcoin.

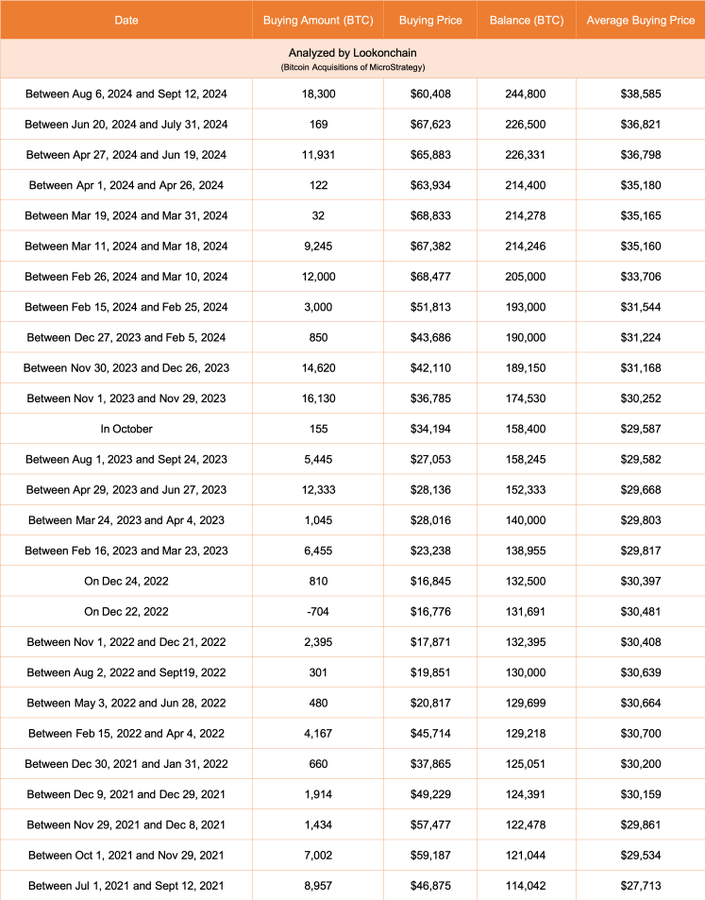

This isn’t the primary time MicroStrategy has used such a technique. Actually, the corporate’s aggressive Bitcoin acquisition started in August 2020, after they made the cryptocurrency a core a part of their treasury technique. The corporate at the moment holds a staggering 244,800 BTC, which accounts for over 1% of the whole Bitcoin provide.

A Large Bitcoin Wager

This providing follows a current buy by MicroStrategy of $1.11 billion in Bitcoin. That buy alone introduced in 18,300 BTC, boosting their already huge holdings. With Bitcoin seeing a 17% year-to-date acquire, MicroStrategy’s inventory has additionally benefited. Traders have taken discover, with the corporate’s shares buying and selling at over $1,500 after the announcement.

The chief chairman of MicroStrategy, Michael Saylor, has been very vocal about his confidence and religion in Bitcoin. His dedication to purchase Bitcoin at varied value factors displays his long run imaginative and prescient for it. This technique has been a key issue to drive its inventory value in addition to total market notion.

Will It Pay Off?

Regardless of the robust concentrate on Bitcoin, MicroStrategy’s technique just isn’t with out threat. The cryptocurrency market is famously risky. But, for now, the corporate’s strikes appear to be paying off, with inventory costs rising after these bulletins. Nonetheless, it’s essential to notice that the providing continues to be topic to market circumstances, and there’s no assure on the timing or phrases of its completion.