Nvidia is the darling of Wall Road because it introduced its newest quarterly monetary outcomes. Briefly, the corporate is a cash printing machine, beating analyst’s estimates. Its reported revenues have been even increased than these from its stellar Q3 2024 earnings report.

In accordance with its press launch, Nvidia generated $26 billion in income over the primary quarter of 2024, up 18% from the earlier quarter and a large 262% enhance from a yr in the past. As anticipated, the large bucks got here from its knowledge heart enterprise and surging AI demand, which made up $22.6 billion of the general $26 billion in income. That is a rise of 23% over the earlier quarter and a hard-to-believe 427% enhance from a yr in the past.

These outcomes noticed the shares of Nvidia hit over $1,000 in after-hours buying and selling. Which means the corporate is clearly the world’s third largest firm by market cap, effectively forward of Alphabet (Google) and behind solely Microsoft and Apple.

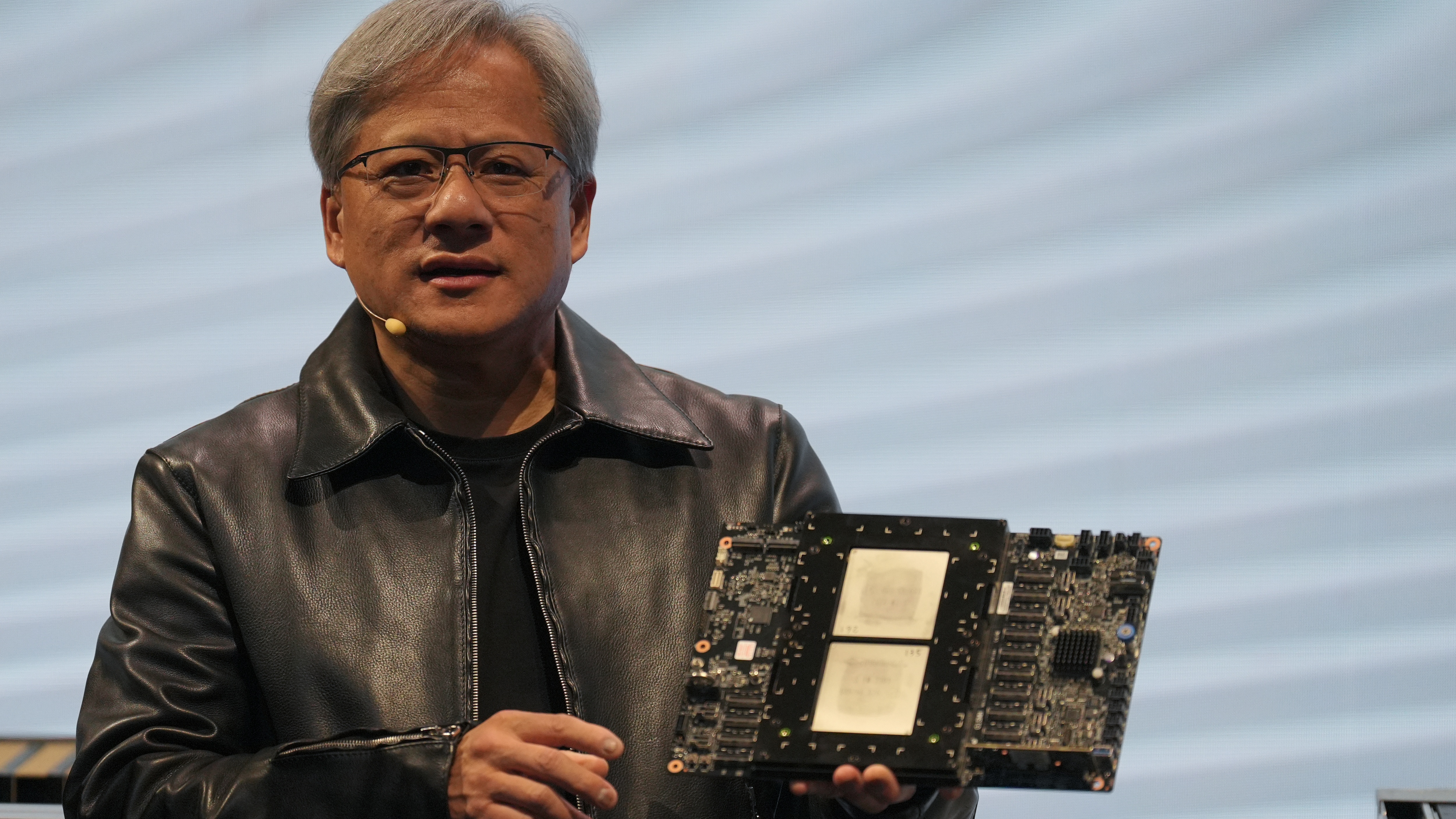

As anticipated, Nvidia CEO Jensen Huang could be very proud of the best way the enterprise goes, and he is bullish about what the longer term holds.

“The subsequent industrial revolution has begun — corporations and international locations are partnering with NVIDIA to shift the trillion-dollar conventional knowledge facilities to accelerated computing and construct a brand new sort of knowledge heart — AI factories — to provide a brand new commodity: synthetic intelligence,” stated Jensen Huang, founder and CEO of NVIDIA. “AI will deliver important productiveness positive aspects to just about each business and assist corporations be extra cost- and energy-efficient, whereas increasing income alternatives.”

Huge phrases certainly.

Do you know Nvidia additionally makes gaming graphics playing cards? That aspect of its enterprise was way more muted, with a income of $2.6 billion, down 8% from the earlier quarter, however up 18% from a yr in the past. That quarterly fall isn’t actually stunning following the vacation and peak buying and selling season over late 2023 and the absence of a brand new GPU household. The gaming financials from upcoming quarters might be fascinating as Nvidia prepares its Blackwell graphics playing cards.

In associated information, Nvidia introduced a 10-to-1 inventory cut up, which implies the worth of each share might be diluted to a tenth of its unique worth. It does not imply lots, because it’s the identical as reducing a pizza into extra slices, however it is going to in all probability alter investor psychology and make complete shares simpler to entry.

That is positively not monetary recommendation, however one would not guess in opposition to Nvidia persevering with its profitable run within the brief time period not less than, so long as AI demand continues unabated. It’s going to be hoping its next-generation Blackwell AI chips and accompanying techniques would be the catalyst for future constructive earnings studies. These Wall Road people are fickle although, and it will not be simple to maintain beating expectations quarter after quarter.