A broadly adopted analyst is predicting a surge for one large-cap altcoin because the crypto markets grace a brand new 12 months.

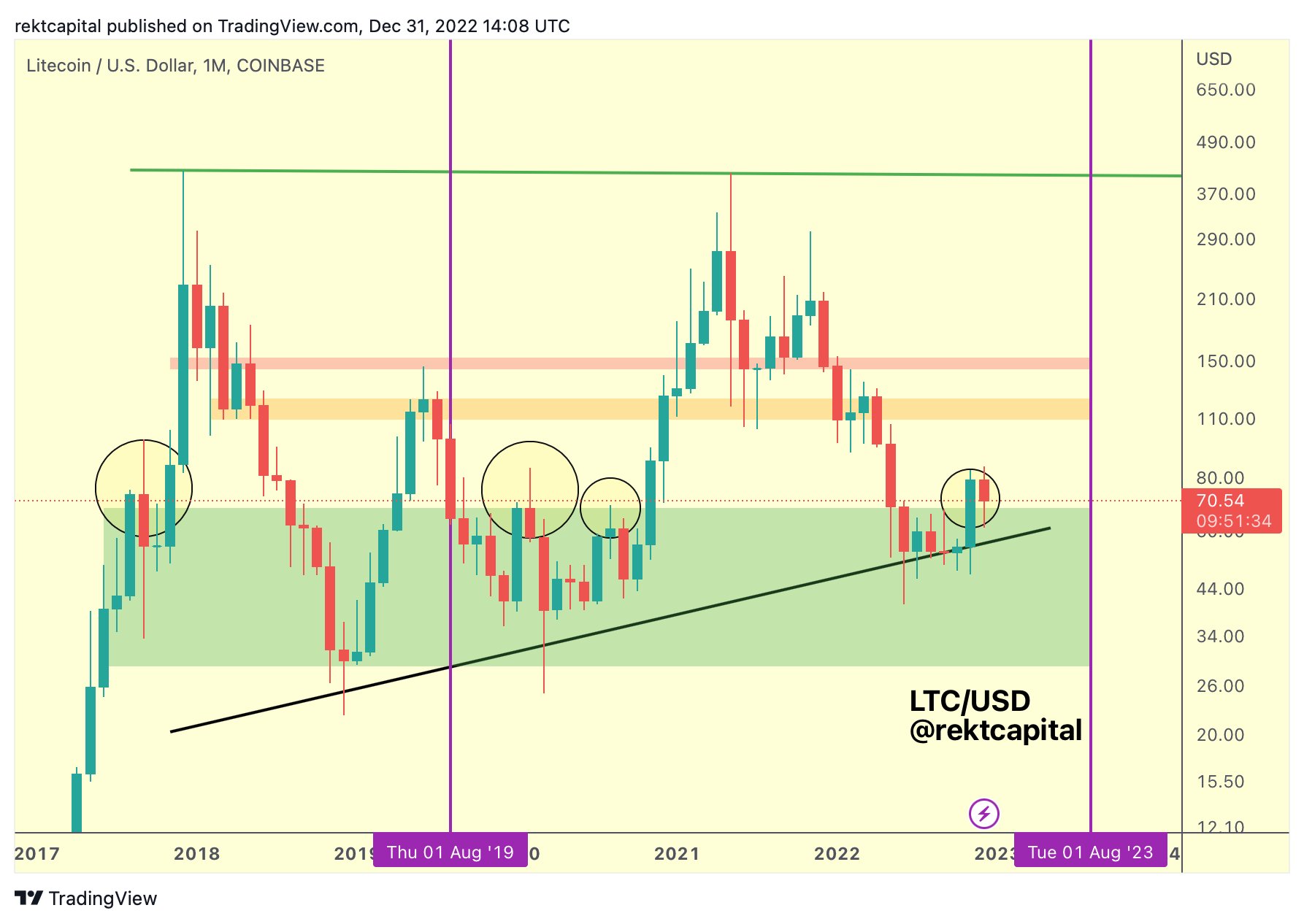

The pseudonymous analyst recognized within the trade as Rekt tells his 331,200 Twitter followers that peer-to-peer funds protocol Litecoin (LTC) closed 2022 on a excessive notice.

“LTC is efficiently retesting the highest of its historic accumulation vary (inexperienced) as help.

Month-to-month shut above this inexperienced field and LTC will likely be well-positioned for upside within the new 12 months.”

Litecoin closed December round $70, above Rekt’s historic accumulation vary. At time of writing, LTC is altering arms for $74.59, a 7.45% enhance on the day.

