Analysts at crypto hedge fund Pantera Capital consider Solana (SOL) may quickly begin pulling market share away from Ethereum (ETH) and different layer-1 opponents.

In its newest Blockchain Letter, Pantera analysts Franklin Bi, Cosmo Jiang and Eric Wallach say that Solana’s monolithic structure offers it a large benefit over different blockchain tasks.

“Solana’s monolithic design and relentless concentrate on optimization provide distinct benefits by way of consumer expertise, developer agility and safety. Because the blockchain business matures, these strengths place Solana to thrive and acquire market share from competing ecosystems.

Whereas the highway forward isn’t with out challenges, Solana’s fundamentals are firing on all cylinders. Retail adoption is surging, builders are flocking to construct groundbreaking purposes and worth seize is accelerating. As its ecosystem continues to evolve and mature, Solana’s architectural benefits and vibrant group level in the direction of a vibrant future.”

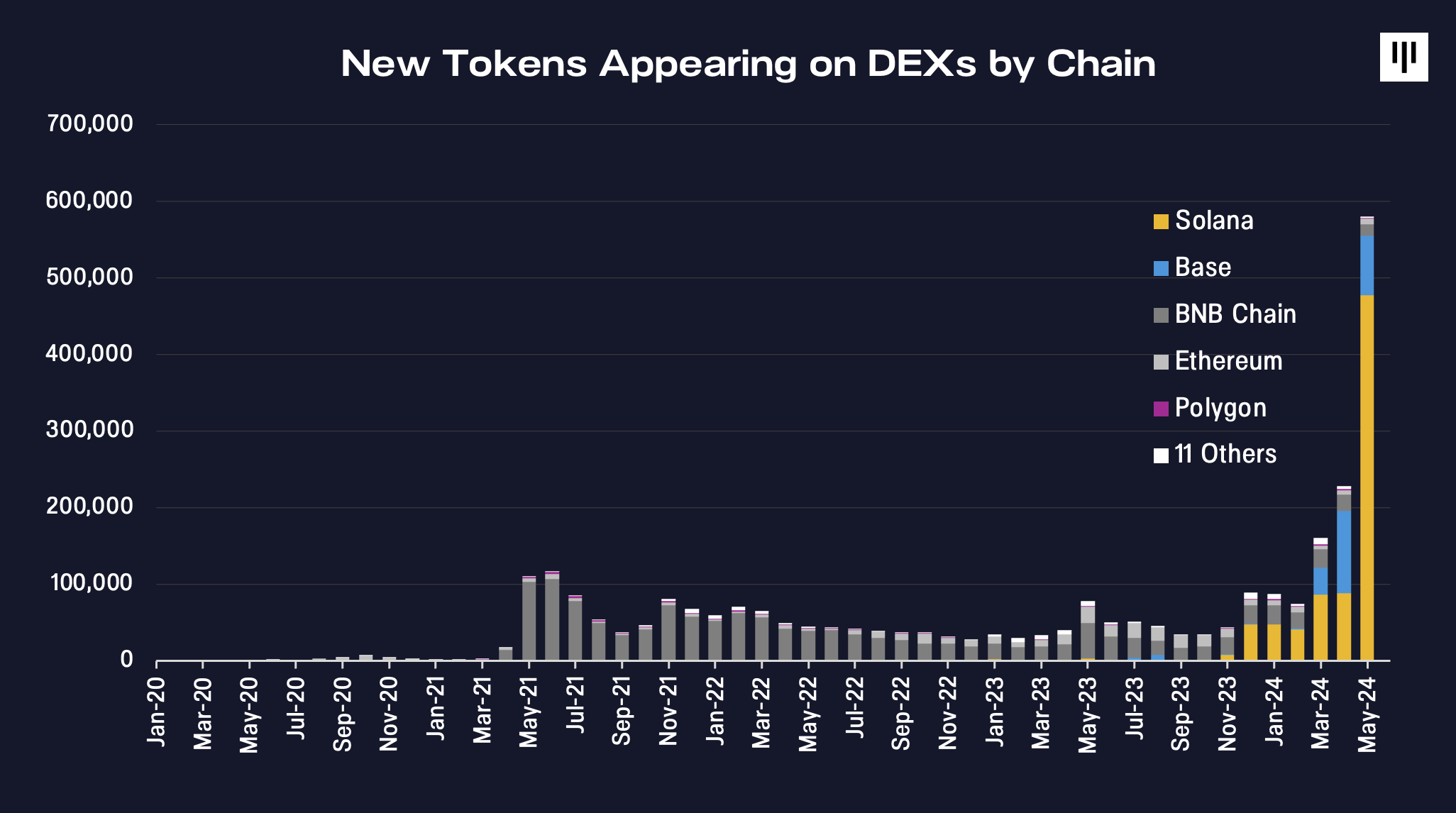

The analysts say a number of metrics level to Solana changing into a most well-liked ecosystem, together with rising token launches, DEX utilization and staking rewards.

“The case for Solana is enjoying out in real-time, with key fundamentals like consumer progress and transaction charges accelerating quickly…

Taken collectively, the mixture of Solana’s increasing retail consumer base, record-breaking token launches, dominant DEX (decentralized trade) progress and surge in staking rewards presents a compelling elementary case. Solana’s architectural benefits are enabling it to seize an outsized share of the brand new demand coming into the blockchain house, accelerating its ascent as a rival to Ethereum.”

Solana is buying and selling for $136 at time of writing, up 1.6% within the final 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Shacil/WhiteBarbie