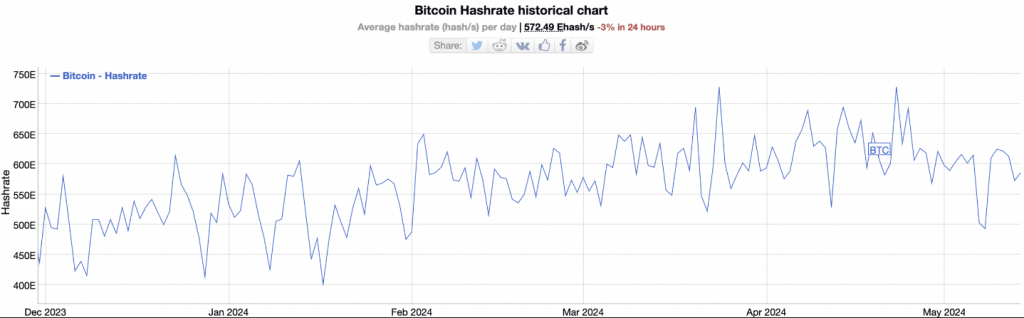

The post-halving world of Bitcoin continues to throw curveballs. After a hashrate surge to have fun the block reward discount in April, Bitcoin’s computational energy has taken a nosedive, dropping 20% in current weeks.

Associated Studying

This surprising decline has ignited a debate amongst analysts, with some sniffing out a hearth sale and others urging warning.

Bitcoin: Hashrate Hiccup Or Miner Exodus?

Hashrate, a measure of the mixed processing energy devoted to securing the Bitcoin community, sometimes climbs after a halving occasion as miners put money into extra highly effective rigs to compete for the diminished rewards.

Nonetheless, this time round, the development defied expectations. Consultants like Maartunn, a pseudonymous analyst at CryptoQuant, consider this alerts a possible “miner capitulation.”

Much less environment friendly miners are actually probably dropping by the wayside. The halving, which reduce block rewards in half, squeezed revenue margins for miners utilizing older tools. As these miners shut down their operations, the hashrate dips.

Hash Ribbons Flash Warning Signal

Supporting Maartunn’s concept is a technical indicator referred to as Hash Ribbons. This metric tracks the distinction between short-term and long-term hashrate averages. When the hole widens, it suggests a decline in mining exercise, doubtlessly resulting from much less environment friendly miners dropping off.

The current hashrate plunge has triggered a spike in Hash Ribbons, traditionally an indication of miner capitulation that has usually coincided with value lows for Bitcoin.

Bitcoin Miners Promoting Off?

Additional fueling the capitulation concept is a lower in Bitcoin’s Miner Reserve. This metric tracks the quantity of Bitcoin held in wallets related to miners. A decline within the reserve suggests miners may be offloading their mined cash, doubtlessly to cowl operational prices or to exit the market altogether.

Undervaluation Sign Or Cyclical Dip?

Maartunn interprets these indicators as a bullish indicator. Hash Ribbons usually level to opportune moments to purchase, he argues. Backing his declare is the Market Worth to Realized Worth (MVRV) ratio, which suggests Bitcoin may be undervalued.

This metric compares the present market value to the typical value at which all Bitcoins have been acquired. A unfavorable MVRV, just like the one Bitcoin at the moment has, suggests the asset is buying and selling beneath its historic price foundation, doubtlessly indicating a shopping for alternative.

Associated Studying

Not Everybody On The Capitulation Practice

Nonetheless, not all analysts are satisfied. Some argue that the hashrate decline might be momentary, maybe resulting from elements like excessive climate occasions disrupting mining operations in sure areas.

Moreover, the post-halving interval is often one in every of adjustment for miners, and a short-term hashrate fluctuation may not essentially sign a mass exodus.

The post-halving Bitcoin panorama continues to be unfolding. Whereas the hashrate decline and different indicators recommend a possible shopping for alternative, notably for long-term traders, the scenario stays fluid.

Featured picture from Shutterstock, chart from TradingView