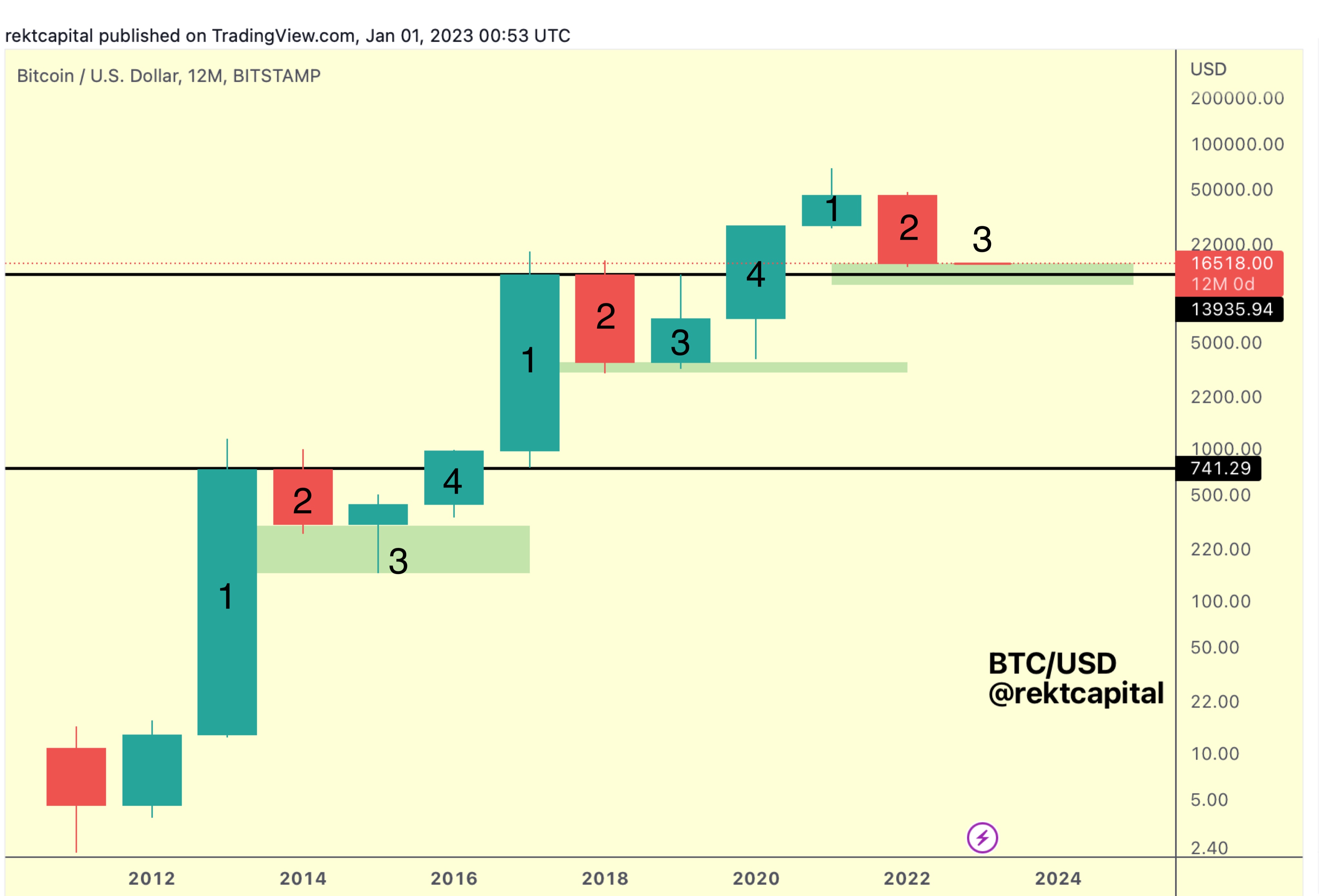

Bitcoin (BTC), Rekt predicts that the king crypto will print a bear market backside near $16,000.

“BTC has yearly closed 2022 at ~$16,000.

Traditionally, wherever BTC begins its new candle three, [it] tends to be very near the place the last word backside types.

The underside will likely be very near ~$16,000.”

Rekt’s evaluation relies on Bitcoin’s four-year-cycle principle, a set of ideas that makes an attempt to foretell the longer term value motion of the king crypto by following BTC’s halving occasions. The following halving, which might reduce rewards issued to Bitcoin miners from 6.25 BTC to three.125 BTC, is scheduled to happen someday in 2024.

In line with Rekt, the third portion of the cycle (candle three) is when BTC traditionally ends its bear market. The crypto analyst predicts that BTC might finish 2023 wherever between $22,300 and $32,400.

At time of writing, Bitcoin is buying and selling at $16,738, an over 1% enhance on the day.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/EB Journey Images/Sashkin