Fast Take

The Bitcoin market is presently exhibiting indicators of a possible bull run, as evidenced by the dynamics of the realized costs amongst completely different investor cohorts.

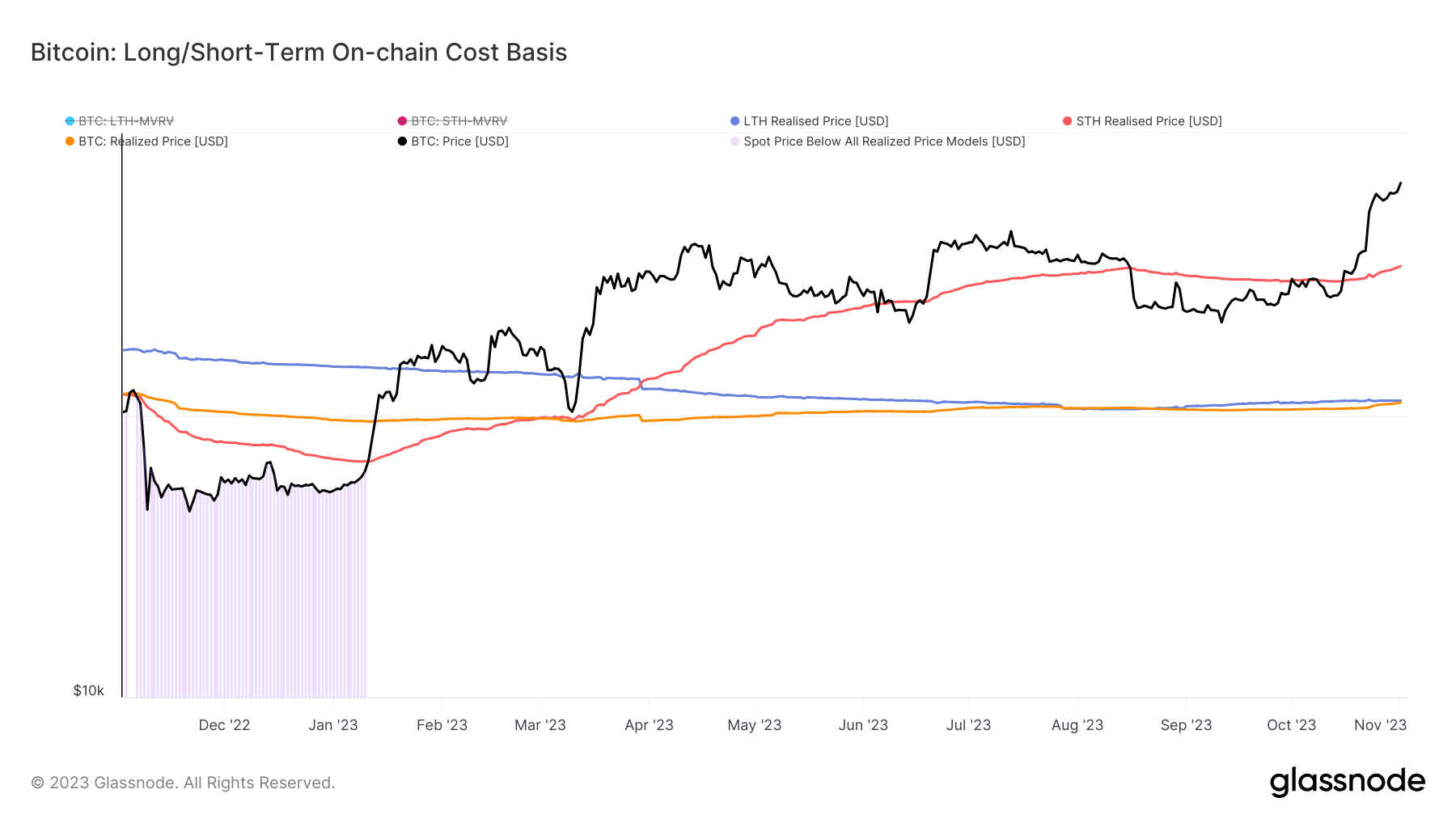

The realized worth, reflecting the combination worth at which every Bitcoin was final spent on-chain, presently stands at $20,638. That is solely $100 shy of the Lengthy-Time period Holder (LTH) realized worth – the common on-chain acquisition worth for cash that haven’t moved inside the final 155 days, which is $20,744.

