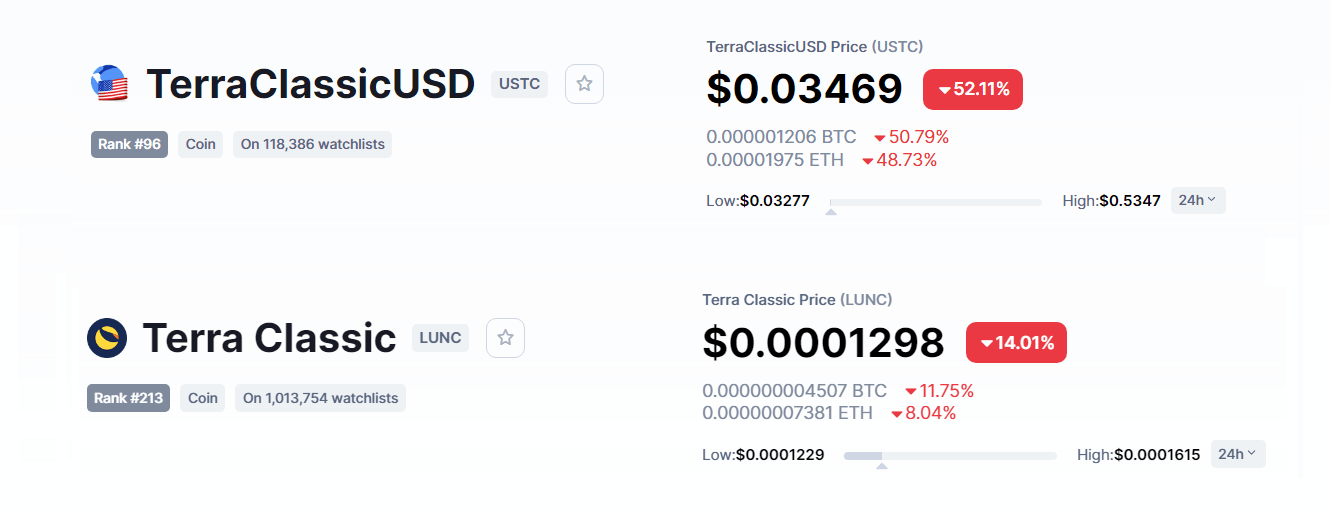

TerraUSD (UST) shedding its $1 peg and falling to $0.03 and the crash of Terra (LUNA) to $0.0001372 had been two occasions that shook the crypto neighborhood.

UST (now rebranded as USTC or TerraClassic USD) is an algorithmic stablecoin backed by the collateral token Terra (now rebranded as Terra Traditional or LUNC) fell to just a few cents, inflicting many buyers to lose their financial savings.

This important loss is as a result of stablecoins are seen as a secure haven for crypto holdings because of their very low volatility, permitting their worth to remain very near a greenback regardless of market situations, thus its attractiveness and impression.

As a result of main impression of UST shedding its peg and the collapse of LUNA, Nansen, a blockchain analytics platform, delved into the on-chain information to find what might have induced the stablecoin to lose its peg. Its evaluation exhibits that multiple actor was liable for the collapse.

The Nansen report discovered a small variety of addresses had taken benefit of the weaknesses within the Terra ecosystem. These actors exploited arbitrage alternatives due to the poor liquidity of Curve (CRV) swimming pools underpinning the TerraUSD (UST) peg.

