The current value motion of Ethereum has not been a lot of a breeze. The second-largest cryptocurrency by market cap skilled a surge that just about reached its all-time excessive, solely to be met with a pointy reversal, leaving lengthy merchants licking their wounds.

Associated Studying

Bulls Take A Hit, However Sentiment Stays Constructive

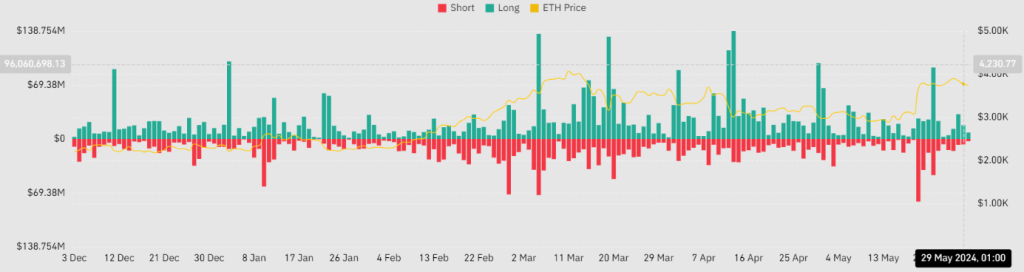

The previous few days have seen a major decline in Ethereum’s value, dropping from $3,880 to round $3,735. This has resulted in substantial liquidations for lengthy merchants, exceeding $55 million within the final three days in comparison with solely $16 million for brief positions.

Regardless of the dip, technical indicators paint a bullish image. The value stays above the brief shifting common, and the Relative Energy Index (RSI) sits comfortably above 60, suggesting a robust underlying pattern.

The funding fee, which displays the price of borrowing and lending cryptocurrency, gives additional proof of bullish sentiment. It has remained optimistic, presently at 0.014%, suggesting that patrons are nonetheless dominant and anticipate the value to rise additional.

Open Curiosity Soars, Signaling Sustained Investor Curiosity

Whereas the value has dipped, investor curiosity in Ethereum stays sturdy. Open Curiosity, which displays the whole quantity of excellent futures contracts, reached a peak of $17 billion on Could twenty eighth, the best stage in over a 12 months. This means that regardless of the current volatility, buyers are nonetheless closely engaged with Ethereum and imagine in its long-term potential.

Ethereum Worth Forecast

In the meantime, Ethereum’s present value prediction of $3,940 by June thirtieth suggests a possible 2% improve. Whereas the technical indicators stay impartial, the excessive Worry & Greed Index of 73 signifies a prevailing sense of greed amongst buyers. This might gasoline additional value motion within the brief time period.

Trying on the current efficiency, Ethereum has skilled a reasonable quantity of volatility with 57% inexperienced days over the previous month. This means a possible for continued upward momentum, particularly contemplating the numerous value improve because the cycle low of $897. Nevertheless, it’s essential to keep in mind that the market is dynamic, and corrections can happen even in bullish environments.

Associated Studying

Total, the technical evaluation paints a blended image for Ethereum. Whereas the impartial sentiment and up to date value dip may increase some considerations, the excessive Worry & Greed Index and robust efficiency because the cycle low recommend potential for additional development.

Featured picture from Pexels, chart from TradingView