After a sell-off of 350,010 Pendle (PENDLE) tokens value $1.26 million on Binance and Bybit, a publish by former BitMEX CEO and co-founder Arthur Hayes on X (previously Twitter) gained widespread consideration. On September 21, 2024, Hayes posted that Maelstrom (Hayes household workplace fund) had decreased its PENDLE holding. Regardless of the token discount, PENDLE stays one in every of their largest holdings.

Arthur Hayes PENDLE Holding

In accordance with the info from the on-chain analytic agency Spotonchain, Arthur Hayes at the moment holds an enormous 1.66 million PENDLE tokens, value $5.93 million. In his publish, Hayes additionally careworn that they nonetheless totally consider in PENDLE changing into a frontrunner in crypto rate of interest derivatives.

Moreover, he added, “Now we have decreased our place to fund a particular scenario. Those that monitor our wallets will get a glimpse as to what that’s within the very close to future.”

Present Worth Momentum

As of now, PENDLE is buying and selling close to $3.53 and has skilled a value decline of over 2% within the final 24 hours. Nevertheless, merchants’ and buyers’ curiosity within the tokens seems to have dropped considerably, leading to a decline of over 45% in buying and selling quantity throughout the identical interval.

PENDLE Technical Evaluation and Upcoming Ranges

In accordance with knowledgeable technical evaluation, PENDLE is on the verge of breakout of the sturdy resistance stage of $3.70 and the 200 Exponential Shifting Common (EMA) on a each day timeframe. If it breaches this 200 EMA and closes a candle above the $3.70 stage, there’s a sturdy chance it may soar by 25% to achieve the $4.80 stage within the coming days.

Nevertheless, this bullish thesis will maintain provided that PENDLE closes a each day candle above the $3.70 stage, in any other case, it might fail.

Bullish On-chain Metrics

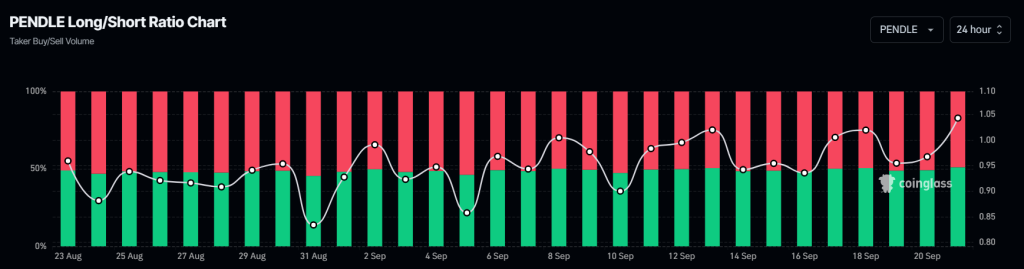

In addition to this bullish technical evaluation, PENDLE’s on-chain metric additional helps its constructive outlook. Coinglass’s PENDLE lengthy/quick ratio at the moment stands at 1.042, the very best since August 20, 2024, (a price above 1 signifies bullish market sentiment amongst merchants). Moreover, its future open curiosity has elevated by 4.5% within the final 24 hours and three.5% within the final 4 hours, indicating a buildup of extra lengthy positions.

Merchants and buyers usually use the mix of rising open curiosity and lengthy/quick ratio above 1, whereas constructing lengthy positions. At present, 51.01% of high merchants and buyers maintain lengthy positions, whereas 48.99% maintain quick positions.