- Solana NFTs noticed $295 million in quantity throughout April

- Integration with OpenSea has boosted whole ecosystem

- Close to-zero fuel charges and low limitations to entry imply new NFT merchants more and more flocking to Solana

- Not Okay Bears spinoff on Ethereum highlights how far Solana has come

NFTs exploded onto the scene in 2021, with $17 billion in gross sales all year long. To date this 12 months, regardless of the intense risk-off setting with property crimson throughout the board, this report from Chainalysis reveals that quantity within the NFT area is stabilising.

With each long-term indicator pointing in the direction of longevity within the area, I assumed it might be attention-grabbing to evaluate the place these gross sales are happening, and whether or not Ethereum nonetheless stays king.

One pattern jumped out fairly swiftly – the expansion of Solana.

OpenSea

Within the brief historical past of NFTs, the overwhelming majority of quantity has occurred on Ethereum, totally on OpenSea, {the marketplace} constructed initially for Ethereum. That’s starting to alter, nonetheless. OpenSea not too long ago built-in with Solana, a watershed second for Solana NFT collections that to this point had been restricted to marketplaces solely for Solana collections, resembling Magic Eden and Solanart.

In one other poignant second, a spinoff assortment referred to as Not Okay Bears was eliminated yesterday from OpenSea, after complaints from Okay Bears collectors. Historically, it has been the opposite approach round – knock-off collections launching on Solana, however a high-profile imitation on Ethereum seems like a seminal second for Solana.

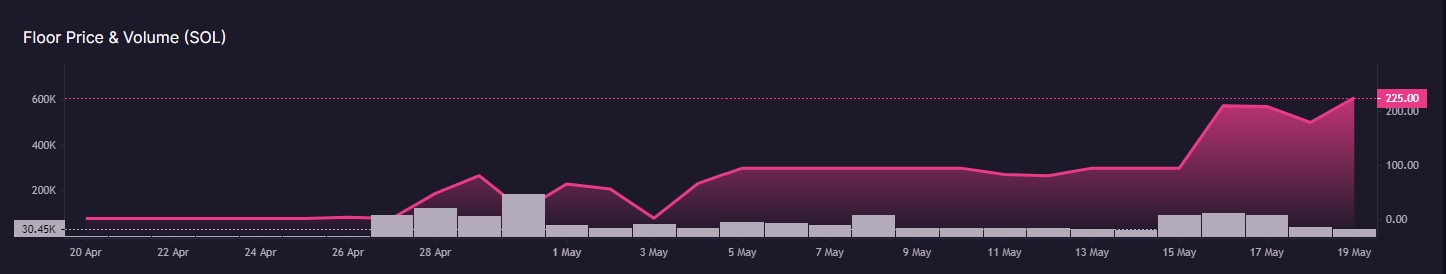

Sticking with Okay Bears, they’re presently the most popular assortment on Solana, buying and selling at a ground worth of 222 SOL ($11,500) and with a stout quantity of 1.5 million SOL ($77 million) during the last month – and that’s on Magic Eden alone. On OpenSea, they’ve achieved nearly an similar quantity of quantity within the final month, putting seventh on the leaderboard – with solely six collections from Ethereum above them.

Okay Bears ground worth and quantity (in SOL) has been on an upward pattern all month

Okay Bears ground worth and quantity (in SOL) has been on an upward pattern all month

