ARM not too long ago introduced it’s going to make adjustments to its licensing coverage that underpins many of the client tech business. Now, due to a Monetary Occasions report, we’ve an concept of how this new ARM licensing mannequin goes to work or dare we are saying change the way in which the patron electronics business works. Let’s perceive.

https://www.youtube.com/watch?v=7Jnm6Ez3ZSw

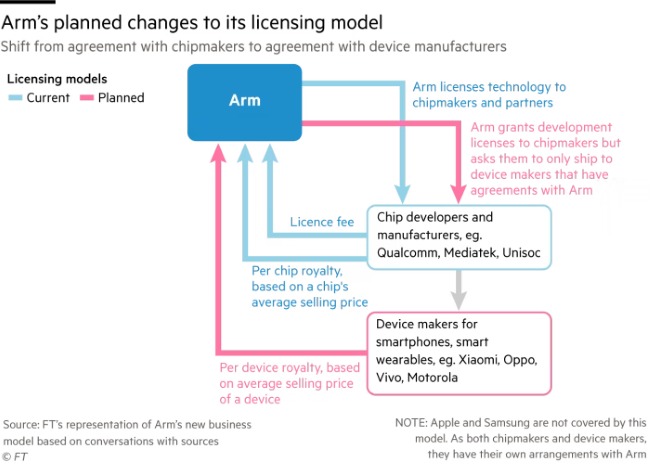

The important thing change is that ARM will cost royalties from gadget producers (based mostly on the worth of the gadget) and never the chip makers (based mostly on the worth of the chip) because it does at present. Since a tool prices greater than a single chip, ARM earns extra. That’s the concept to spice up its income forward of its forthcoming IPO.

Let’s break it down even additional.

ARM licensing change: The way it impacts the chip and gadget makers

Earlier than, ARM used to license blueprints of the chip design to chip makers and cost a license charge in addition to recurrent royalties for each new chip bought.

Now, it prices this royalty from the gadget makers and never the chip makers. As an alternative, the chip maker must promote the chips to the gadget makers with whom ARM has its royalty settlement. Arm will get the royalty and the gadget maker will get the chip.

What’s extra, is that these chip corporations gained’t be allowed to make use of their very own customized ISP, GPU, and different co-processors.

So, this new licensing choice makes information at a time when Qualcomm is claimed to be engaged on new 2-tier Nuvia CPU structure and MediaTek is outwardly working with Nvidia for a customized GPU. These plans might thus be below menace from ARM’s new transfer.

Let’s see the way it seems because it goes into drive as early as subsequent yr. ARM has reportedly knowledgeable the main chip producers like Qualcomm, MediaTek, and Unisoc in addition to gadget makers like Xiaomi and Oppo. We’ll see how its clients react. They may must bow right down to strain. “What SoftBank is doing in the intervening time is testing the market worth of the monopoly that Arm has,” says an ex-employee to FT whereas speaking about this radical shift in the way in which ARM has been doing its enterprise.