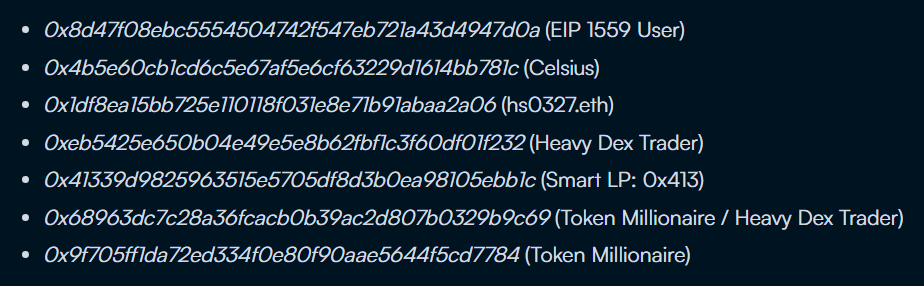

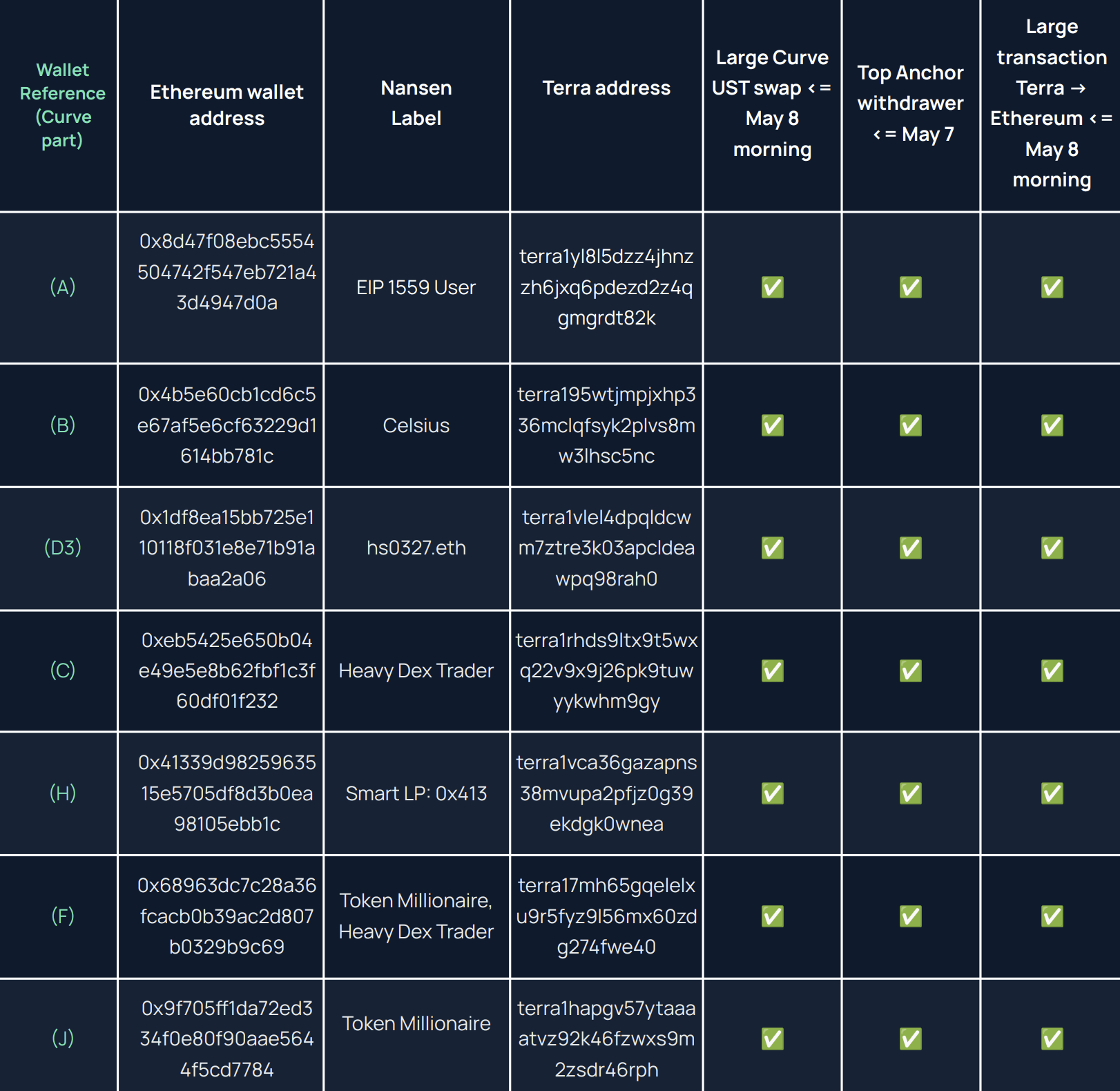

Nansen’s findings debunked the idea {that a} single hacker or attacker destabilized UST. Nansen as an alternative recognized seven addresses as being concerned in UST shedding its peg, with a lot of them being huge gamers with massive token holdings.

