Pepecoin (PEPE) has just lately skilled a major growth because it hits a vital bullish order block (OB), elevating hopes for a possible restoration alternative. Nevertheless, the flexibility to reverse the prevailing downtrend momentum is contingent upon a necessary issue that holds the important thing to the coin’s future trajectory.

In a market characterised by uncertainty, buyers and fanatics eagerly await the decision of this pivotal aspect to find out whether or not Pepecoin can regain its misplaced momentum and chart a brand new course.

Evaluating Pepecoin Worth Potential For A Reversal

Since Might 24, Pepecoin (PEPE) has exhibited a optimistic response to the bullish OB. This encouraging value motion implies a major inflow of consumers at this stage, indicating that the bullish OB might function a vital demand zone able to triggering a possible value U-turn, particularly if Bitcoin makes it previous the important thing $28,000 area.

Nonetheless, PEPE’s value motion at present faces constraints from each ends. On one facet, there may be the trendline resistance, whereas on the opposite facet, the bullish OB acts as a limiting issue.

Crypto complete market cap unchanged at $1.12 trillion. Chart: TradingView.com

Ought to the bullish sentiment persist and bulls handle to beat the resistance posed by the trendline, PEPE might endeavor to rally in direction of the 50% Fibonacci stage, which stands at $0.00000160.

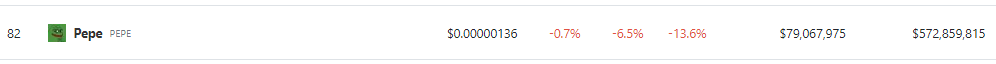

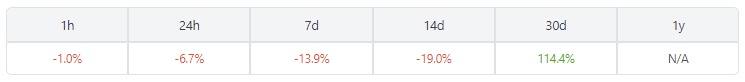

PEPE at present finds itself within the grips of a difficult market atmosphere, with its CoinGecko value at a meager $0.00000136. The previous 24 hours have witnessed a slight droop of 6.5%, additional exacerbating the coin’s struggles, whereas the seven-day interval has seen a major decline of 13.6%.

Supply: Coingecko

Understanding PEPE’s Volatility And Intrinsic Worth

Pepecoin (PEPE) has persistently exhibited an extremely risky motion, a attribute that isn’t completely sudden. As a cryptocurrency, PEPE falls inside the broader class recognized for its extremely risky nature. Nevertheless, PEPE’s standing as a meme coin provides an extra layer of complexity to its value fluctuations, because it lacks intrinsic worth.

Within the early levels, PEPE skilled a steady upward value motion, drawing consideration and curiosity from buyers looking for fast features. Nevertheless, specialists within the subject have lengthy predicted that, finally, PEPE’s value would spiral downwards. Regrettably, the present scenario appears to align with these projections.

Spectacular DEXT Rating For Pepecoin

In the meantime, Pepecoin enjoys a powerful DEXT Rating of 99/99 and excessive liquidity, which is a optimistic signal for the meme coin.

DEXTools’ DEXT Rating is an algorithm that takes into consideration knowledge from the blockchain in addition to different sources to find out the reliability of a given undertaking. The upper the rating, the higher for the crypto.

Social knowledge, pair liquidity, transaction quantity, token circulation, and contract creation are simply a few of the metrics that make up the DEXT Rating.

Supply: DEXTools

Meme cash, like PEPE, usually rely closely on social media developments, neighborhood enthusiasm, and speculative buying and selling. And not using a stable basis of intrinsic worth or underlying property, their costs are significantly weak to sudden shifts in sentiment and market dynamics.

Consequently, buyers should method meme cash like PEPE with warning and a radical understanding of the inherent dangers concerned.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Whenever you make investments, your capital is topic to threat)

-Featured picture from Science & Religion