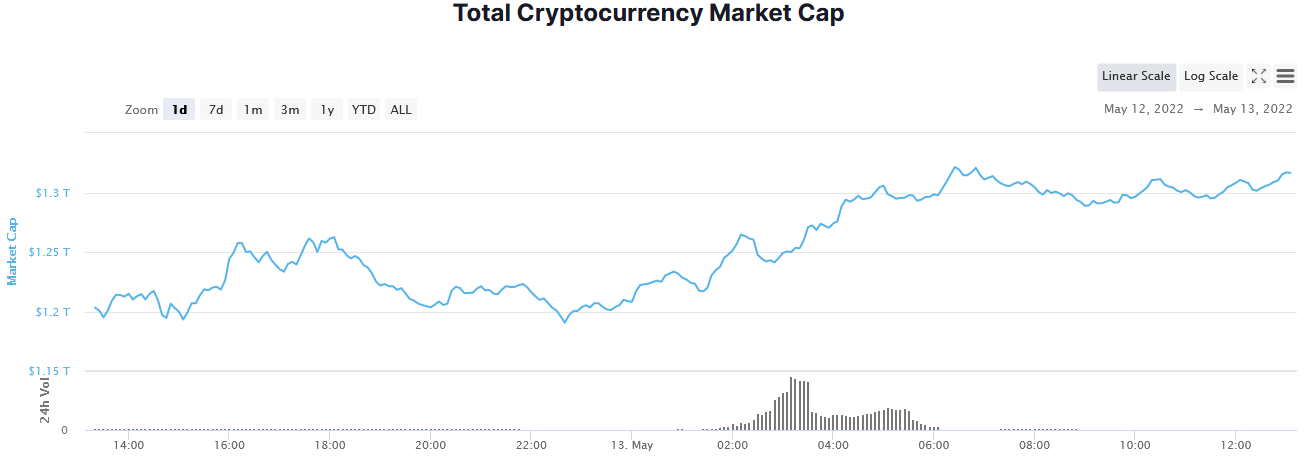

The working week is ready to finish on a inexperienced day, with $113 billion of capital flowing again into the entire crypto market cap during the last 24-hours.

Altcoins profit from capital inflows

The market cap chart evaluation reveals quantity choosing up at round 02:00 (GMT) on Could 13, peaking at 10:00. Regardless of quantity tailing off since then, inflows have continued to climb, suggesting bear exhaustion.

YouTuber Lark Davies tweeted that some altcoins have posted 70% features throughout this bounce to result in some much-needed optimistic sentiment.

BIG bounce right here! Some Alts up between 20 and 70%!!!! #crypto

— Lark Davis (@TheCryptoLark) May 13, 2022

Within the final 24 hours, essentially the most distinguished prime 100 gainers had been Gala at +57%, STEPN at +57%, and Kadena at 47%. In the meantime, the market chief, Bitcoin, swung 8% to the upside recapturing $30,000. Presently, BTC is hovering tentatively near that degree at $30,600.

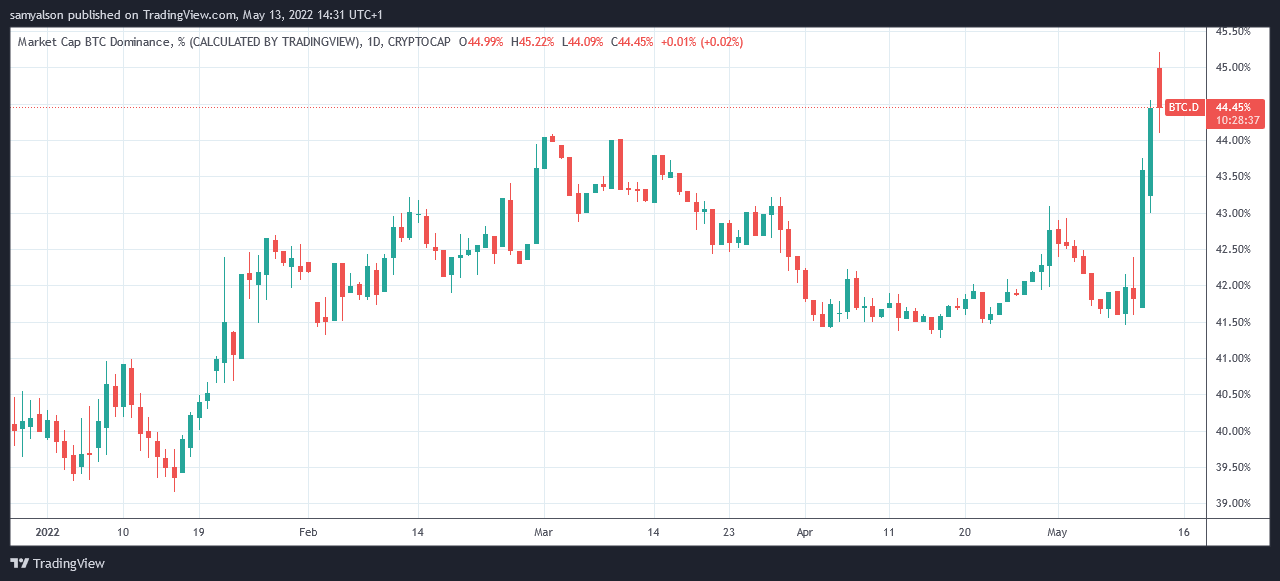

Could 11 noticed Bitcoin dominance rise dramatically from 41.6% to 45.2% (a six-month excessive)over the next two days. Nonetheless, traders have since cycled again into altcoins resulting in a drop to 44.5% at writing.

The place now for crypto?

The bounce introduced much-needed aid from the brutal sell-off triggered by happenings within the Terra ecosystem. Nonetheless, even contemplating this, the entire crypto market cap remains to be down 20% on the week and 55% from the November 2021 excessive.

As occasions unfolded, the narrative shifted from uncertainty, of the present market cycle, to a bear market. Few analysts are calling the current sell-off a blip within the bull section.

As a substitute, a extra somber and defensive tone dominates. Will Clemente posits that extra ache is forward, giving a name of low-mid $20k for Bitcoin.

“Based mostly on the aggregation of those metrics and worth ranges; backside is most certainly in low-mid $20Ks, aligning with the speculation of frontrunning earlier ATH.“

In the meantime, gold-bug Peter Schiff warned that Bitcoin’s transfer again above $30k shouldn’t be taken as an indication it has bottomed.

“It’s possible this space is not help, however resistance. New help is far decrease down.“

Schiff’s tweet additionally drew consideration to Bitcoin’s correlation to tech shares, including that ‘even when the Nasdaq has a bear market rally, it’s possible Bitcoin gained’t take part.’

Despite the fact that Schiff has no goal proof for that assertion, he’s appropriate in stating {that a} macro affect is in play. And with some economists predicting a pointy international financial downturn, now just isn’t the time to increase danger.