Cobie, a outstanding determine within the crypto buying and selling circles recognized for his insightful and infrequently correct predictions, made a post on Aug. 23, 2023, that outlined the spot Bitcoin ETF state of affairs to a frighteningly correct diploma.

Cobie’s put up, which delved into the intricacies of Bitcoin (BTC) and the anticipated approval of a Bitcoin ETF, showcased his deep understanding of the market dynamics.

His prediction of a big rise in BTC’s worth, probably reaching $50,000 by the yr’s finish, alongside an in depth evaluation of the potential affect of the ETF approval, displays a degree of research that few within the discipline can match.

Foresight

The dealer additionally predicted when the SEC would approve the ETFs and stated on the time that it was principally “free” to lengthy Bitcoin till then and beneficial promoting as soon as the approval got here in, or shortly earlier than that.

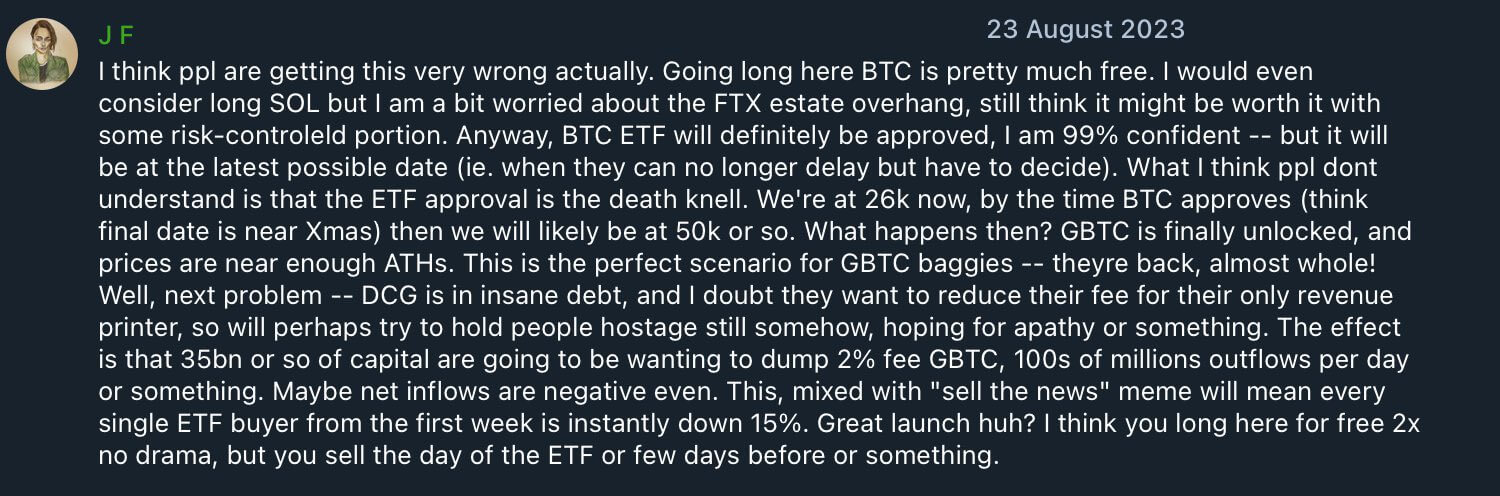

Cobie wrote:

“Anyway, BTC ETF will certainly be authorised, I’m 99% assured however it is going to be on the newest doable date (ie. after they can now not delay however must resolve).”

He added that after the ETFs have been authorised, it could be a “dying knell” which might possible drive the worth down on account of excessive ranges of promote stress coming in from Grayscale’s GBTC holders, who’ve been ready for a possibility to promote as soon as they’re near being entire once more.

Contemplating the worth motion, following that recommendation would have been the most effective transfer in hindsight. This has drawn widespread admiration from crypto Twitter. Nonetheless, Cobie feels the admiration is undue.

Cobie’s reflective response

In a candid response to the social media ruckus, Cobie emphasised monetary predictions’ dynamic and infrequently unsure nature.

“I can’t even bear in mind, man,” he started, highlighting the problem of protecting monitor of ever-changing market views. He identified how straightforward it’s to seek out previous predictions that appear correct in hindsight, given the frequent shifts in opinions and market circumstances.

He cautioned in opposition to over-reliance on remoted predictions, stating:

“The screenshot in isolation ‘appears to be like cool’ however doesn’t imply very a lot in actuality, , misses principally half a yr of shit and different elements that pollute the considering.”

His feedback supply a humble reminder of the transient nature of market evaluation. Regardless of his evaluation, he stated he didn’t persist with that thesis within the ensuing months. Cobie added:

“The fact (at the least for me) is that it’s fairly straightforward for me to void my very own opinions 3 weeks later, give you new concepts that I really feel counter them, and so forth., so it’s only a entire mess of doubt and indecision and stuff alongside the best way.”

This attitude resonates deeply within the cryptocurrency neighborhood, the place fast modifications and volatility are the norms. Cobie’s reflection on the method of forming and reforming opinions in response to new info and market shifts highlights the advanced, non-linear nature of monetary forecasting.

Cobie’s full put up is obtainable to learn beneath: