Fast Take

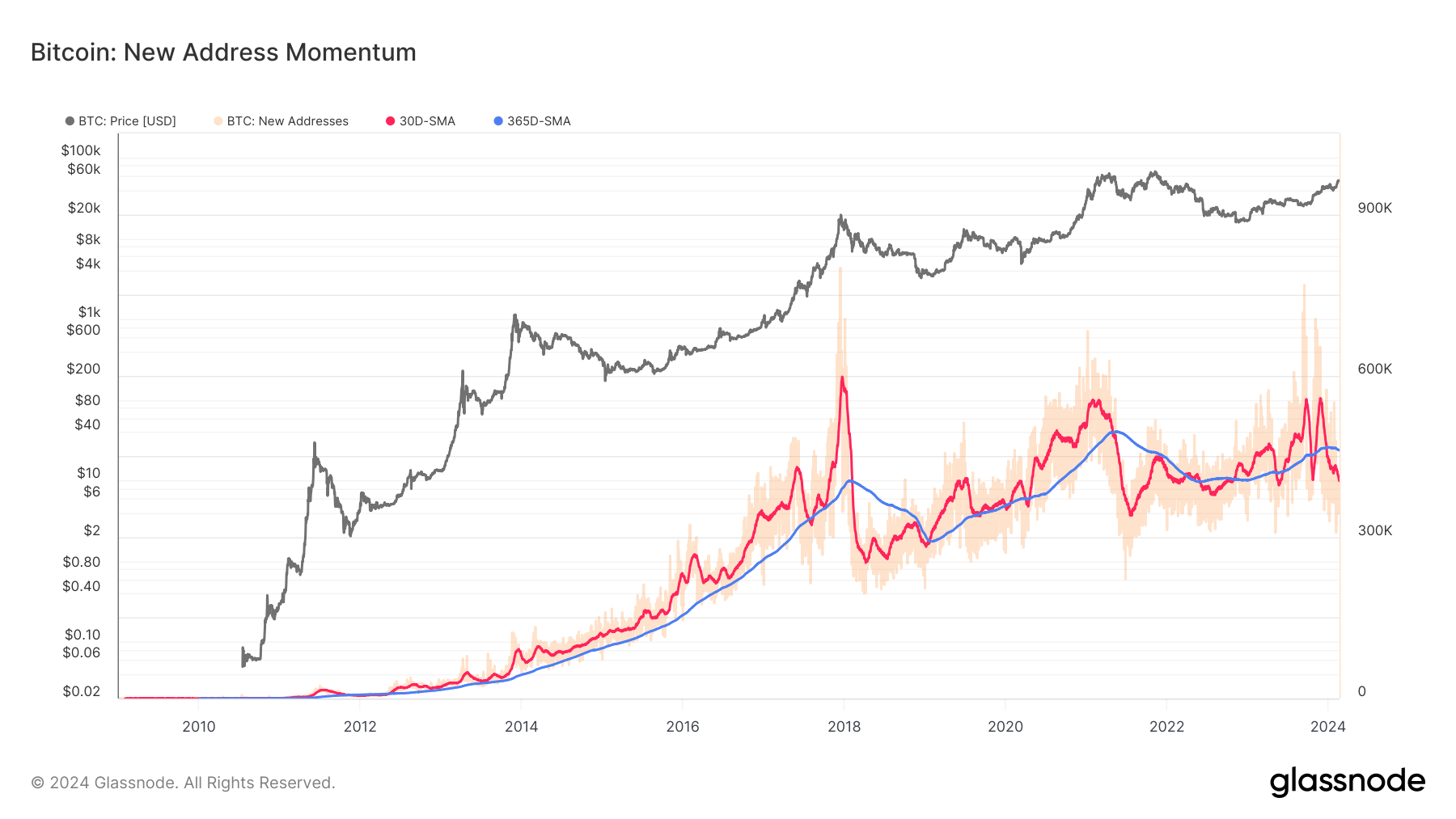

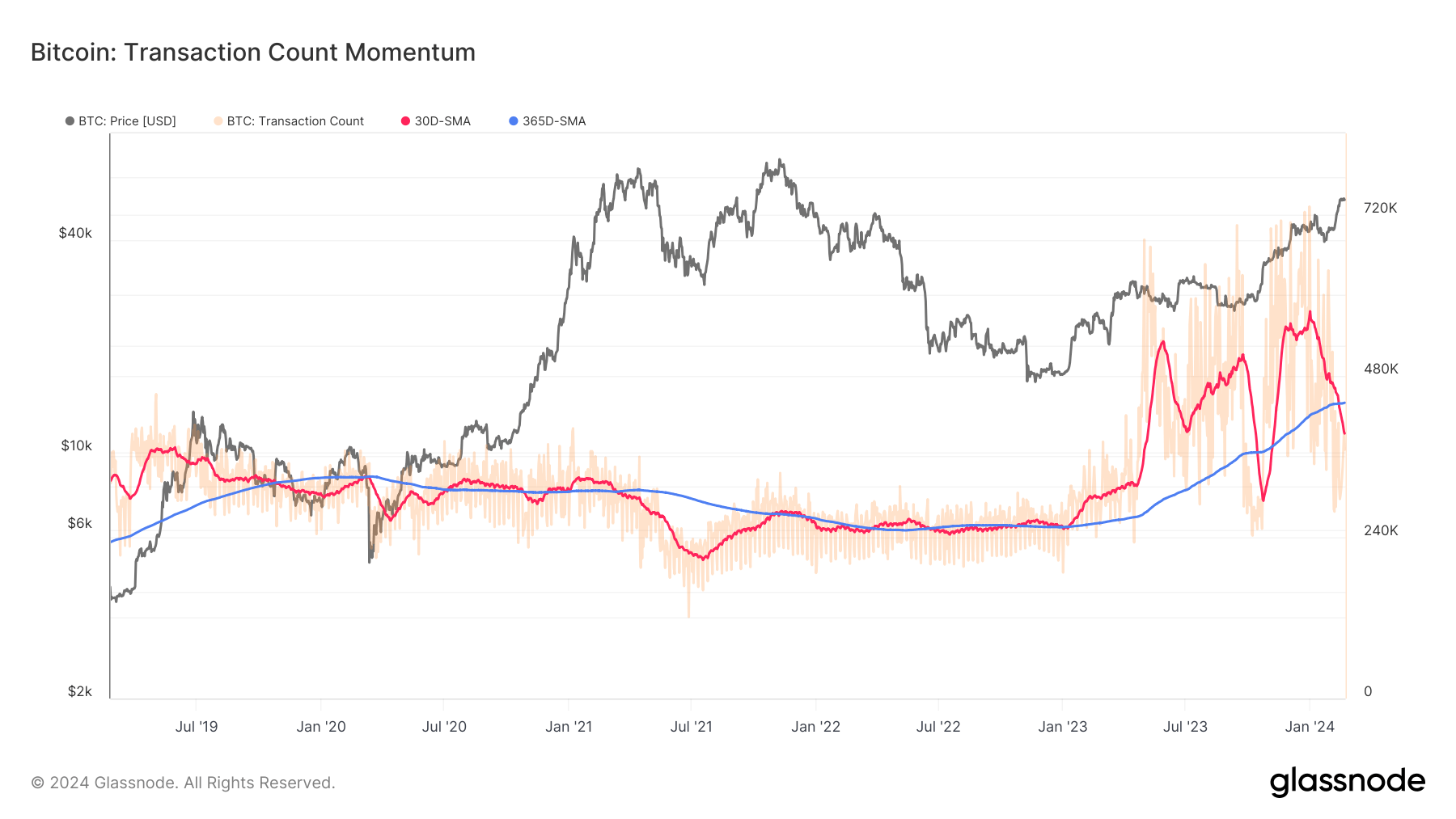

On-chain metrics grant an insightful glimpse into the well being of the Bitcoin community. These indicators, specifically new and lively addresses and transaction counts, are barometers of the demand for Bitcoin’s blockspace. Nevertheless, their each day fluctuations current an analytical problem. A extra environment friendly strategy is to match month-to-month averages in opposition to yearly benchmarks.

When juxtaposed with the yearly determine, a rise within the month-to-month common reveals an growth in on-chain exercise. This means strengthening community fundamentals and escalating community utilization. Conversely, a declining month-to-month common in comparison with the yearly metric hints at a contraction in on-chain exercise, indicating weakening community fundamentals and decreased community utilization, in accordance with Glassnode.

An instance of this dynamic is the 2021 bear market, which, in accordance with CryptoSlate observations, initiated in Might, not November, after the all-time excessive. A noticeable dip in each transaction depend and new deal with creation evidenced this.

Lately, nonetheless, regardless of a short doubling of Bitcoin’s value since October 2023, the variety of new addresses persistently fell wanting the yearly common and continues on a downward trajectory, simply because the transaction depend’s momentum has additionally slipped beneath the annual common. These findings spell a possible decline in Bitcoin’s community well being, a pattern that warrants shut monitoring.

The put up On-chain metrics reveal Bitcoin community’s well being hinting at potential decline appeared first on CryptoSlate.

:contrast(5):saturation(1.16)/https%3A%2F%2Fprod.static9.net.au%2Ffs%2Fa521a821-8701-47e1-a6c6-ab251c2e75ff)