In response to the report, UST was withdrawn by these wallets from Terra’s Anchor protocol utilizing the Wormhole infrastructure. Transferring these funds from the Terra blockchain to Ethereum. In case you’re questioning, Wormhole is a bridging protocol that enables customers to switch funds from one blockchain to a different.

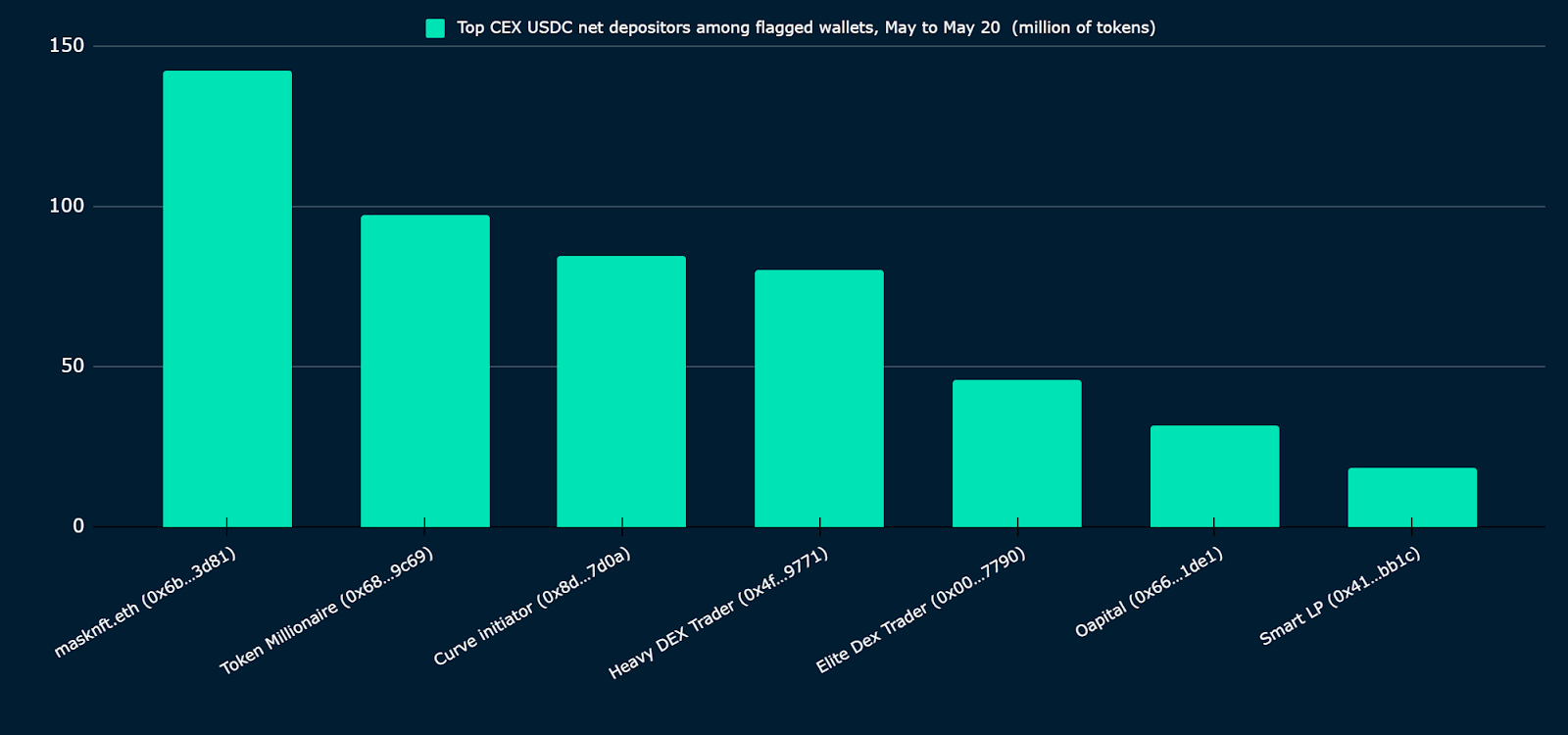

After that, monumental sums of UST had been exchanged for a wide range of stablecoins held in Curve’s liquidity swimming pools. Consequently, Nansen hypothesized that all through the collapse of UST, among the found wallets took benefit of worth disparities on Curve and decentralized and centralized exchanges by shopping for and promoting between them.

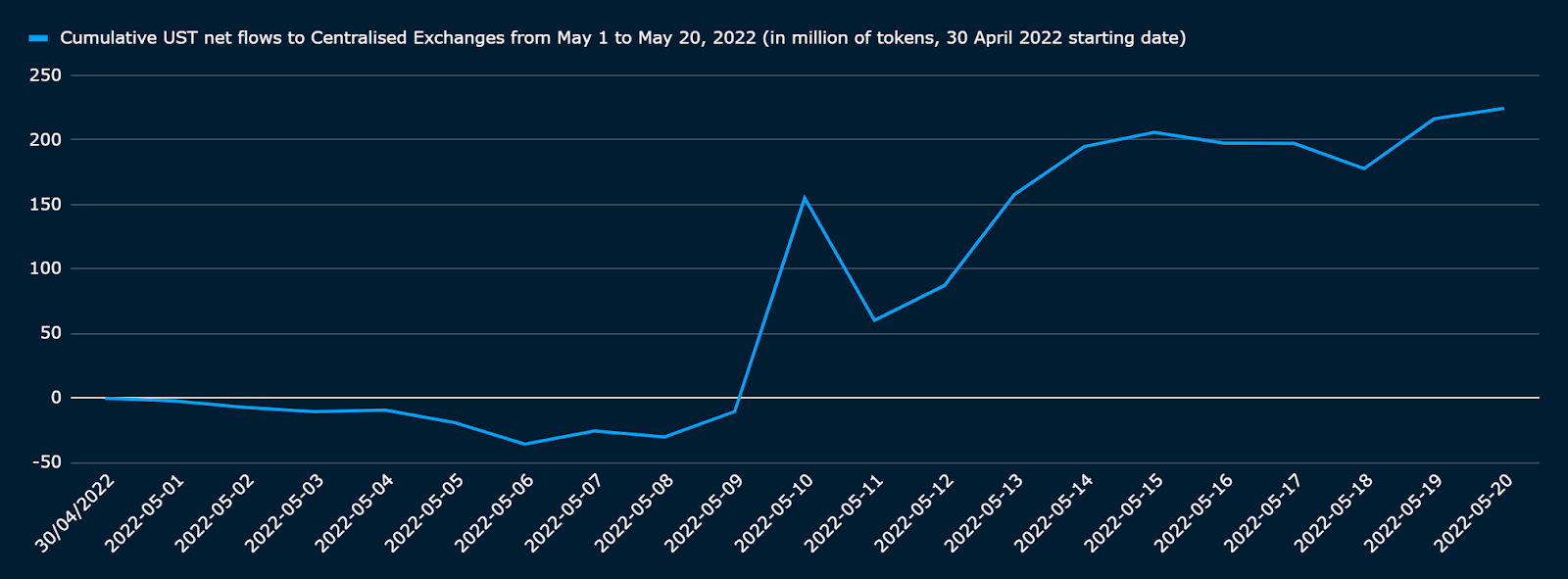

Knowledge from Could 7 to 11—the interval when UST misplaced its $1 peg—was utilized in Nansen’s blockchain analysis to determine vital transaction quantity information. Nansen checked out social media and discussion board posts to slender down that interval, figuring out main transaction quantity on Curve liquidity swimming pools, which led to its three-phase analytical strategy.

To start, Nansen examined transactions out and in of the Curve lending protocol to generate a listing of wallets with an exercise suggesting they’d a substantial affect on the UST collapse.

Nonetheless, throughout section two, Nansen’s observations of transactions occurring through the Wormhole bridge made issues harder. It was found that solely a choose few wallets had been utilizing the Anchor protocol to ship out their UST. After that, Nansen regarded into UST and USD Coin (USDC) gross sales on centralized exchanges.

Lastly, on-chain proof was triangulated to construct a story of the occasions surrounding the UST stablecoin shedding its peg. Then, a listing of seven wallets which might be thought-about to have performed a major position within the collapse of the Terra ecosystem was offered.

The Nansen analysis affords some intriguing observations generated via blockchain analytics. Nonetheless, one factor is bound: Nansen has chosen to not speculate on what could possibly be happening behind the seven key addresses that had been instrumental within the collapse of the UST’s stablecoin.

This report’s findings assist present a extra clear image of what led to UST shedding its pegs and the next collapse of each the UST and LUNA cryptocurrencies.