Bored Ape Solana Membership

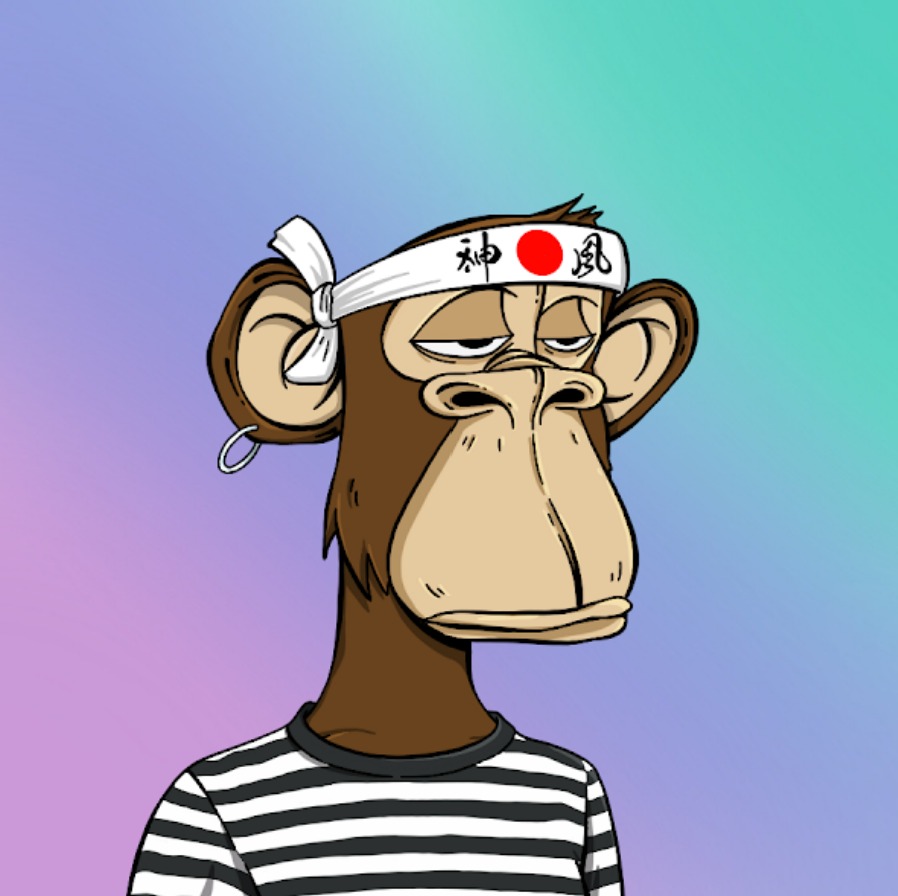

Staying inside the sphere of derivatives, one other poignant case is that of Bored Ape Solana Membership (BASC)– the Solana model of Bored Ape Yacht Membership (BAYC) on Ethereum. That is totally different from the Not Okay Bears scenario in that the spinoff assortment right here is extra of a homage than a knock-off. BASC even turned verified on OpenSea, seeing quantity and ground worth rocket shortly afterwards.

Final month, following the chaos of the Otherside launch from Yuga Labs, the creator of BAYC, I wrote right here about how unique the Ethereum NFT world had develop into. It felt like a Bored Ape 1% Membership, as sky-high costs and onerous fuel charges priced abnormal traders out from getting concerned.

The focus of wealth within the NFT area was getting worryingly excessive, whereas the centralisation of the area was an actual concern – Yuga Labs have the highest three collections on OpenSea and likewise personal the IP rights to CryptoPunks, to not point out their tweets final month that they need to begin their very own blockchain.

Solana offers the abnormal investor entry to the NFT world, tearing down limitations to entry with its basement-low fuel charges and easy-to-use interface. For enjoyable, I even purchased the beneath Ape from the BASC to quell my dissatisfaction from the Yuga Lab fallout. The charges I paid had been a fraction of a cent, and the whole course of couldn’t have contrasted extra with the ultra-exclusive BAYC counterparts on Ethereum.

Instagram and Coinbase

This week additionally introduced the information that Meta-owned Instagram is to check a characteristic permitting customers to show NFTs as their profile footage. Meta confirmed that whereas the preliminary check launch is proscribed to Ethereum and Polygon, Solana is to be added at a later date. Coinbase additionally introduced their intention to increase to Solana as soon as their Ethereum NFT ecosystem is up and working.

Development

This entry for the little man that Solana gives is beginning to catch on. An increasing number of new traders are selecting Solana reasonably than Ethereum for his or her first foray into NFTs, for a similar causes I went to Solana to buy my above Ape. There have been 9.2 million transactions on Magic Eden vs 1.67 million on OpenSea over the previous month, in accordance with this report.

It needs to be caveated, nonetheless, that this chasm in transactions is skewed largely attributable to bot exercise. Nonetheless, the expansion tendencies are clear – Solana is increasing at a speedy tempo, with ground costs of the primary collections growing during the last month, in distinction to what’s taking place on Ethereum.

Maybe extra correct than transaction depend is quantity, and in accordance with DappRadar, the Solana NFT market jumped 91% in April, with quantity of $295 million. Wanting again during the last 30 days from right this moment, the meltdown has lowered the greenback quantity, however the SOL quantity is up considerably. Certainly, when contemplating the pullback within the wider market, the truth that quantity during the last 30 days throughout the highest 14 marketplaces is $274 million (on the present SOL worth of $52) is an especially bullish signal.

The beneath graph reveals the majority of this quantity has been happening on Magic Eden and OpenSea.

Conclusion

In conclusion, it’s been a massively bullish interval for Solana NFTs. Whereas the crypto market has been a massacre – and the Solana token has not been spared – the long-term trajectory for the ecosystem stays upward.

Ethereum fairly merely can not compete with the almost-zero limitations to entry that Solana gives to NFT traders. Flipping NFTs, enjoying round with totally different collections and shopping for on a whim is all doable on Solana, with charges a fraction of cent per transaction. That is merely not viable on ETH, exacerbated by the dominance of the highest collections, which layer in large costs on prime of the onerous fuel charges.

Then once more, except you’re spending loads on a really costly NFT, Ethereum shouldn’t be possible to make use of given you lose a lot on fuel – which means it continues to solidify itself as a blockchain for the elites, in the case of NFTs at the least. For the abnormal investor seeking to make investments quantities which can be very a lot within the non-life-changing numbers, then Solana merely makes extra sense.

The market is beginning to realise this.