NAB warns scammers have gotten more and more subtle, discovering new methods to tear off sudden Aussies.

In accordance with NAB’s specialists, there are 5 key rip-off tendencies that each one Aussies must learn about in 2025.

NAB Govt, Group Investigations Chris Sheehan says whereas scammers are continually evolving, there are some frequent crimson flags to be careful for.

“Criminals create urgency to behave shortly. It may very well be creating FOMO (concern of lacking out) that resold live performance tickets will go shortly, that’ll you miss the following massive crypto funding alternative or that there’s an issue together with your checking account and you might want to transfer your cash elsewhere,” he mentioned.

Mr Sheehan, who was a former Australian Federal Police officer mentioned the indicators can fluctuate with some being apparent together with emails and texts crammed with typos, pretend hyperlinks that don’t match and sudden causes to contact the sufferer.

“One other frequent crimson flag throughout totally different rip-off varieties is that the contact is sudden,” he mentioned.

“For instance, an out-of-the blue telephone name from an ‘web supplier’ to repair your connection.”

Mr Sheehan mentioned there have been 5 scams to look at in 2025 they hear are focusing on on a regular basis Aussies.

“Each Australian must learn about these scams to allow them to recognise the crimson flags and shield themselves and their family members in 2025.”

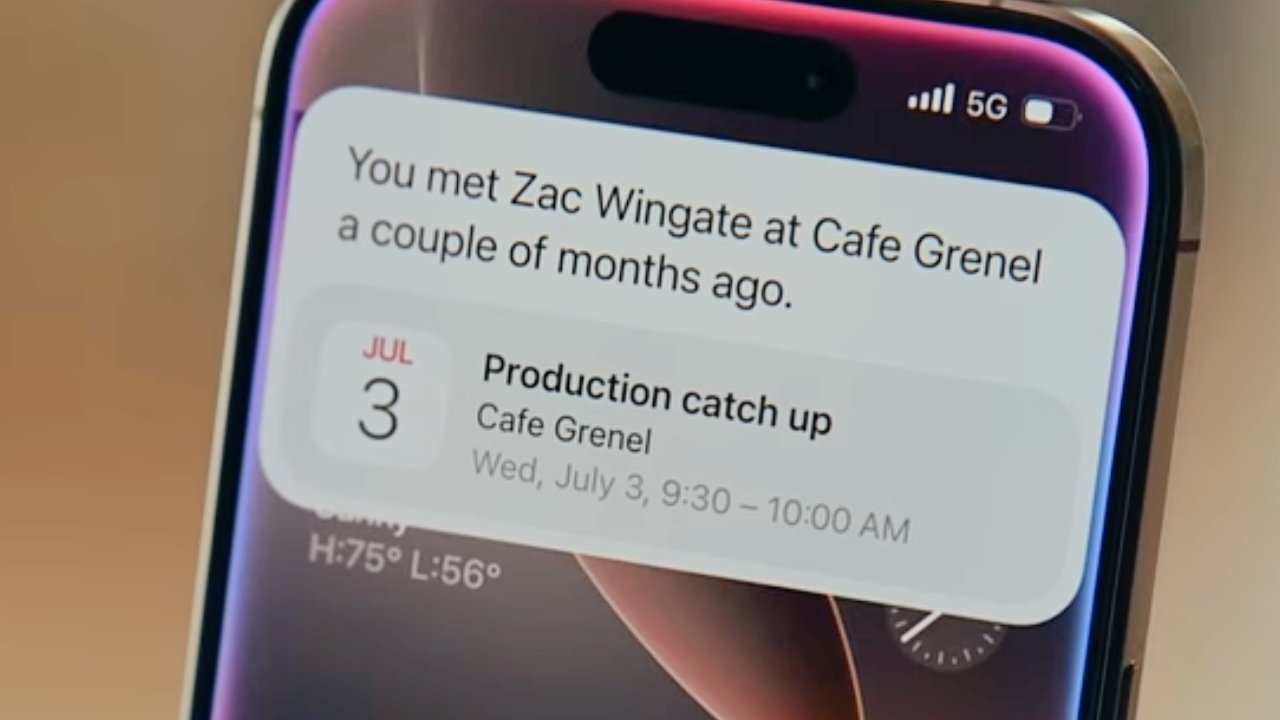

AI-driven scams

NAB warns with the rise of AI, criminals are utilizing scams of impersonating Aussies of be aware and spruiking a chance or product on social media.

