BRC-20 tokens, generally often called Ordinals, are experiencing main upward momentum as Bitcoin breaks previous the $39,000 stage. ORDI, the most important of the BRC-20 tokens, is pulled up by BTC’s rally. Based on CoinGecko, ORDI is up almost 36% since yesterday, and at present buying and selling at $32.42, it’s new all-time excessive.

This latest value motion locations ORDI beneath the limelight, placing monumental strain on the bears whereas giving massive positive aspects for the bulls.

$39K Barrier Damaged: What’s Subsequent?

The market is encountering a slight rally with Bitcoin gaining momentum on the authorized facet of issues. The US Securities and Change Fee (SEC) has been eyeing the approval of a spot Bitcoin exchange-traded fund (ETF), giving conventional buyers a safer avenue to spend money on crypto.

Crypto-related shares additionally skilled an enormous bounce in value, with names like Clear Spark (CLSK) and Iris Power (IREN) making headlines. Michael Saylor’s Microstrategy can be up almost 6% on the each day timeframe.

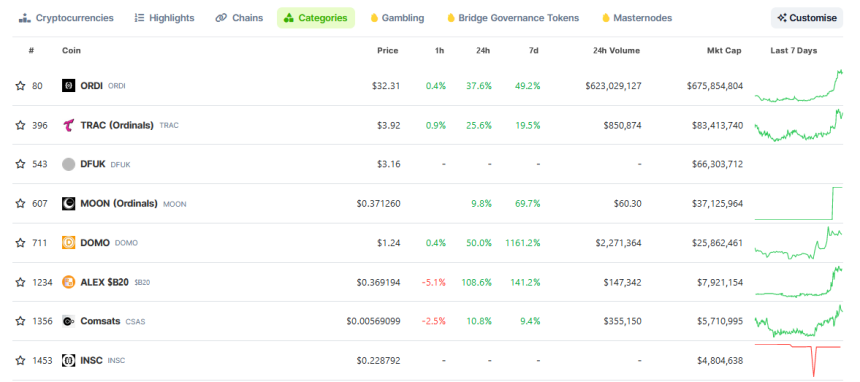

High BRC-20 cash by market cap. Supply: Coingecko

Ordinals, then again, are following go well with. Coingecko’s BRC-20 index exhibits an almost 40% improve in value prior to now 24 hours.

Though no main developments have adopted Ordinals prior to now few months, Bitcoin’s most up-to-date rally offers the bulls lots of hope for a steady rally.

ORDIUSD at present buying and selling at $32.51 territory on the each day chart: TradingView.com

Buyers Ought to Train Warning On These Ranges…

The present value motion means that ORDI’s value has no secure help and can finally revert to extra sustainable ranges.

Nevertheless, bulls may be capable of use the $25 value stage to bounce upward to a good place. But when they fail to carry this value level as soon as the hype settles, the $19 value level would be the lowest it may possibly go.

Supply: TradingView

ORDI Value Enhance From ETF Nod

Buyers and merchants ought to take into accout the SEC’s Bitcoin ETF choice. If the company approves, this can carry extra buyers to crypto, thus boosting the worth upward. However buyers and merchants shouldn’t financial institution their cash on this single choice alone.

Economists are nonetheless optimistic a couple of “delicate touchdown” as deflationary winds proceed to blow by sectors of the financial system. If this continues and the US Federal Reserve does cut back its present 5.5% rate of interest, buyers and merchants could have extra confidence available in the market.

Paired with a optimistic approval of the Bitcoin ETF by the SEC, it should push costs upwards extra, together with the Ordinals. Nonetheless, bulls ought to be capable of deal with a slight decline in value if they will maintain onto the $25 value stage.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Whenever you make investments, your capital is topic to threat).

Featured picture from Shutterstock