| Value Kind | Quantity |

|---|---|

| Realized Value | $20,638 |

| Quick-Time period Holder Realized Value | $28,870 |

| Lengthy-Time period Holder Realized Value | $20,744 |

Supply: Glassnode

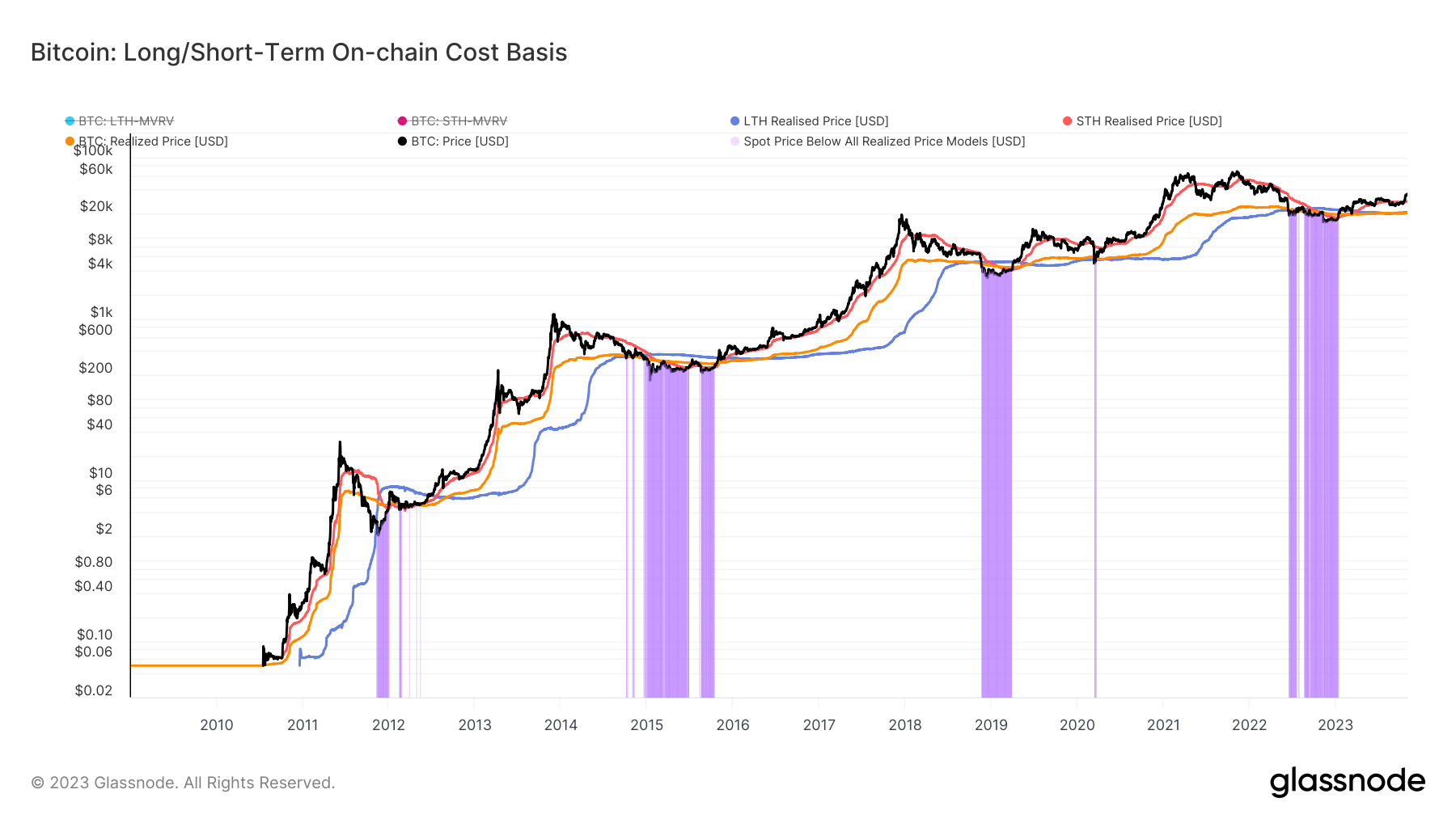

Historic tendencies recommend {that a} surpassing of the LTH realized worth by the realized worth has been a constant marker for the graduation of a brand new bull market.

In March 2023, an analogous situation unfolded when the Quick-Time period Holder (STH) realized worth – the common on-chain acquisition worth for cash moved inside the final 155 days – rose above each the realized worth and LTH realized worth. This led to a marked spike in Bitcoin’s worth following the SVB collapse.

Nonetheless, it’s vital to notice that in deep bear markets, spot costs usually fall beneath all cost-basis fashions, which means that irrespective of the holding period, the common investor incurs an unrealized loss.

The publish Potential Bitcoin bull run predicted by closing hole between realized and long-term holder costs appeared first on CryptoSlate.