These scams are created with deep fakes – that are lifelike impersonations of actual individuals generated by AI – which may be generated with simply three seconds of audio or a picture from a social media profile, voicemail or video on an internet site.

An AI generated model of the guitarist is getting used to promote pretend live performance tickets to followers

Worse nonetheless, Mr Sheehan mentioned AI allowed criminals to ‘nudify’ and manipulate pictures from social media as an alternative of counting on pictures individuals have shared with them.

“Whereas we haven’t had any stories of our prospects being impacted by sextortion utilizing AI-generated pictures, we’re watching this subject abroad given sextortion can have devastating penalties,” Mr Sheehan mentioned.

Cryptocurrency funding scams

One other rip-off NAB is seeing on the rise is criminals making an attempt to take advantage of concern by way of lacking out on the following main cryptocurrency funding.

On this occasion criminals are creating pretend cryptotrading apps or web sites that don’t have any professional portfolio.

In some instances duped traders may see a small quantity of income because the criminals attempt to achieve belief with the sufferer.

However if you happen to attempt to withdraw, victims are met with charges, taxes or problems with the account being locked out.

As cryptocurrency explodes in reputation, a brand new report has revealed Elon Musk impersonators have stolen over $2.5M by way of digital forex scams.

“Older Australians might not be as conversant in the digital forex and phrases like digital wallets and tokens, whereas underneath 50s are the quickest rising age group to lose cash nationally to crypto funding scams,” Mr Sheehan mentioned.

NAB mentioned criminals proceed to focus on prospects with time period deposit funding scams as cost-of-living pressures stay entrance of thoughts for a lot of Australians.

Bucket listing scams

Scammers are additionally focusing on main ‘as soon as in a lifetime’ moments, comparable to worldwide music acts enjoying in Australia or worldwide travellers.

In accordance with NAB consumers may be duped into getting pretend or counterfeit tickets to those occasions or if they’re actual they’re typically at inflated costs.

With Boxing Day gross sales about to kick off, Australians are being reminded to remain vigilant towards scammers. Web shoppers are being warned about parcel supply messages and pretend web sites imitating fashionable manufacturers. The important thing to a scam-free festive season is double-checking URLs and avoiding clicking on suspicious hyperlinks.

A lot of all shopping for and promoting scams prospects report are linked to social media or digital platforms, reinforcing the necessity for a co-ordinated nationwide method to stopping scams.

In an instance, NAB says they have been capable of forestall scammers who used tickets to a latest Coldplay live performance as a means of luring in potential victims.

“Sadly, there have been numerous crimson flags, so I urged the sufferer ask the vendor what state they stay in and why two totally different names have been being utilized by the vendor,” NAB mentioned.

The shopper might pay for an merchandise that doesn’t exist or, if one thing arrives, it’s random or counterfeit. Different variations contain paying an inflated worth for a professional services or products.

“We anticipate ticket scams when Oasis and Metallica tour, just like these seen with Taylor Swift and Coldplay in 2024,” Mr Sheehan mentioned.

Distant entry scams focusing on companies

In accordance with NAB, distant entry scams focused at companies stays the commonest means scammers are focusing on Aussies.

NAB prospects report these scams begin with telephone calls impersonating well-known organisations.

The criminals then direct individuals to obtain an app or software program, giving them distant entry to your pc to allow them to entry your on-line banking or different private info.

Mr Sheehan mentioned criminals might steal vital quantities of cash in minutes by way of distant entry.

“We anticipate criminals will proceed to focus on Australian customers and companies with distant entry scams in 2025.

“Losses typically run into tens of hundreds of {dollars}, in comparison with different scams the place the criminals may internet $500 or $1000,” he mentioned.

Phishing scams

Aussies are additionally being warned that phishing scams stay a favorite of criminals. Utilizing numerous methods of contacting Aussies together with textual content, emails or telephone calls, scammers faux to be from a trusted organisation and ask for delicate info.

“An rising development is textual content messages urging individuals to make use of their grocery store or comparable retail rewards factors earlier than they expire,” Mr Sheehan mentioned.

“These heartless criminals are preying on cost-of-living pressures.”

The warning comes as NAB continues its struggle towards criminals as a part of a bank-wide rip-off technique.

“Buyer rip-off losses decreased 20 per cent year-on-year. That’s regardless of buyer rip-off stories growing 18 per cent in the identical interval,” Mr Sheehan mentioned.

“We will, and can, do extra in 2025 to guard our prospects and the neighborhood.

“Contact your financial institution instantly if you happen to suppose you’ve been scammed.”